Business Taxpayer Consent Form

Option 3 Mark the option box on the CONS screen to. Taxpayer name and address.

Our site uses cookies that we store on your computer.

Business taxpayer consent form. Check here if a list of additional designees is attached Name and address. Taxpayer must sign and date this form on line 6. Utilize the disclosure and use forms above to take advantage of strategic tax consulting and planning from PADGETT BUSINESS SERVICES.

Planning Forms Get Started with PADGETT BUSINESS SERVICES. Dec 09 2019 Effective with loans delivered on or after December 16 2019 PennyMac is requiring all loans to include a consent form meeting the requirements of The Taxpayer First Act Public Law 116-25. You are not required to complete this form.

Dec 28 2019 Does the new consent form apply to business tax returns as well. If applicable taxpayers must also be. Authorize any individual corporation firm organization or partnership you designate to inspect andor receive your confidential information verbally or in writing for the type of tax and the years or periods listed on the form.

Option 1 Have the taxpayer s sign the forms in the software. 51 rows Form 14446 VN Virtual VITATCE Taxpayer Consent Vietnamese Version 1020. Unless authorized by law we cannot use without your consent your tax return information for purposes other than the preparation and filing of your tax return.

The Act passed on July 1 2019 and effective December 28 2019 requires a taxpayer to provide consent for the express purpose for which their tax information will be used. TAXPAYER CONSENT FORM I understand acknowledge and agree that Shellpoint Mortgage Servicing and Other Loan Participants can obtain use and share tax return information for purposes of i providing an offer. Your Business Consent form must be properly completed before the CRA can process your request.

Mar 16 2021 This section provides links to a variety of forms that businesses will need while filing reporting and paying business taxes. If you do not specify the duration of your consent your consent is valid for one year from the date of signature. The list should not be construed as all-inclusive.

Plan number if applicable 2. Option 2 Have the taxpayer s sign the printed form from Tools. Ii originating maintaining managing.

The taxpayer and tax return preparer may agree to specify the period of time the consent will be effective and include the period in the consent form. New Taxpayer First Act Consent Form As part of the Taxpayer First Act that was passed into law earlier this year on July 1 2019 a lender who obtains a borrowers tax transcript during the origination process must obtain the borrowers consent to share that information with any other party including an investor to whom the loan is sold. Be sure to read the individual taxpayer consent form instructions carefully.

If you wish to name more than two designees attach a list to this form. We use the information collected to improve user experience and ensure the site works as intended. You can now authorize your representative online using My Business Account.

If consent is required under the Act it should be obtained in a timely. Printed name of tax preparer. Virtual VITATCE Taxpayer Consent OMB Number 1545-2222 This form is required whenever the taxpayers tax return is completed andor quality reviewed in a non-face-to-face environment.

Mar 23 2021 File Form 8821 to. The duration of your consent granted by this form shall be 5 years unless you indicate otherwise. It includes a provision that persons receiving tax return information must obtain the express permission of taxpayers prior to disclosing that return information to any other person.

Federal law requires this consent form be provided to you you refers to each taxpayer if more than one. You should consult the instructions for each form for any related forms necessary to file a complete tax return. Mar 03 2021 The Taxpayer First Act was signed into law on July 1 2019.

A taxpayer is a taxpayer regardless of whether they are an individual or business. Aug 12 2011 RC59 Business Consent Form Notice to the reader. Disclosure of your tax return information your consent is valid for the amount of time that you specify.

Having borrowers sign form 4506-T has always sufficed to indicate taxpayer consent. Section 2202 modifies the tax code and now necessitates that organizations inform the taxpayer of the express purpose. Taxpayer identification numbers Daytime telephone number.

This component of the law goes into effect December 28 2019. MISMOS TAXPAYER CONSENT LANGUAGE I understand acknowledge and agree that the Lender and Other Loan Participants can obtain use and share tax return information for purposes of i providing an offer. For which tax return information will be used.

