Do Medical Insurance Companies Get A 1099

The exemption from issuing Form 1099-MISC to a corporation does not apply to payments for medical or healthcare services provided by corporations including professional corporations. Healthcare networks and insurance carriers may frequently send out payments but are not technically a TPSO and therefore are NOT required to file a 1099-K.

What Is A 1099 Employee What Is A 1099 Tax Forms Independent Contractor

What Is A 1099 Employee What Is A 1099 Tax Forms Independent Contractor

The 1099-HC form is a Massachusetts tax document which provides proof of health insurance coverage for Massachusetts residents.

Do medical insurance companies get a 1099. When the repair work was completed they sent us the remainder. The insurance company will only report amount paid by that insurance companies. Whenever the Forms 1099 arrive dont ignore them.

There are entities and organizations that may loosely fit the definition of a PSE but do not need to file 1099-Ks according to the IRS. Most Forms 1099 arrive in late January or early February but a few companies issue the forms throughout the year when they issue checks. Due to the high level of administrative reporting for corporations the IRS exempts corporations from needing to receive a Form 1099-MISC.

This includes payments to medical health care insurance companies. If payment is made to a corporation list the corporation as the recipient rather than the individual providing the services. File this form if you received any advance payments during the calendar year of qualified health insurance payments for the benefit of eligible trade adjustment assistance TAA Reemployment TAA or Pension Benefit Guaranty Corporation PBGC pension recipients and their qualifying family members.

Nonemployee compensation includes the following payment types to independent contractors. Your company will receive more comprehensive benefits or lower premiums by allowing 1099 employees to join the group plan. You must report payments your business made to doctors suppliers or providers of medical or health care services Box 6.

I have received 1099-misc from insurance company for critical illness insurance payout. 1099s are issued to people who perform services if they are incorporated a 1099 does not have to be issued you are paying insurance premiums and altho it. Every Commonwealth of Massachusetts resident who has health insurance will receive a 1099-HC form.

About Form 1099-H Health Coverage Tax Credit HCTC Advance Payments. We received 14000 from our insurance company. If you pay directly to the doctor - that amount is not reported.

You can deduct the portion of medical expenses that exceeds 75 of your adjusted gross income AGI for 2019. You do not have to send a 1099-MISC form to corporations nor to limited liability companies which have made an election to be treated as corporations for income tax purposes. We have received a 1099-Misc from the mortage company.

1099s for employer-paid health insurance premiums for employees. It would be highly unusual if not unheard of for an insurance agency to function as anything other than a corporation or a limited liability taxed as a corporation. Medical and Health Care Payments.

It would be more cost-effective for your company to limit your group health insurance plan to your actual employees. Insurance companies are almost without exception corporations and as such are exempted from IRS 1099-MISC filing requirements except in certain cases unrelated to insurance companies. Do I need to issue a 1099 to the Insurance Exchange whom we get our coverage from several different providers through for.

The check was made out to us and our mortgage company. No matter which scenario fits your business best we can help you compare multiple options so you can make. The mortgage company made us endorse the check and send it to them.

Other forms of compensation for services. You dont have to report payments to pharmacies for prescription drugs. Personal payments are not reported.

1099 Forms and Insurance Agencies. Use a 1099-NEC form to report nonemployee compensation. You personally do not need to issue form 1099MISC if that payment is NOT in the course of your business.

However a few exceptions exist that require a. Does that mean the payout is taxable. It will all depend on the state where you live and work as well as the specific requirements of the plan and the insurance carrier that youre enrolling with.

Can you give me any more details about your issue. Employer-paid premiums for health insurance are exempt from federal income and payroll taxes. You and your family may be better off with a family health insurance plan if all your employees are 1099 contractors.

In some cases 1099 workers paid on a contract basis may be able to qualify as employees for health insurance purposes. If you itemize they are deductible on Schedule A as a medical expense. They then sent us a check for 10000.

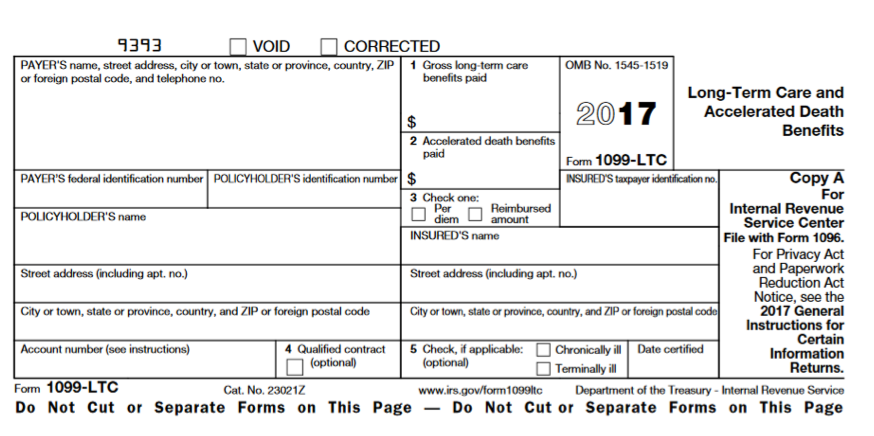

Nextgen Long Term Care Planning

Nextgen Long Term Care Planning

1099 Nec Tax Services Accounting Firms Accounting Services

1099 Nec Tax Services Accounting Firms Accounting Services

Important Changes For 2019 And 2020 Filing Forms 1099 Misc Irs Forms Irs Efile

Important Changes For 2019 And 2020 Filing Forms 1099 Misc Irs Forms Irs Efile

Fake Health Insurance Card Inspirational How To Make Proof Document Of Petermcfarland Us Small Business Tax Documents Templates

Fake Health Insurance Card Inspirational How To Make Proof Document Of Petermcfarland Us Small Business Tax Documents Templates

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Any Health Insurance Company Can Help Fix A Broken Arm Ours Is Trying To Fix A Broken System Health Insurance Companies Dental Life Health Insurance

Any Health Insurance Company Can Help Fix A Broken Arm Ours Is Trying To Fix A Broken System Health Insurance Companies Dental Life Health Insurance

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Top Benefits Of Having An Independent Insurance Agent Buy Health Insurance Life Insurance Facts Life Insurance Marketing

Top Benefits Of Having An Independent Insurance Agent Buy Health Insurance Life Insurance Facts Life Insurance Marketing

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Am I Supposed To File A 1099 Misc Form The Smart Keep Inc Financial Planning For Couples Small Business Bookkeeping Bookkeeping Business

Am I Supposed To File A 1099 Misc Form The Smart Keep Inc Financial Planning For Couples Small Business Bookkeeping Bookkeeping Business

The 1099 Misc And Home Health Innovative Financial Solutions For Home Health

The 1099 Misc And Home Health Innovative Financial Solutions For Home Health

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Ask The Taxgirl Form 1099 Misc Mistake Tax Forms Doctors Note Template Important Life Lessons

Ask The Taxgirl Form 1099 Misc Mistake Tax Forms Doctors Note Template Important Life Lessons

Understanding Your Tax Forms 2016 1099 Misc Miscellaneous Income Tax Forms Doctors Note Template Important Life Lessons

Understanding Your Tax Forms 2016 1099 Misc Miscellaneous Income Tax Forms Doctors Note Template Important Life Lessons