How To Start A Venture Capital Company In South Africa

Venture capital should not be the go-to funding choice for everyone starting a business. One of the ways through which they achieve this is by giving small business loans South Africa.

Naspers has said it will invest a total of R46-billion over the next three years in the local technology sector.

How to start a venture capital company in south africa. Its usually the first institutional money that entrepreneurs take on. If South Africa had adopted such a proposal this would have marked a radical break with the fundamental principles of our tax system. Alfred Capital Partners LP.

Angelists Rolling Funds in particular now enable folks with strong followings in. Venture capital is private equity capital offered to early-stage enterprises often to those in high-risk hi-tech industries. This is ideal for start-ups not yet at a stage where they can apply for a bank or debt loan.

Some funders will provide funds specifically for research and development while others will help you finance your business. Local examples of angel investors include GroVest Venture Capital Company. Choose a Catchy Business Name.

Here are samples you can use. Anyone searching for business funding can approach the company for support. However in the Draft Revenue Laws Amendment Bill 2008 SARS has made provision for the creation of an alternative in the legislation for the introduction of a so-called venture capital company VCC.

Proposals for caps on tax incentive-related venture capital investments South Africa. This list of venture capital investors headquartered in South Africa provides data on their investment activities fund raising history portfolio companies and recent news. When you start your search for startup funding you should probably look for angel funding before seeking out venture capital.

Why is this vital. Knife Capital invests via a consortium of funding partnerships including a Sars section 12J Venture Capital Company KNF Ventures and select. In starting your venture capital business it would be in your own best interest to have a very catchy name.

A startup is a high growth potential company in search of a repeatable and scalable business model. Perhaps 5m 10m 20m to start mainly from Very Rich Individuals. Operating out of Stellenbosch in South Africa and backed by two family offices we are passionate about early stage investments in South Africa.

4Di Capital is a specialist firm based in the Western Cape that provides early stage development and seed funding to technology-focused start-ups in South Africa. Since their establishment in 2012 SEFA grants business owners access to the capital they desire efficiently and sustainably to get their ideas running. By Guest Post on March 12.

Caps on venture capital investments Pending legislative proposals would impose caps on the amounts of investments made by natural persons and corporations that would be eligible for tax incentives available under Section 12J. Founded in 2010 the objective of the fund is to invest in and grow SMEs as well as provide growth support services to both investee and non-investee companies. Start Small before your start a Venture Capital Firm.

Starting out in 2011 as the first angel group in SA we matured into an early stage Venture Capital firm in January 2014. Once it gets product-market fit and some traction through the scale. Another veteran venture capitalist in South Africa is Keet van Zyl.

This is vital because you can attract your customers with the best of names. This used to be very hard but now its merely hard. Start as an angel investor make some good investments and then after proving yourself as an angel raise a small fund.

A playbook for raising venture capital in South Africa 0. Venture capital finance This is where private equity capital is used as seed funding for businesses that are considered high growth with high potential. Together with Anthea Bohmert he serves as a managing partner of Knife Capital.

Keet van Zyl Knife Capital. Naspers Foundry is a R14 billion startup fund that backs South Africa-focused technology startups. In exchange the venture capital firm usually has certain decision-making powers as well as an ownership stake.

In fact you can get between R50000 and. It is first-stage financing for companies that show potential for growth. Venture capital is an overly-used term.

The Vumela Fund a R588 million social venture capital fund is managed by Edge Growth on behalf of the Vumela Trustees. They focus on South African startups both in the tech industry and others too. This is a venture capital company in South Africa that provides funding for businesses pursuing expansion strategies.

VC refers to institutional investment funds that invest into startups and small businesses. Insights about their portfolio exits top trending and most active investors are also included. You can access a detailed list of venture capital and private equity firms on the South African Venture Capital Association SAVCA website.