Form RC59 Business Consent for Offline Access is no longer available. Taxpayer First Act - Consent - 112519 0121 PM. The site must explain to the taxpayer the process this site will use to prepare the taxpayers return.

The CONS screen can be signed and dated electronically. Mark the option box on the CONS screen. Get access to your clients business information faster when you fill out the authorization online by logging in to Represent a Client.

If no period is specified the regulations state that the consent will be effective for a period of one year from the date the taxpayer signed the consent. For information on how you can authorize a representative for your business go to Representative authorization. Small Business Tax Consulting.

Other forms may be appropriate for your specific type of business. Delete or revoke prior tax information authorizations.

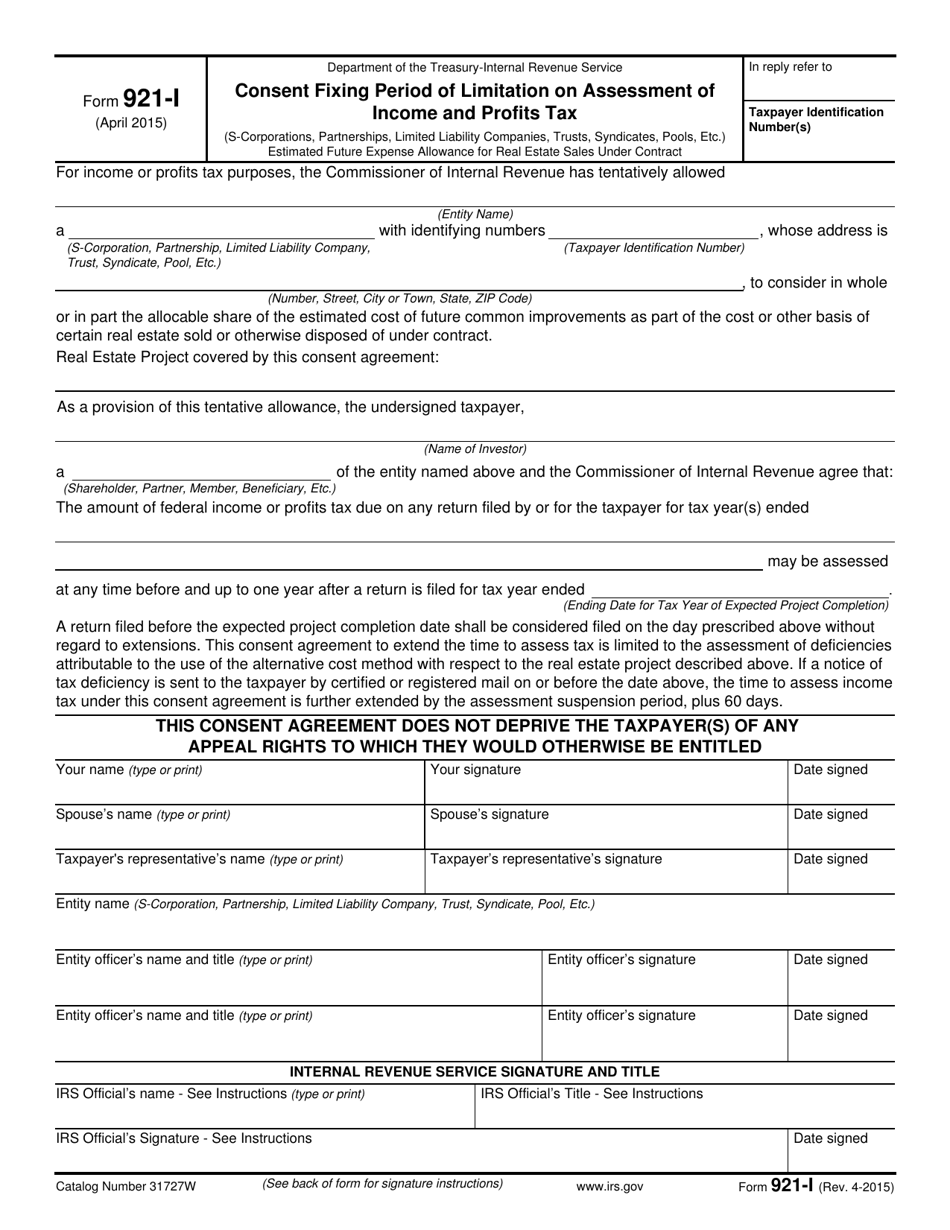

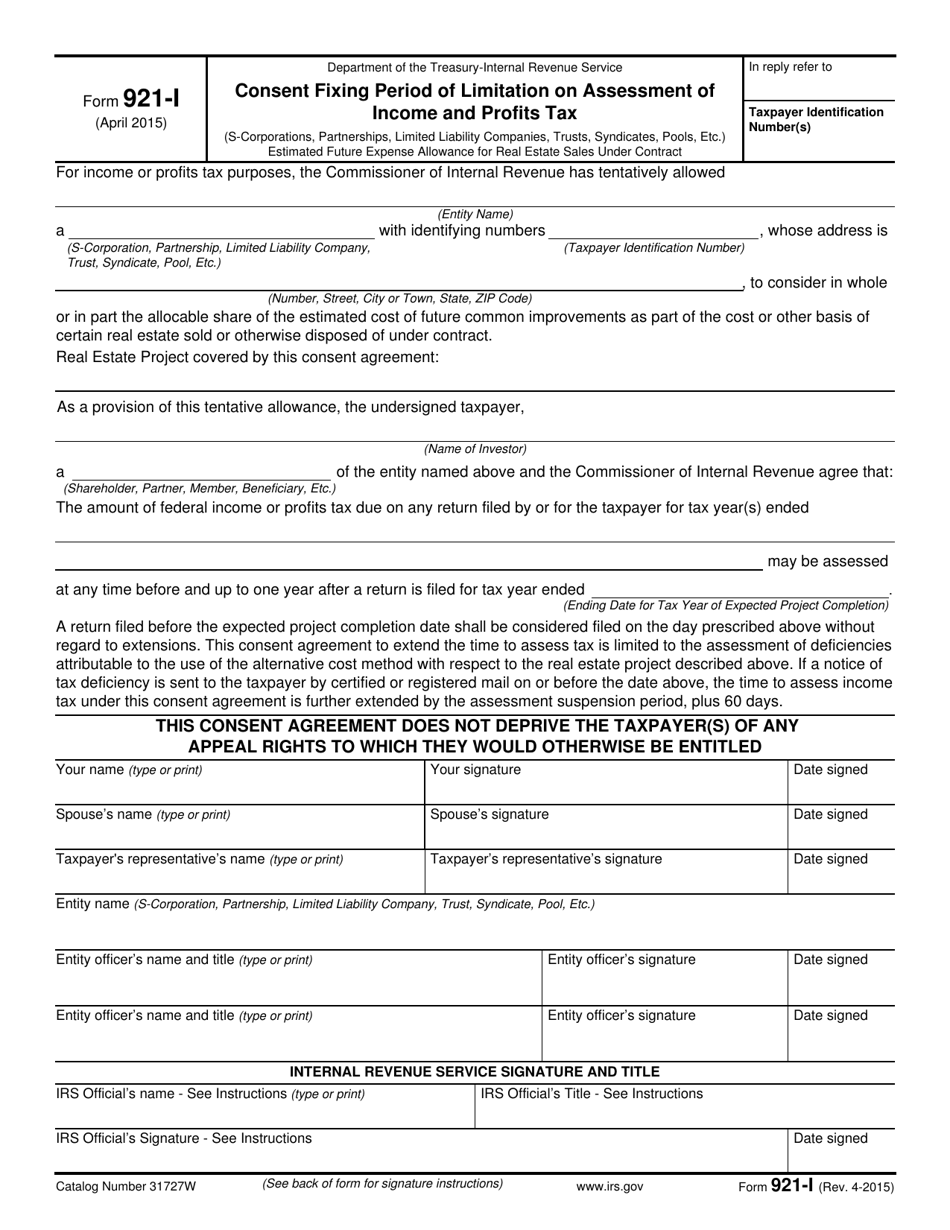

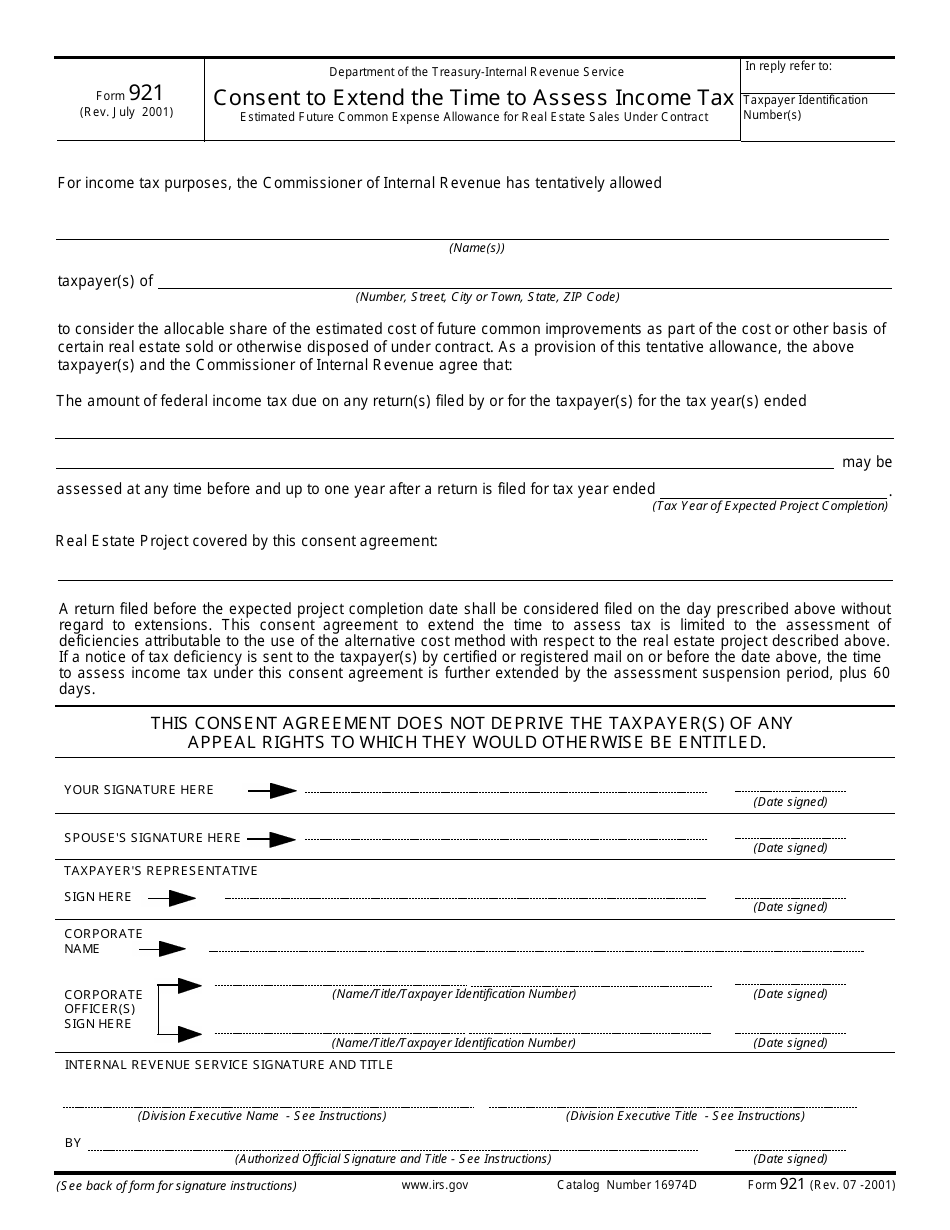

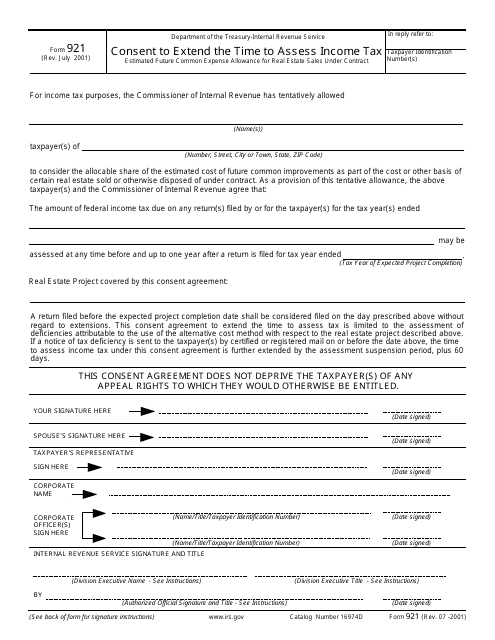

Form 921 Consent To Extend The Time To Assess Income Tax

Https Www Sba Gov Sites Default Files Serv Da All Loanapp 7 0 0 Pdf

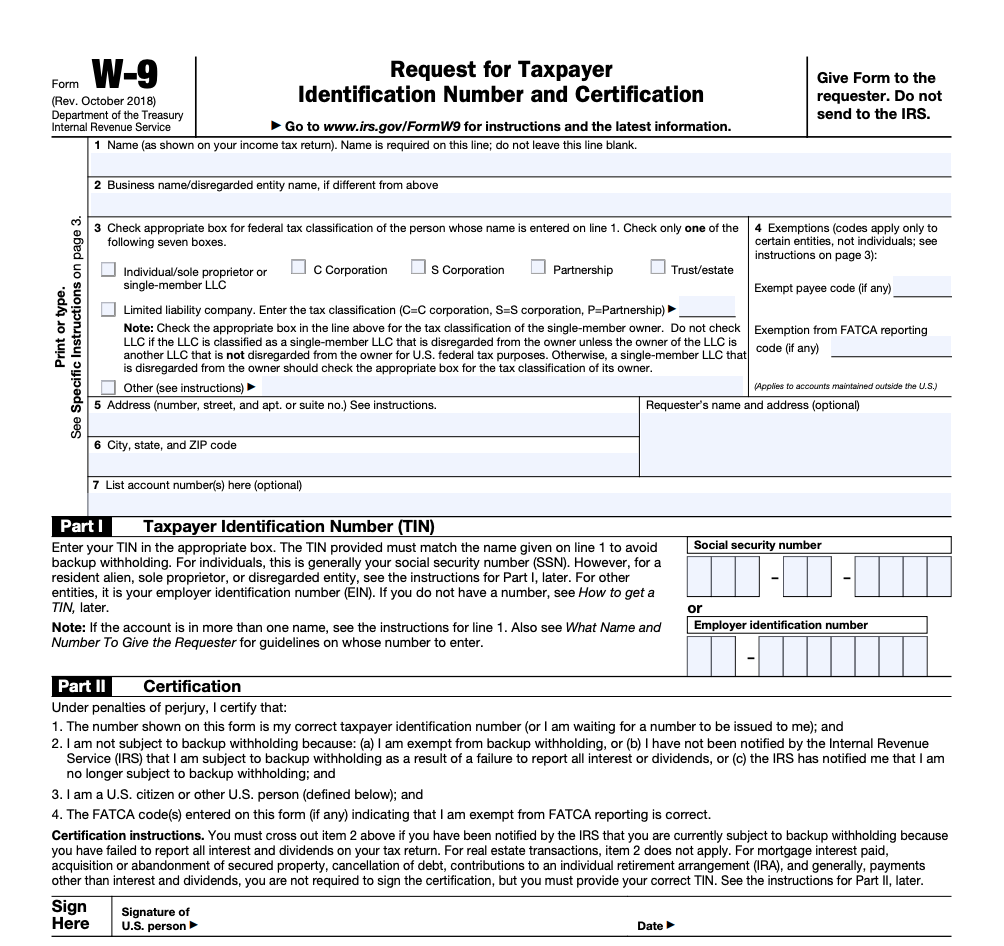

Taxpayer Consent Form Pdf Fill Online Printable Fillable Blank Pdffiller

