Blank 1099-r Form 2020

How to complete each 1099-R Record. Payments made from IRAs to state unclaimed property funds must be reported on Form 1099-R.

Form 1096 Sample Templates Invoice Template Word Template

Form 1096 Sample Templates Invoice Template Word Template

The amount shown may be payments received as the beneficiary of a deceased employee prizes awards taxable damages Indian gaming profits or other taxable income.

Blank 1099-r form 2020. Summary information for the group of forms being sent is entered only in boxes 3 4 and 5 of Form. However the actual Federal Form 1099R Box gives this information in Box 14. What is used for.

Turbo Tax Home and Business 2020 is instructing the user to enter the State Distribution Amount in Box 16. Complete IRS 1099-R 2020-2021 online with US Legal Forms. Enter only the information requested on Form IT-1099-R.

Form 1099-S is used to report proceeds from real estate transactions. Download print with other fillable US tax forms in PDF. The 2020 W-2 and 1099-R tax forms are now available for retirees in myCalPERS.

File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of 10 or more from. Payments of reportable death benefits in accordance with final regulations that will be published under section 6050Y must be reported on Form. See the Instructions for Form 8949 the Instructions for Schedule D Form 1040 or 1040-SR or.

753 available at IRSgovirb2018-25_IRBRR-2018-17 as modified by Notice 2018-90 2018-49 IRB. Save or instantly send your ready documents. The IRS 1099 Tax Form is a form used by the United States income tax system.

See Box 1 later. Get ready for this years Tax Season quickly and safely with pdfFiller. Enhanced Form IT-1099-R Summary of Federal Form 1099-R Statements Enhanced paper filing with a fill-in form.

Get it as soon as Thu Mar 25. Any individual retirement arrangements IRAs. Any device and OS.

If box 5 is checked box 1e may be blank. Form 1040 or 1040-SR or Form 1040-NR and identify the payment. Electronic filing is the fastest safest way to filebut if you must file a paper Summary of Federal Form 1099-R Statements use our enhanced fill-in Form.

Profit-sharing or retirement plans. Notice 2020-62 contains the two model notices that may be provided to recipients of eligible rollover distributions to satisfy the notice requirements under section 402f. Complete additional Forms IT-1099-R if necessary.

Those who receive a salary wages and tips would use a W-2 form. However TB does not provide fields for Box. An information return is a return used to report various types of income other than salaries wages and tips.

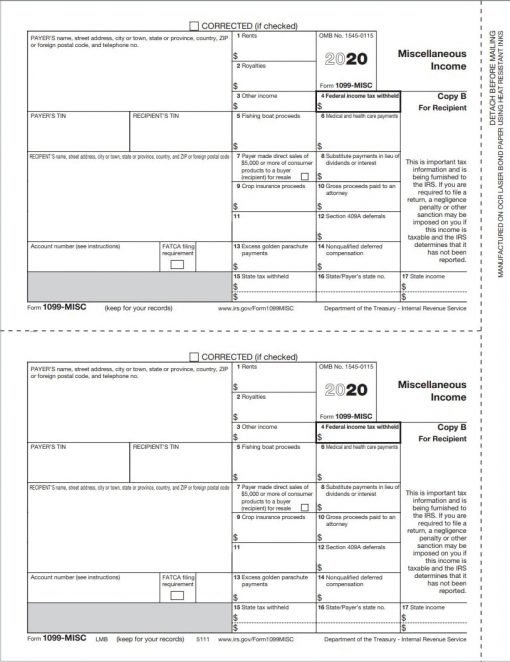

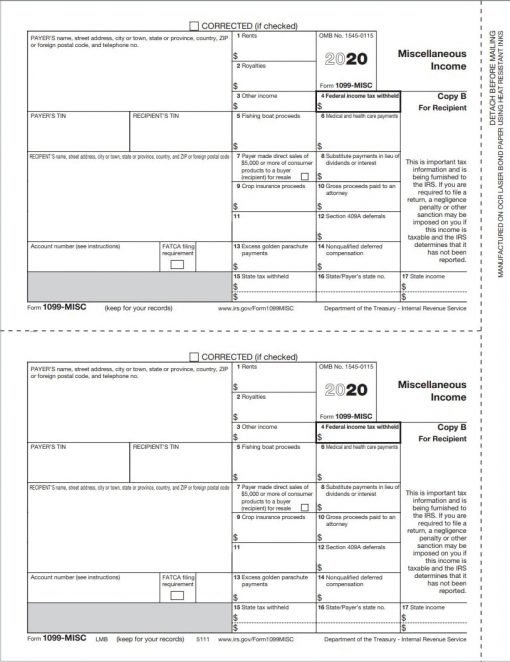

Easily fill out PDF blank edit and sign them. 826 available at httpswwwirsgovirb2018-49_IRBNOT-2018-90. Tax 2-Up Blank Laser Form - for 1099-MISC 1099-NEC and 1099-R Forms Pack of 1002020 48 out of 5 stars 8.