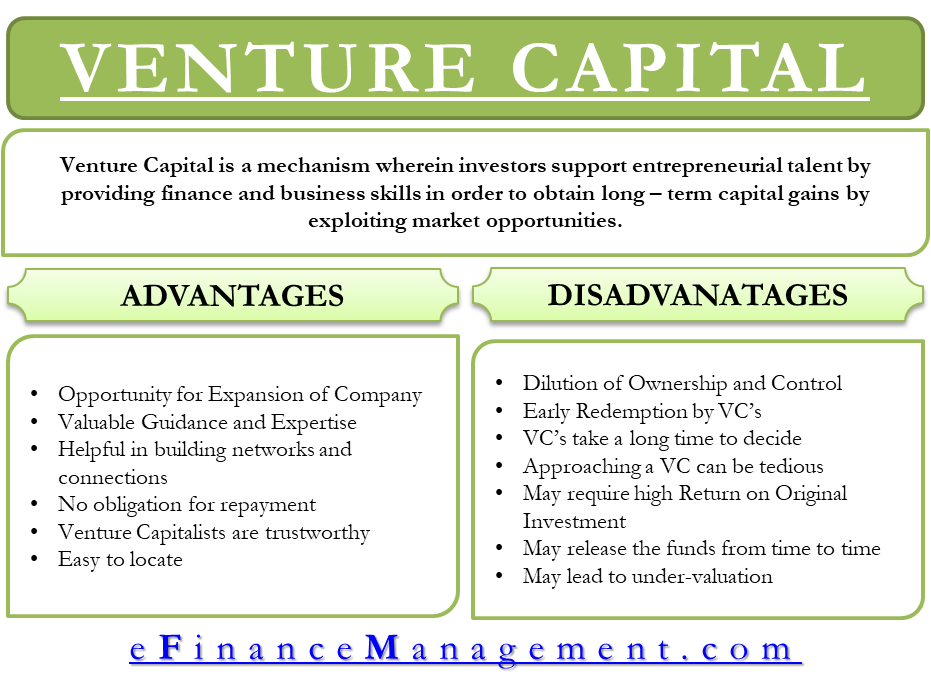

Advantages And Disadvantages Of Venture Capital Efinancemanagement

Advantages And Disadvantages Of Venture Capital Efinancemanagement

Entrepreneurs Angel Investors Business Finance Venture Capital Angel Investors Venture Capital Investing

Entrepreneurs Angel Investors Business Finance Venture Capital Angel Investors Venture Capital Investing

Silicon Is Clean And Modern Design Responsive Wordpress Theme For Venture Capital Investment Company Website Html5 Templates Layout Download Homepage Layout

Silicon Is Clean And Modern Design Responsive Wordpress Theme For Venture Capital Investment Company Website Html5 Templates Layout Download Homepage Layout

How Would A Person Start A Venture Capital Fund Saastr

How Would A Person Start A Venture Capital Fund Saastr

Indian Start Up Space Attracting New Venture Capital Investors Livemint Venture Capital Start Up Capital Investment

Indian Start Up Space Attracting New Venture Capital Investors Livemint Venture Capital Start Up Capital Investment

Founders Factory Africa And Netcare To Fund 35 Health Tech Startups Health Tech Tech Startups Healthcare Companies

Founders Factory Africa And Netcare To Fund 35 Health Tech Startups Health Tech Tech Startups Healthcare Companies

The First Comprehensive Study On Women In Venture Capital And Their Impact On Female Founders Techcrunch Startup Funding Start Up Venture Capital

The First Comprehensive Study On Women In Venture Capital And Their Impact On Female Founders Techcrunch Startup Funding Start Up Venture Capital

South Africa Investment Network Entrepreneurs Angel Investors Business Finance Venture Capital South Business Investors Angel Investors Venture Capital

South Africa Investment Network Entrepreneurs Angel Investors Business Finance Venture Capital South Business Investors Angel Investors Venture Capital

Next Steps For Venture Capital Firm Greycroft S Bitcoin Bet South Africa The Emirates Ethereum Cryptocurrency Bitcoin Cryptocurrency What Is Bitcoin Mining

Next Steps For Venture Capital Firm Greycroft S Bitcoin Bet South Africa The Emirates Ethereum Cryptocurrency Bitcoin Cryptocurrency What Is Bitcoin Mining

The Study Of Venture Capital Finance And Investment Behaviour In Small And Medium Sized Enterprises

African Venture Capital 2018 Report Usd 725 6 Mn Invested In 458 Deals Weetracker Venture Capital Investing Startup News

African Venture Capital 2018 Report Usd 725 6 Mn Invested In 458 Deals Weetracker Venture Capital Investing Startup News

Venture Capital To Start Businesses Graphic By Setiawanarief111 Creative Fabrica Venture Capital Business Illustration Business Company

Venture Capital To Start Businesses Graphic By Setiawanarief111 Creative Fabrica Venture Capital Business Illustration Business Company

Trends In Venture Capital Investments Oecd Small Business Start Up Venture Capital Capital Investment

Trends In Venture Capital Investments Oecd Small Business Start Up Venture Capital Capital Investment

Knife Capital S Grindstone Accelerator Announces Its Fourth Cohort Weetracker Venture Capital Startup News Warehouse Management System

Knife Capital S Grindstone Accelerator Announces Its Fourth Cohort Weetracker Venture Capital Startup News Warehouse Management System

