How To Report Uber Income In Turbotax Without 1099

If youre already signed in to your TurboTax account and working on your return. This means that you simply treat the income the same way you would if it were less than 600 and didnt require a.

How To Avoid An Irs Audit As An Uber Or Lyft Driver Laptrinhx

How To Avoid An Irs Audit As An Uber Or Lyft Driver Laptrinhx

With no 1099 you just enter your income as business income not a 1099 and then walk through the deductions as it asks.

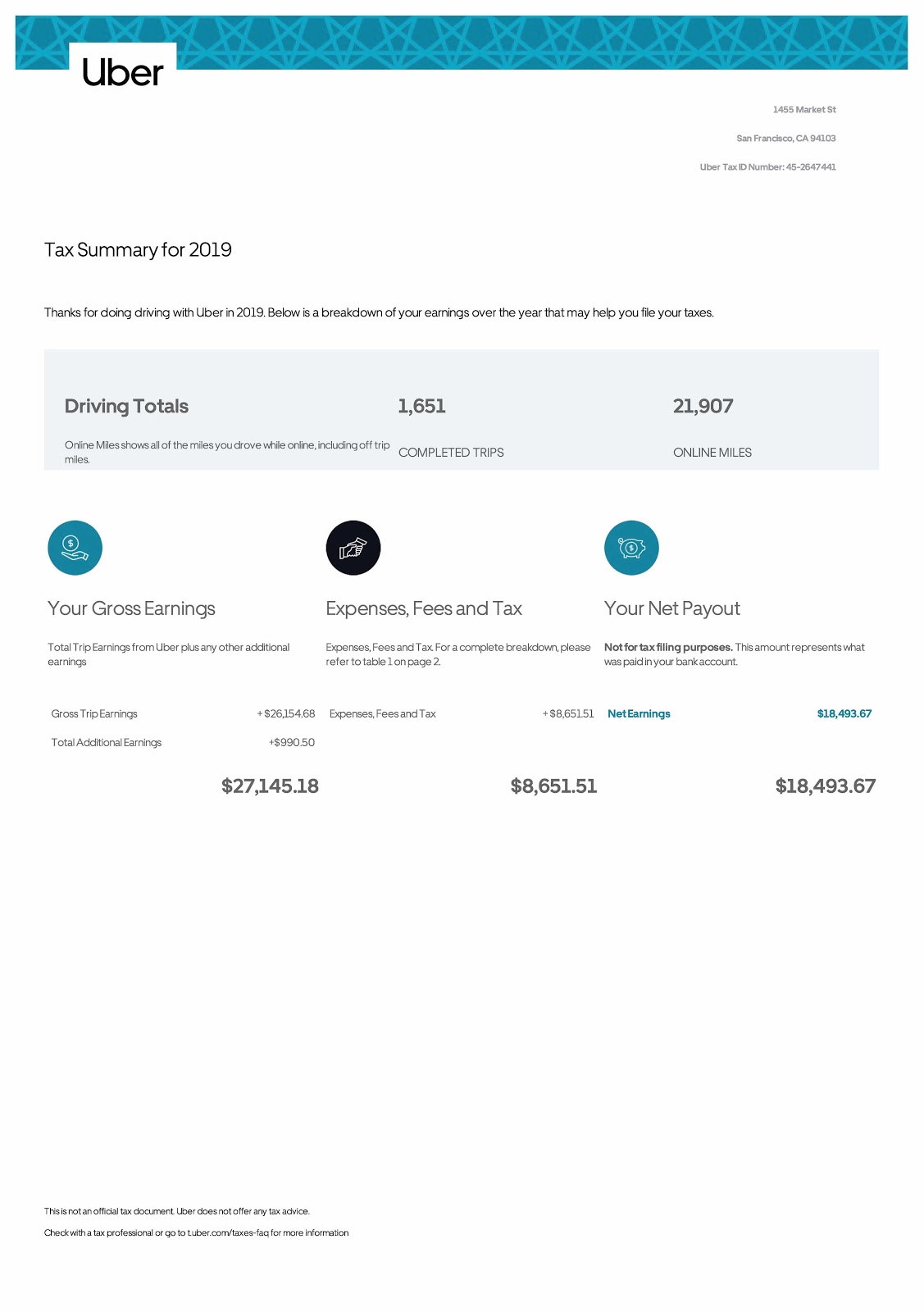

How to report uber income in turbotax without 1099. If your net earnings from Uber exceed 400 you must report that income. Instead youll manually enter your income from your Tax Summary by following these steps. Follow along as we outline how to read your Uber 1099 and report.

