Business Mileage Form Hmrc

The current rates are. This set amount takes the form of a car mileage allowance per mile and covers the cost of fuel as well as wear and tear on your vehicle MOT and servicing.

Self Employed Guide How To Claim For Business Mileage

Self Employed Guide How To Claim For Business Mileage

HMRC do not allow business mileage to be claimed by sole traders using a bicycle which is rather unfortunate for those green-minded among you or even cycle couriers.

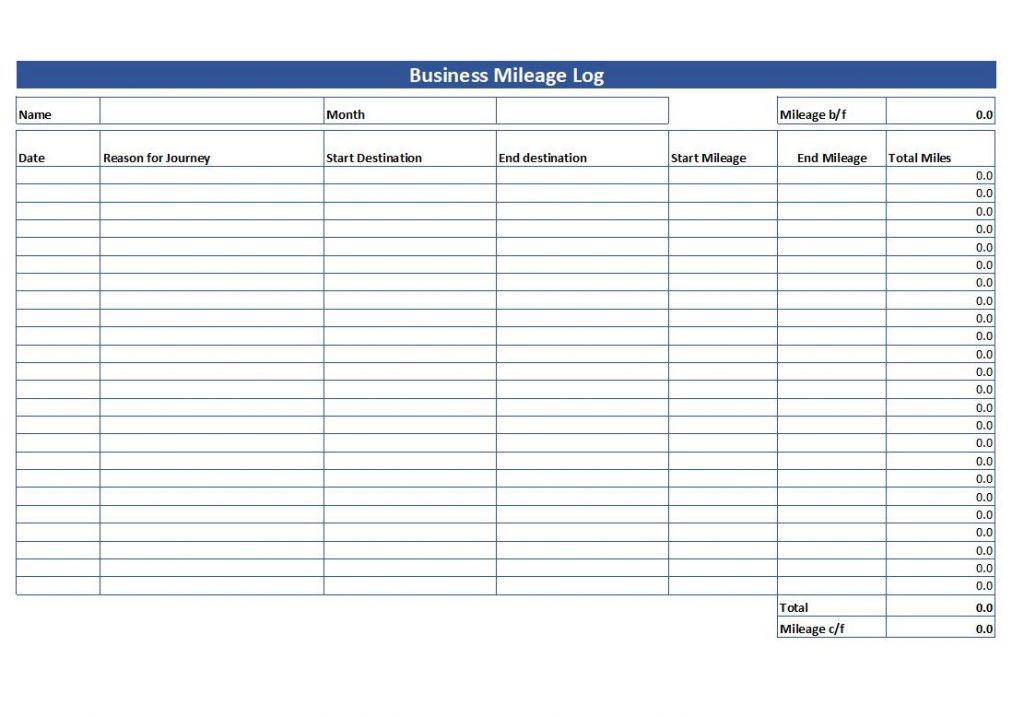

Business mileage form hmrc. Tax rates per business mile. When using a vehicle for your business its important to keep accurate records of every work journey including the dates and mileage. When you are self-employed and use your personal vehicle for business travel HMRC permits you to claim a set amount per journey as an allowable business expense against your taxes.

HMRC guidelines define travel between your home and your regular permanent place of employment as a non-work journey making it ineligible to. Basically you can reduce the amount of payment that taxes pay you. You should file a return with HMRC.

This makes calculating business mileage fairly simple. Theyre identical to the rates that applied during 2019-20. The HMRC allows you to claim 45 pence for every business mile you drive in tax relief.

For many years a paper mileage log was the only method of maintaining this record. UK HMRC Business Mileage Rates for 2020-2021. You may be able to claim tax relief if you use cars vans motorcycles or bicycles for work.

1Fill in a P87 form for the years in question if the expense claim for the year is below 2500. Business miles for self-employed can also be claimed. Business mileage refers to journeys you undertake in the course of your work with the exception of your regular commute.

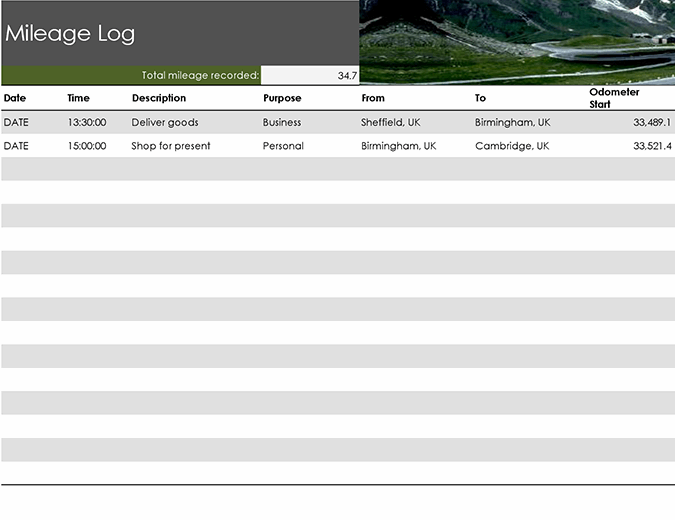

I am in a similar position I have been working from home since March at my employers request I live 12 miles from my normal place of work so any business mileage I claim they say I should be deducting 12 miles every journey from home to a site then 12 miles back home so I am not able to claim any business mileage if dont travel more than the 12 they also are still telling me I am based at. Simple Mileage Log Information Needed. Claiming your business miles is a form of tax relief meaning the cost of your mileage will reduce your tax bill at the end of the year.

The HMRC permits you to use whichever reliable method you prefer to maintain your mileage log. 45p for cars and vans for the first 10000 miles. However you may be able to claim the costs of buying a bicycle for work and consumables such as tyres or maintenance.

