Where Can I Find My 1099 G Form From Unemployment

You can log into CONNECT and click on My 1099G49T to view and print the forms. If you see a 0 amount on your 2020 form call 1-866-401-2849 Monday through Friday from 8 am.

After logging in click View Correspondences in the left-hand navigation menu or in the hamburger menu at the top if youre on mobile.

Where can i find my 1099 g form from unemployment. The New Mexico Department of Workforce Solutions mails all Unemployment Insurance 1099 tax information by the last day of January each year. Individuals can access copies of 1099 forms by logging into the UI Tax Claims System wwwjobsstatenmus Sunday through Friday from 400 am. These forms will be mailed to the address that DES has on file for you.

Regardless of the initial method of delivery all claimants can access copies of their 1099-G form in multiple ways. Ask Your Own Tax Question. How to requestRequest your unemployment benefits 1099-G.

Click on the down arrow to select the right year. Click on View and request 1099-G on the left navigation bar. We will mail you a paper Form 1099G if you.

Call your local unemployment office to request a copy of your 1099-G by mail or fax. You can access your Form 1099G information in your UI Online SM account. Anyone who repaid an overpayment of unemployment benefits to the State of Arizona in 2020 will also receive a 1099-G form.

I cant file my taxes until I get my 1099 G form and cant get any help to resolve this matter. If you have a 1099 discrepancy call the NMDWS 1099G informational and message line at 505. Your local office will be able to send a replacement copy in the mail.

Applicant Services 1099 Information The 1099s reflecting unemployment benefits paid in 2020 will be mailed to the last address on file no later than January 29 2021. The 1099-G will be mailed to the address on file with the Maryland Department of Labor. Then you will be able to file a complete and accurate tax return.

Most claimants who received Pandemic Unemployment Assistance PUA benefits during 2020 can access their 1099-G form within the MyUI application. 1099-G The 1099-G is the tax form the department issues in January for the purposes of filing your taxes. Click on View 1099-G and print the page.

Your 1099-G will be sent to your mailing address on record the last week of January. You can log-in to CONNECT and go to My 1099- G in the main menu to view the last five years of your 1099-G Form document. Form 1099G is now available in Uplink for the most recent tax year.

If you have additional questions about accessing your 1099-G form please call IDES at 800 244-5631. You can access your Form 1099G information on your Correspondence page in Uplink account. You can receive a copy of your 1099-G Form multiple ways.

The fastest way to receive a copy of your 1099-G Form is by selecting electronic as your preferred method for correspondence. Log in to your UI Online account. Getting Your 1099-G Tax Form.

We mailed you a paper Form 1099G if you have opted into paper mailing or are a telephone filer. IDES began sending 1099-G forms to all claimants via their preferred method of correspondence email or mail in late January. For additional questions please review our 1099-G frequently asked questions here.

Please ensure that your mailing address is up-to-date. For Pandemic Unemployment Assistance PUA claimants the forms will also be available online in the. You can view 1099-G forms for the past 6 years.

Pacific time except on state holidays. A 1099-G issued by the Tax Department does not include unemployment compensation benefits. Unemployment benefits are taxable income meaning benefit payments must be reported on your federal tax return when filing taxes with the Internal Revenue Service IRS.

Email alerts will be sent to the claimants that elected to receive electronic notifications advising that they can view and print their 1099G online. 31 there is a chance your copy was lost in transit. If you wish to request a duplicate 1099-G for prior years send your request to the Maryland Department of Labor - Benefit Payment Control BPC Unit at dlui1099-labormarylandgov.