You can find your yearly summary through your online account with Lyft. You should file a Form 1040 and attach Schedule C and Schedule SE to report your Uber income. If youre filling out your tax return by hand youll include your 1099 income totals in.

The remaining amount is your net profit. If you dont have a Form 1099 from Uber or Lyft TurboTax wont be able to import your income automatically. An official IRS tax document providing a summary of other income such as prizes legal settlements etc.

Answer a few questions about your driving work. They dont owe you a 1099 and you have zero need for one. Go to Federal Income Expenses.

Scroll down to See all income. Sign in to your return and open or continue your return. Every number you need as far as income and Uber fees is on the tax summary.

Uber actually does not have to send out 1099-Ks to anyone who made under 20000 and received less than 200 payments for driving services. Select Wages Income from the top. Reporting a 1099-K on your tax return.

Beginning with the 2012 tax year if you are self-employed report your 1099-K payments on Schedule C on a separate revenue line. You must pay self-employment taxes on net earnings exceeding 400. As long as you know or can find out from your client or the IRS how much you made you just go ahead and file the return.

If they dont it doesnt really matter. Uber drivers use this form to calculate how much of their income is taxable. Despite making well over 600 Uber sent me an email saying I didnt qualify for a 1099 while turbo tax says they are required to send me one.

If youre not required to file an income tax return and your net earnings from Uber are less than 400 you arent required to report your Uber income. Youll report the income you earn as a rideshare driver on Schedule C Profit or Loss from Business which youll file along with Form 1040. Using the Yearly Summary to Report Your Earnings and Expenses Without a Form 1099 No 1099-K or 1099-NEC.

Answer Yes to Did you have any self-employment income or expenses. For those taxes you. If you have less than 400 in income from Uber but are otherwise required to file a tax return you must still file.

As an independent contractor report your income on Schedule C of Form 1040 Profit or Loss from Business. However they choose to send 1099s so that driver partners remember to file taxes and have a clear summary of their earnings. Search for self-employment income and select the Jump to link to go to the Self-employment income section.

0 Federal 0 State 0 To File offer is available for simple tax returns with TurboTax Free Edition. When asked the type of self-employment work you do type Uber or rideshare driving. Plug that number into the Schedule SE.

Thanks in advance and yes I know its super late in the season to do taxes but Ive had a hell of a year so far lol. Attach Schedule C and Schedule SE to report your earnings from being an Uber partner. If you received income in referrals and incentives but not enough to receive a 1099-MISC you can check your Uber Tax Summary for this income and then report it as Other income on your Schedule C.

Only drivers and delivery people who received 600 or more of these types of payments will receive a 1099-MISC. Form 1099-NEC is only replacing the use of Form 1099-MISC for reporting independent contractor payments. To enter your Uber tax summary.

How am I supposed to report income without having that information. This amount can be found by subtracting Uber fees and business expenses from your income. Select Federal in the left menu.

If youre moonlighting as an Uber driver to supplement income from another job youll report both incomes on Form 1040. Consider performing a double check on your total business income by comparing the total revenue on Schedule C to your profit and loss statement from your accounting system. They also dont have to send a 1099-MISC to anyone who made under 600 in referrals.

You will still need to report any income earned as a rideshare driver to the IRS. A simple tax return is Form 1040 only without any additional schedules OR Form 1040 Unemployment Income. If you have net earnings not gross from Uber in excess of 400 you must file a federal tax return with Schedule C and Schedule SE attached.

In the Self-employment section click Start next to Income Expenses. Im an Uber Driver.