Taxpayer Consent Form Pdf Fill Online Printable Fillable Blank Pdffiller

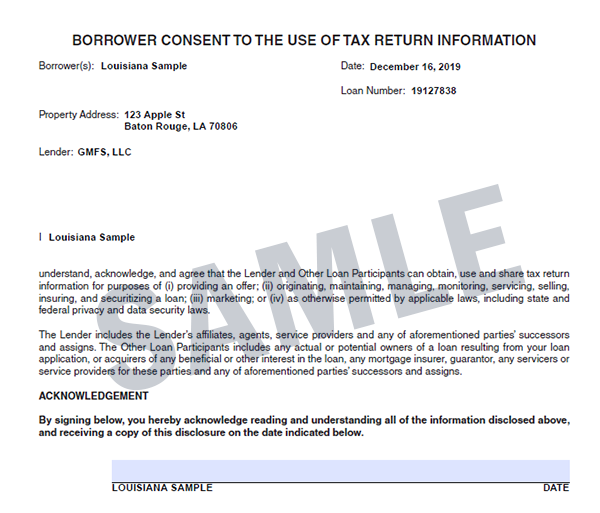

Sharing Of Borrower Tax Return Information By Lenders Gmfs Agent

Sharing Of Borrower Tax Return Information By Lenders Gmfs Agent

Form 921 Consent To Extend The Time To Assess Income Tax

Irs Form 921 I Download Fillable Pdf Or Fill Online Consent Fixing Period Of Limitation On Assessment Of Income And Profits Tax Templateroller

Irs Form 921 I Download Fillable Pdf Or Fill Online Consent Fixing Period Of Limitation On Assessment Of Income And Profits Tax Templateroller

Irs Form 921 Download Fillable Pdf Or Fill Online Consent To Extend The Time To Assess Income Tax Templateroller