In this article we will take a closer look at what a 1099 Form is and how it can help you and your small company. 1099 R Form Just what are 1099 Forms. Create a blank editable 1099-R form fill it out and send it instantly to the IRS.

The tax form 1099 in 2020 is issued to report income from independent contractors. Do not send a form 1099 5498 etc containing summary subtotal information with Form 1096. Form 1099 in 2020.

This form allows you to prepare and file an information return. For retirees who live outside the United States the 1042-S forms are also available in myCalPERS. If you have a form 1099 blank template.

Form 1099 is a multipurpose form. Exactly what does it imply. Also report on Form 1099-R death benefit payments made by employers that are not made as part of a pension profit-sharing or retirement plan.

Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc. Reported to you on a Form W-2. Easily complete a printable IRS 1099-R Form 2020 online.

Let us say youve made a sale at your store but there was no money received from the sale simply because the individual wasnt present for your transaction. Form 1099-R Safe harbor explanations for eligible rollover distribu-tions. Complete one 1099-R Record section for each federal Form 1099-R you and if filing jointly your spouse or an estate or trust received that shows New York State New York City or Yonkers withholding.

Use your W-2 and 1099-R forms for reporting your retirement income from the previous year. In addition Federal Form 1099R includes boxes 17 through 19. Form 1099 is a form used for reporting different types of income including interest dividends pensions royalties and certain payments by a business to its employees.

You need not submit original and corrected returns separately. If it is trade or business income report this amount on Schedule C or F Form 1040 or 1040-SR. W-2 and 1099-R Forms Blank Paper 4-Up VersionNO Instructions on Back for Laser and Ink Jet Printer 1 Pack - 100 Sheets.

Annuities pensions insurance contracts survivor. Form 1099-R is used to report distributions from a retirement plan. 1098 and another Form 1096 to transmit your Forms 1099-A.

965 available at IRSgovirb2020-45_IRBREV-RUL-2020-24.

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

1 R Forms Free Download How I Successfuly Organized My Very Own 1 R Forms Free Download Tax Forms 1099 Tax Form Tax

1 R Forms Free Download How I Successfuly Organized My Very Own 1 R Forms Free Download Tax Forms 1099 Tax Form Tax

Official 1099 Forms At Lower Prices Discounttaxforms Com

Official 1099 Forms At Lower Prices Discounttaxforms Com

1099 R Form 6 Part Carbonless Discount Tax Forms

1099 R Form 6 Part Carbonless Discount Tax Forms

Form 1099 Misc 2018 Credit Card Services Form Electronic Forms

Form 1099 Misc 2018 Credit Card Services Form Electronic Forms

1099 Form 2016 Download 1099 R Instructions For Recipient 2016 Printable Pdf Form Job Application Form Irs Forms

1099 Form 2016 Download 1099 R Instructions For Recipient 2016 Printable Pdf Form Job Application Form Irs Forms

1099 R Form Copy B Recipient Zbp Forms

1099 R Form Copy B Recipient Zbp Forms

1099 Misc Form Copy A Federal Discount Tax Forms

1099 Misc Form Copy A Federal Discount Tax Forms

Fillable 1099 Form 2016 Free Fillable 1099 Misc Form 2016 In 2020 Irs Forms Fillable Forms Doctors Note Template

Fillable 1099 Form 2016 Free Fillable 1099 Misc Form 2016 In 2020 Irs Forms Fillable Forms Doctors Note Template

1099 R Form Copy C Recipient Discount Tax Forms

1099 R Form Copy C Recipient Discount Tax Forms

Irs Form 1099 R Box 7 Distribution Codes Ascensus

1099 Misc Form Copy B Recipient Discount Tax Forms

1099 Misc Form Copy B Recipient Discount Tax Forms

13 Form Sample 13 Disadvantages Of 13 Form Sample And How You Can Workaround It Quarterly Taxes Tax Software Small Business Accounting

13 Form Sample 13 Disadvantages Of 13 Form Sample And How You Can Workaround It Quarterly Taxes Tax Software Small Business Accounting

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Downloadable 1099 Tax Forms Printable 1099 Form 2018 Word Image 510 Printable Pages 1099 Tax Form Business Letter Template Simple Cover Letter Template

Downloadable 1099 Tax Forms Printable 1099 Form 2018 Word Image 510 Printable Pages 1099 Tax Form Business Letter Template Simple Cover Letter Template

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

1099 Forms And More At Everyday Low Prices Discounttaxforms Com

1099 Forms And More At Everyday Low Prices Discounttaxforms Com