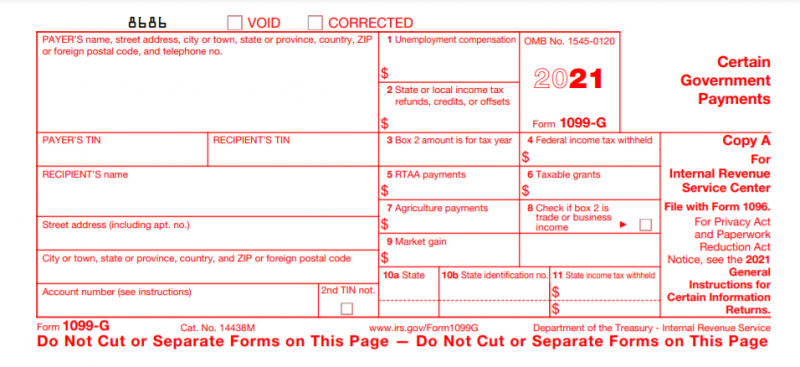

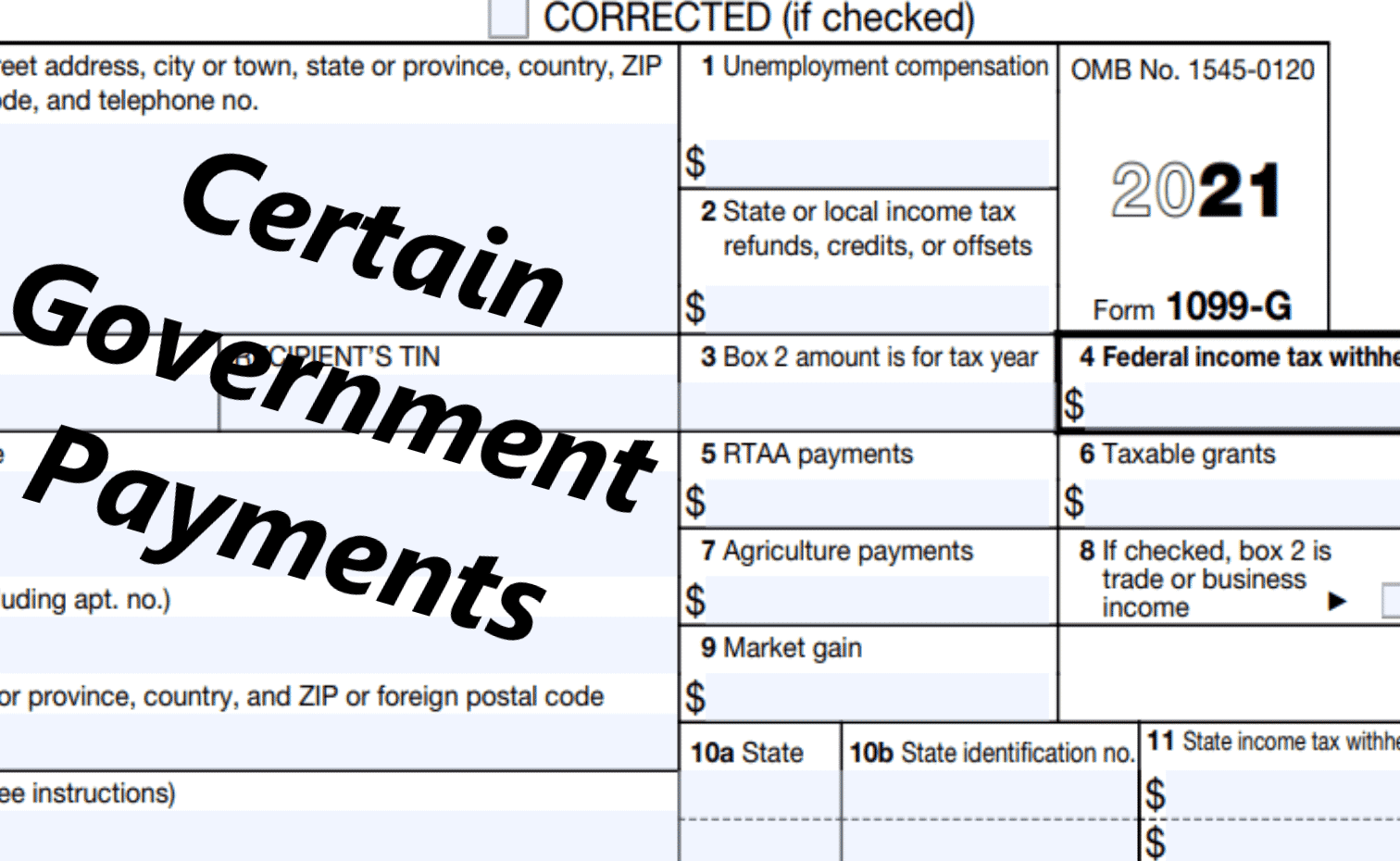

Lost my pandemic unemployment 1099G form and unable to reset password request copy online. You can also download your 1099-G income statement from your unemployment benefits portal. The 1099-G tax form is commonly used to report unemployment compensation.

If you havent received your 1099-G copy in the mail by Jan. Instructions for the form can be found on the IRS website. If you received unemployment compensation last year you may view your 1099-G online from your New York State Department of Labor account or call.

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Users Report Problems Accessing 1099 G Form On Florida S Unemployment Website

Users Report Problems Accessing 1099 G Form On Florida S Unemployment Website

Ct Dept Of Labor Recent Irs Guidance On The 1099g Tax Form

Ct Dept Of Labor Recent Irs Guidance On The 1099g Tax Form

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

1099 G Form 2021 Irs Forms Zrivo

1099 G Form 2021 Irs Forms Zrivo

1099g Maryland Fill Online Printable Fillable Blank Pdffiller

1099g Maryland Fill Online Printable Fillable Blank Pdffiller

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

1099 Form Available For 2017 Unemployment Recipients

1099 Form Available For 2017 Unemployment Recipients

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training