40k Small Business Loan Government Of Canada

Check out the resources to help manage your business during COVID-19. Canada has more than 11 million small businesses employing.

Covid 19 How To Apply For The Canada Emergency Small Business Loan Youtube

Covid 19 How To Apply For The Canada Emergency Small Business Loan Youtube

The minimum and maximum annual payroll required to access a CERB loan was recently changed to a minimum of 20000 from 50000 and maximum.

40k small business loan government of canada. The program will now be available to businesses with sole proprietors those that rely on contractors and family-owned. On April 16 2020 the federal government announced that the payroll threshold for businesses qualifying for the Canada Emergency Benefit Account CEBA has been reduced from 50000 to 20000 and increased at the upper end from 1 million to 15 million. This means the additional loan effectively increases CEBA loans from the existing 40000 to 60000 for eligible businesses of which a total of 20000 will be forgiven if the balance of the loan is repaid by December 31 2022.

The 25 billion program offers government-backed loans of up to 40000 interest-free until the end of 2022 administered by banks. Canada Emergency Business Account The new Canada Emergency Business Account will provide interest-free loans of up to 40000 to small businesses and not-for-profits to help cover their operating costs during a period where their revenues have been temporarily reduced. Trudeau also unveiled a new measure to help cash flow the Canada Emergency Business Account that will see banks offer 40000 loans which will be guaranteed by the government for qualifying businesses.

The federal government has since updated the criteria for this program. This loan is a government-sponsored loan program that offers up to 1000000 350000 for equipment and leasehold improvements to small businesses in Canada. On Tuesday Prime Minister Justin Trudeau announced that eligibility criteria for Canada Emergency Business Account CEBA has been expanded to include more small businesses.

The Federal government has announced that they will be providing additional support to small businesses which a guaranteed loan through the Chartered Canadian banks. March 27 2020 Businesses will be able to access interest free loan of 40000 through their financial institutions and 25 of the loan up to 10000 will be eligible for forgiveness. As of December 4 2020 hard-hit small businesses and not-for-profits could be eligible for an additional 20000 CEBA loan on top of the 40000 already available.

Canadian banks have begun enrolment for the Canada Emergency Business Account which is meant to provide interest-free loans of up to 40000 to small businesses and not-for-profits to help cover operating costs for businesses that have seen a reduction in revenue during COVID-19. Small businesses looking to purchase or improve their assets for new or expanded operations could benefit from the Canada Small Business Financing Loan CSBFL. More Businesses Qualify for a 40K Interest-Free Loan.

Applicants Seeking Status Updates Applicants can check the status of their CEBA Loan online at httpsstatus-statutceba-cuecca. The loan will be interest-free for the first year and if certain conditions are met 10000 of it will be forgivable. Canada Small Business Financing Loan 1 CSBFL Start or grow your business with a Canada Small Business Financing Act Loan.

Check out the interactive business benefits finder at innovationcanadaca. The CSBFP is committed to its service standards. Canada Emergency Business Account CEBA You will be able to apply for a government backed loan up to 40K 25 of loan up to 10K.

Details of the loan and terms. The Government of Canada has launched the Canada Emergency Business Account CEBA which provides qualifying businesses with an interest-free loan of up to 40000 to help cover operating costs during a period where revenues have been temporarily reduced. Canada Emergency Business Account.

The CEBA offers interest-free loans of up to 40000 to small businesses and not-for-profits. Government-Guaranteed Loans to Support the Growth of Your Business. Canada Emergency Business Account for small businesses.

These banks will begin the application process starting the week of April 6 th 2020. A financing option through TD and the Government of Canada that can help you fund the purchase or improvement of land buildings and equipment. For more information on other government programs and services.

Launched on April 9 2020 CEBA provided a 40000 zero-interest partially forgivable loan to small businesses that experienced diminished revenues due to COVID-19 and faced ongoing non-deferrable costs such as rent utilities insurance taxes and employment costs.

How To Apply For Ceba 40k Loan As Real Estate Investors Real Estate Agents Cherry Chan Chartered Accountant Your Real Estate Accountant

How To Apply For Ceba 40k Loan As Real Estate Investors Real Estate Agents Cherry Chan Chartered Accountant Your Real Estate Accountant

Covid 19 Business Thread Info Discussion Page 2 Sportfishing Bc

Covid 19 Business Thread Info Discussion Page 2 Sportfishing Bc

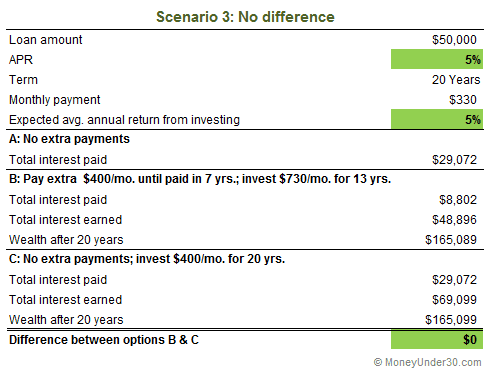

Should You Pay Off Student Loans Early Money Under 30

Should You Pay Off Student Loans Early Money Under 30

Soaring Student Debt Prompts Calls For Relief Wsj

Soaring Student Debt Prompts Calls For Relief Wsj

Adu Financing Understanding Your Options Renofi

Adu Financing Understanding Your Options Renofi

Mortgage Loan Types Infographic To Learn More About Mortgages Visit Http Todaysmortgage N Mortgage Loans Mortgage Loan Calculator Mortgage Loan Originator

Mortgage Loan Types Infographic To Learn More About Mortgages Visit Http Todaysmortgage N Mortgage Loans Mortgage Loan Calculator Mortgage Loan Originator