When you are completing your tax return the mileage calculation comes under Car van and travel expenses on the self assessment form. This does not include travelling to and from your work unless its a temporary place of work. HMRC has several rules in place to ensure that businesses claim mileage correctly and the 24 month rule is one of these.

Accepted forms include a paper mileage logbook a spreadsheet on a computer or using a mileage tracking app like MileIQ. HMRC require you to keep records of all transactions which includes claims for car use. Your general business costs including business mileage can be deducted from your salary and you only pay taxes on the balance.

In the UK you can claim back up to 45p per mile for the first 10000 miles and then 25p per mile. For cars this is 45p per mile reducing to 25p after 10000 miles. It states that youre entitled to claim travel expenses as.

The HMRC AMAP rates for 2020-2021 are in. HMRC do allow the reimbursement of business mileage in company cars at a rate higher than AFR but will allow it to be paid without tax only if there is a. This is limited to your first 10000 miles.

With the HMRC set mileage allowance the same rate is applied for every employee depending on the type of vehicle they use. The rates apply for any business journeys you make between 6 April 2020 and 5 April 2021. The rule applies to employees and contractors working in multiple locations.

You have as long as four years from the finish of the fiscal year to claim it. In fact the last time AMAP rates changed was in April 2012 when the AMAP rate for the first 10000 car and. With regards to previous years expenses for mileage you would do one of the following.

Claim tax relief for your employment expenses P87 2. You just need to multiply the miles you travelled by the specific mileage rate for your vehicle. What is mileage allowance.

The Mileage Allowance Relief is based on HMRCs approved mileage rates. HMRC recommend rates to pay employees for their business mileage when using their own vehicles. But you can still count miles over that limit for tax savings.

Mileage relief is a HMRC tax refund to deduct business travel costs from your income. Download our free mileage claim template form as an Excel spreadsheet to help you record the details of each work trip.

A Way To Determine If You Can Request Fmla Leave From Your Employer Family Medical Leave Act Medical Leave Caregiver Resources

A Way To Determine If You Can Request Fmla Leave From Your Employer Family Medical Leave Act Medical Leave Caregiver Resources

Quick Tips For Tow Realty Executives Mi Invoice And Resume Regarding Towing Service Invoice Template Business Plan Template Invoice Template Business Planning

Quick Tips For Tow Realty Executives Mi Invoice And Resume Regarding Towing Service Invoice Template Business Plan Template Invoice Template Business Planning

Free Sworn Statement Template Beautiful Free Sworn Statement Template Statement Template Doctors Note Template Templates

Free Sworn Statement Template Beautiful Free Sworn Statement Template Statement Template Doctors Note Template Templates

Hmrc Form P87 What You Need To Know For Taxes

Hmrc Form P87 What You Need To Know For Taxes

Free Self Employed Bookkeeping Spreadsheet Go Self Employed Spreadsheet Template Spreadsheet Design Bookkeeping

Free Self Employed Bookkeeping Spreadsheet Go Self Employed Spreadsheet Template Spreadsheet Design Bookkeeping

Mileage Log Form For Taxes Awesome Mileage Tracker Printable Bud More Mileage Tracker Printable Mileage Tracker Mileage Log Printable

Mileage Log Form For Taxes Awesome Mileage Tracker Printable Bud More Mileage Tracker Printable Mileage Tracker Mileage Log Printable

Computer Repair Service Agreement Free Printable Documents Computer Repair Services Contract Template Computer Repair

Computer Repair Service Agreement Free Printable Documents Computer Repair Services Contract Template Computer Repair

Free Mileage Log Template For Taxes Track Business Miles Mileiq Uk

Free Mileage Log Template For Taxes Track Business Miles Mileiq Uk

Bakery Mission Statement Examples Google Search Mission Statement Template Business Mission Statement Mission Statement Examples

Bakery Mission Statement Examples Google Search Mission Statement Template Business Mission Statement Mission Statement Examples

Self Employed Accounting Software Quickbooks Uk Track Your Self Employed Income Using Flat Rates For Hmrc Self Assessment Tax R Tax Software Quickbooks Self

Self Employed Accounting Software Quickbooks Uk Track Your Self Employed Income Using Flat Rates For Hmrc Self Assessment Tax R Tax Software Quickbooks Self

3 Ways To Record Business Miles Wikihow

3 Ways To Record Business Miles Wikihow

Simple Mileage Log Free Mileage Log Template Download

Simple Mileage Log Free Mileage Log Template Download

Being Self Employed Means Doing It All One Way I Save My Sanity Is By Using Quickbooks Self Emplo Virtual Assistant Freelance Tools Virtual Assistant Business

Being Self Employed Means Doing It All One Way I Save My Sanity Is By Using Quickbooks Self Emplo Virtual Assistant Freelance Tools Virtual Assistant Business

Proforma Invoice Template Excel Awesome 11 Business Proforma Invoice Template Sampletemplatess Invoice Template Invoice Template Word Templates

Proforma Invoice Template Excel Awesome 11 Business Proforma Invoice Template Sampletemplatess Invoice Template Invoice Template Word Templates

Report Review Template 3 Templates Example

Report Review Template 3 Templates Example

Executive Summary Sample Executive Summary Template Executive Summary Executive Summary Example

Executive Summary Sample Executive Summary Template Executive Summary Executive Summary Example

Free Mileage Log Template Download Ionos

What Are The Penalties For Missing The Tax Return Deadline Tax Deadline Tax Return Business Tax Deductions

What Are The Penalties For Missing The Tax Return Deadline Tax Deadline Tax Return Business Tax Deductions