Irs Form 921 Download Fillable Pdf Or Fill Online Consent To Extend The Time To Assess Income Tax Templateroller

Irs Form 921 Download Fillable Pdf Or Fill Online Consent To Extend The Time To Assess Income Tax Templateroller

Irs Form 921 Download Fillable Pdf Or Fill Online Consent To Extend The Time To Assess Income Tax Templateroller

Fill Free Fillable Irs Pdf Forms

Fill Free Fillable Irs Pdf Forms

Https Www Irs Gov Pub Irs Tege 2848 8821 Phoneforum Handout Pdf

Irc 7216 Consent To Use Form Personalized Item 72 731

Irc 7216 Consent To Use Form Personalized Item 72 731

Https Www Gopennymac Com Assets Documents Announcements Sample Mismo Taxpayer Consent Form Pdf

Https Www Morrisonclarkcompany Com Wp Content Uploads 2017 02 Section 7216 Sample Consent Forms Aicpa Org Pdf

4 10 8 Report Writing Internal Revenue Service

4 10 8 Report Writing Internal Revenue Service

Https Www Logginscpa Com Wp Content Uploads 2015 02 Consent Form To Release Tax Returns And Personal Financial Statements Pdf

Form 9325 After Irs Acceptance Notifying The Taxpayer

Form 9325 After Irs Acceptance Notifying The Taxpayer

Fill Free Fillable Irs Pdf Forms

Fill Free Fillable Irs Pdf Forms

Fill Free Fillable Irs Pdf Forms

Fill Free Fillable Irs Pdf Forms