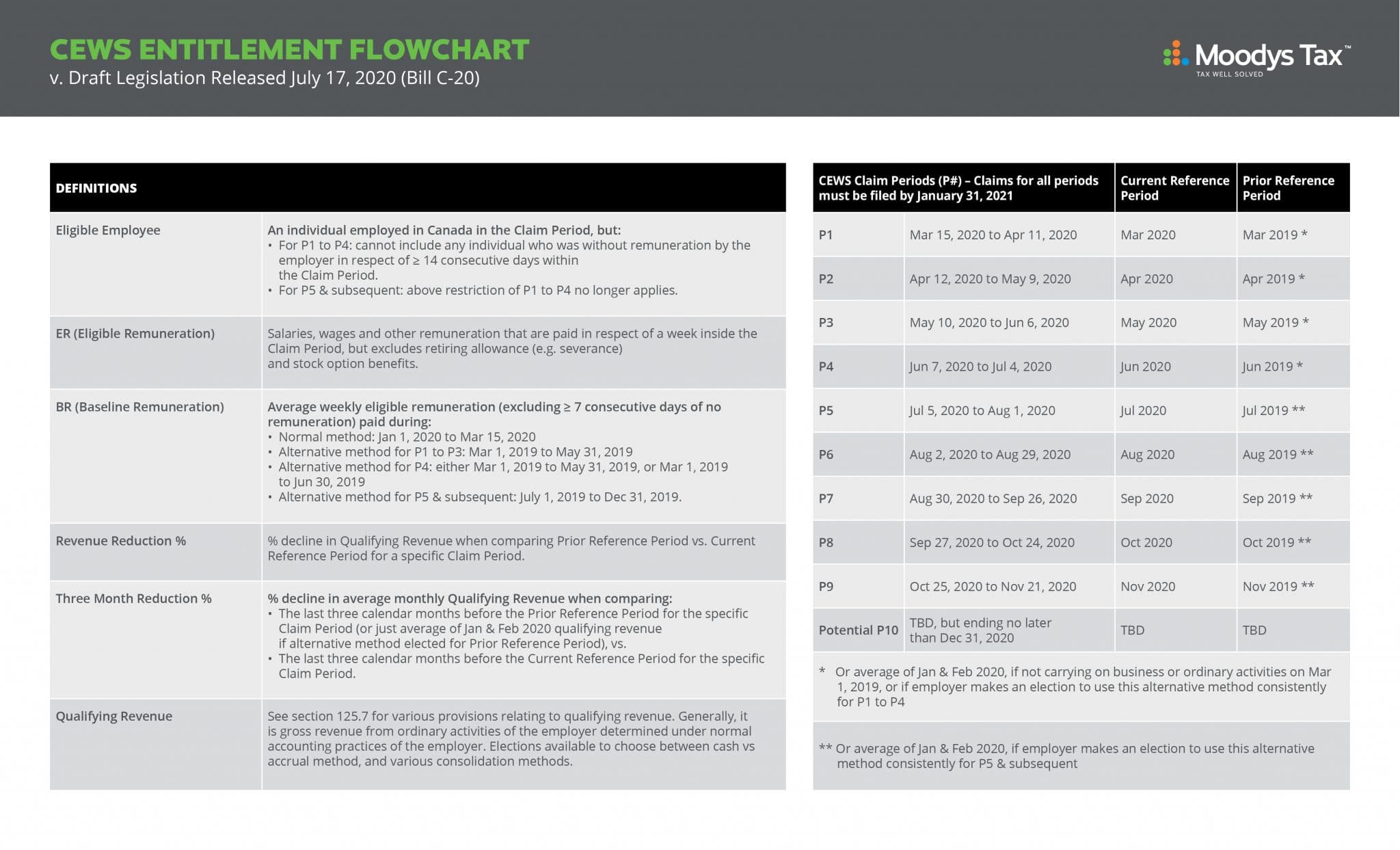

Covid 19 Canadian Small Business Guide Zenbooks

Covid 19 Canadian Small Business Guide Zenbooks

How To Fill Out The Sba Disaster Loan Application Youtube

How To Fill Out The Sba Disaster Loan Application Youtube

Tips On How To Prepare For 40k Ceba Loan Application Cherry Chan Chartered Accountant Your Real Estate Accountant

Tips On How To Prepare For 40k Ceba Loan Application Cherry Chan Chartered Accountant Your Real Estate Accountant

Jared Hecht On Twitter 8 As An Example Lender 15 On This Sba Ppp List Is A Small Non Bank Sba Lender With A Couple Hundred Employees That Normally Does 400 Sba Loans Year

Jared Hecht On Twitter 8 As An Example Lender 15 On This Sba Ppp List Is A Small Non Bank Sba Lender With A Couple Hundred Employees That Normally Does 400 Sba Loans Year

Upstart Announces Availability Of Upstart Referral Network

Upstart Announces Availability Of Upstart Referral Network

Community Futures Offering Covid 19 Related Business Loans The Chatham Voice

Community Futures Offering Covid 19 Related Business Loans The Chatham Voice

40k In Tfsa Turned Into 150k If I Withdraw All Now Can I Contribute 150k In 2022 Canadianinvestor

40k In Tfsa Turned Into 150k If I Withdraw All Now Can I Contribute 150k In 2022 Canadianinvestor

Details Of The Canada Emergency Business Account Ceba Loan Physician Finance Canada

Details Of The Canada Emergency Business Account Ceba Loan Physician Finance Canada

How To Apply For 40k Interest Free Loan As Real Estate Investors And Realtors Cherry Chan Chartered Accountant Your Real Estate Accountant

How To Apply For 40k Interest Free Loan As Real Estate Investors And Realtors Cherry Chan Chartered Accountant Your Real Estate Accountant