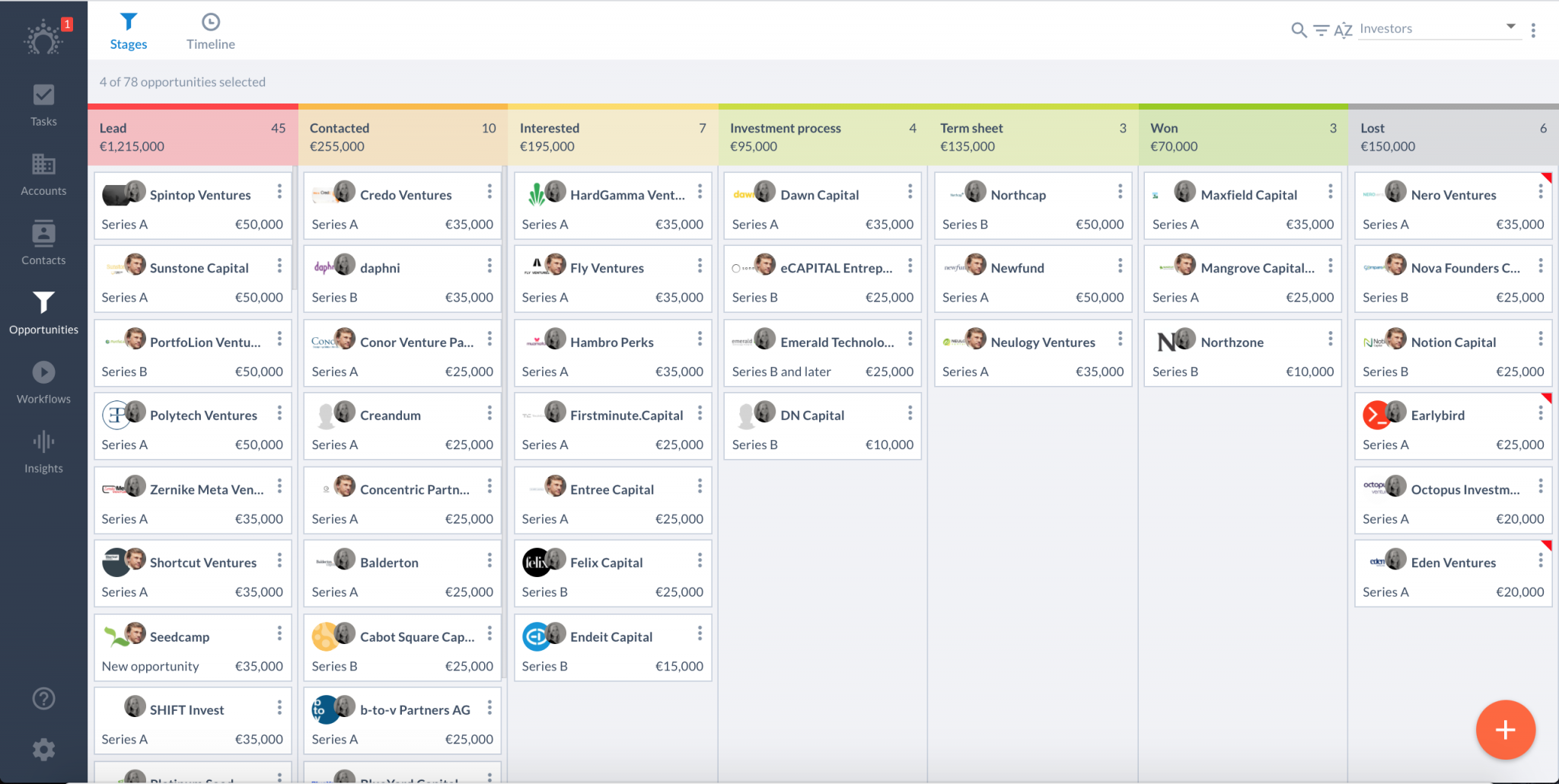

The Top 100 Early Stage Venture Capital Investors In Europe In 2021

The Top 100 Early Stage Venture Capital Investors In Europe In 2021

Twitter Start Up City Drawing Venture Capital

Twitter Start Up City Drawing Venture Capital

Top Venture Capital Funds For Food And Beverage Industry

Top Venture Capital Funds For Food And Beverage Industry

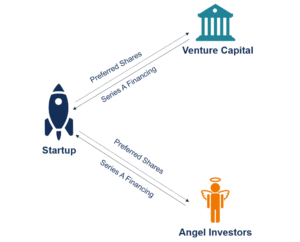

Series A Financing Overview Objectives And How It Works

Series A Financing Overview Objectives And How It Works