Uber Tax Filing Information Alvia Uber Filing Taxes Uber Driving

Uber Tax Filing Information Alvia Uber Filing Taxes Uber Driving

25 Rideshare Tax Deductions Uber And Lyft Drivers Can Use In 2018 Six Figure Drivers

25 Rideshare Tax Deductions Uber And Lyft Drivers Can Use In 2018 Six Figure Drivers

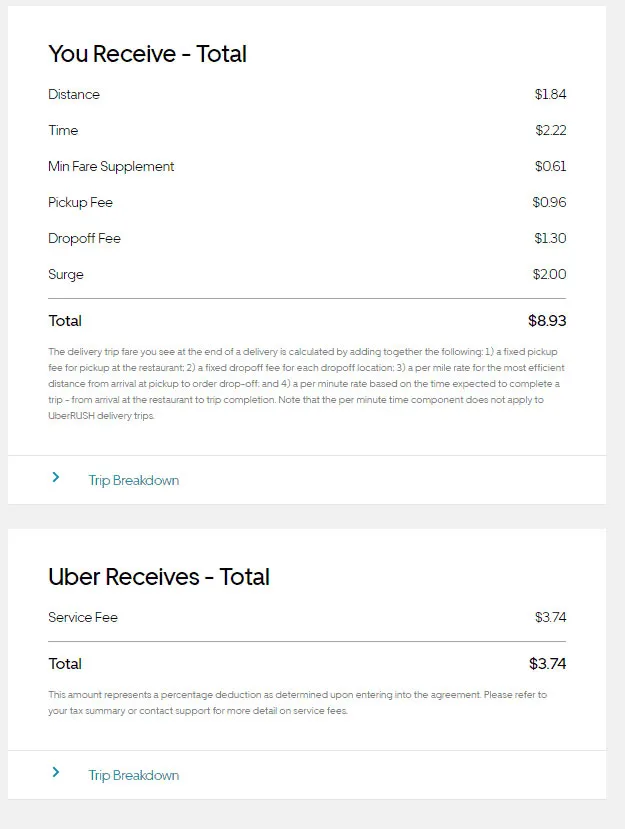

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

What Can An Uber Driver Deduct Uber Driver Uber Driving Uber Car

What Can An Uber Driver Deduct Uber Driver Uber Driving Uber Car

Why Didn T Uber Eats Send A 1099 Why 1099 K Entrecourier

Why Didn T Uber Eats Send A 1099 Why 1099 K Entrecourier

Any Uber Eats Driver Know Why My 1099 Nec Form Shows A Smaller Amount Than What Was Deposited Into Their Account Tax

Any Uber Eats Driver Know Why My 1099 Nec Form Shows A Smaller Amount Than What Was Deposited Into Their Account Tax

Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience

Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience

Uber Taxes Explained How To File Taxes For Uber Lyft Drivers Youtube

Uber Taxes Explained How To File Taxes For Uber Lyft Drivers Youtube

How To File Your Uber 1099 Tax Help For Uber Drivers Tax Help Lyft Driver Uber Driver

How To File Your Uber 1099 Tax Help For Uber Drivers Tax Help Lyft Driver Uber Driver

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2021

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2021

Tax Tips For Uber Driver Partners Understanding Your Taxes Turbotax Tax Tips Videos

Tax Tips For Uber Driver Partners Understanding Your Taxes Turbotax Tax Tips Videos

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Top 7 Mistakes That Rideshare Drivers Make At Tax Time Stride Blog Tax Time Rideshare Driver Tax

Top 7 Mistakes That Rideshare Drivers Make At Tax Time Stride Blog Tax Time Rideshare Driver Tax

How To File Your Uber 1099 Tax Help For Uber Drivers Tax Help Lyft Driver Uber Driver

How To File Your Uber 1099 Tax Help For Uber Drivers Tax Help Lyft Driver Uber Driver

Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience

Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2021

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2021

Why Didn T Uber Eats Send A 1099 Why 1099 K Entrecourier

Why Didn T Uber Eats Send A 1099 Why 1099 K Entrecourier

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2021

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2021