Can I Create A 1099 In Quickbooks

Solution Description Corrected 1099s and 1096s can be generated in the Information Return System IRS. Click Finish preparing 1099s.

Here You Find Full Detail About Quickbooks 1099 Forms Quickbooks Quickbooks Online Bookkeeping Software

Here You Find Full Detail About Quickbooks 1099 Forms Quickbooks Quickbooks Online Bookkeeping Software

Click the Prepare 1099s button.

Can i create a 1099 in quickbooks. Click on Edit in the toolbar and then choose Preferences. Go to the Workers menu. You can fill out your W-9 submit it and view your 1099-MISC.

Click on the Prepare 1099s button. Under Change columns check the box for Amount. This option is good for users on older QuickBooks Desktop versions or who have problems working through the other two methods.

You can run the 1099 Contractor Balance Detail Report and make sure to check the column for AmountAlso filter the Report period to be on the year 2019. Open QuickBooks Online then go to the Payroll menu then select Contractors and then Prepare 1099s. Lets go through the process of setting up the 1099 preferences.

The Information Return System does NOT support Electronic Filing for 1099-C or W2-C corrected forms they must be paper filed. Search for Vendor Contact List and open the report. How to find and produce 1099 reports in Quickbooks Heres how to get the report that lists all of your 1099 vendors.

The procedure to create 1099s in QuickBooks Desktop involves the following steps. If you want to sort the report by 1099 vendors. Printing your 1099s in QuickBooks Online is relatively straightforward.

Its nice to have you here in the Community artsexpress. Select the Track 1099 checkbox. Follow the steps to fill out and submit your W-9.

If you already have a QuickBooks Self-Employedaccount select Sign in. Enable 1099 Option 1 Launch QuickBooks then click. The first time you run this report you will receive a blank page.

Click on the Workers tab then select Contractors. Click the Settings icon from the report. Problem Description How to generate a corrected 1099 or 1096.

Click on PrintE-File 1099 Forms. To set up a 1099 employee in QuickBooks Online follow the below steps. Tax1099 can convert the data to our import grid to create the forms.

Select Yes for the Do you file 1099-MISC forms and click OK to save preferences. Choose the Contractors tab. Creating a 1099 form for a contractor whom youve added to the employee.

From the RowsColumns drop-down menu select Change columns. From the left menu select Reports. Enter 1099 Contractor Balance Detail on the search bar.

Now your employer has the info they need to complete your 1099-MISC. To use this method please pull the following two reports from QuickBooks Desktop noting the customization of the Vendor Contact List. Or follow the steps to create a limited QuickBooks Self-Employed account.

You can correct your 1099-NEC or 1099-MISC in Tax1099. Can I file another set of 1099s. Fire up the 1099 Wizard follow the steps and hit print.

QuickBooks business accounting software enables you to generate 1099 forms for both categories of independent contractor. Click 1099 contractors below the threshold. From the main dashboard click the Workers tab on the left-hand side.

Select Contractors from the sub-menu and then click Add your first contractor Enter the name and. This account has limited features. Now QuickBooks will enable you to.

1099 section and then switch to Company Preferences tab. Start QuickBooks and go to Vendors. Go to the Clients tab.

Yes you can use our W2 Mate 2020 software and above to import data from QuickBooks and then prepare 1099-NEC forms for mailing to recipients or filing with the IRS. In Preferences menu move to the Tax. QuickBooks can track money paid to an independent contractor and automatically populate a printable 1099 form with his relevant financial data.

Use the QuickBooks 1099 Wizard to prepare your 1099s In the sidebar of your QuickBooks Online dashboard hover your mouse over Workers. To generate the 1099 Transaction Details Report you will need to pretend like you want to process your 1099s through QuickBooks Online. Once there go to the Type of contractors drop-down arrow.

Go to Step number 4 by clicking Next. If contractors are not added yet add them first before going to the 1099 e-file flow. This button is also located in the Vendor.

For instructions on correcting your 1099s refer to this Tax 1099 article Different types of 1099.

Quickbooks 1099 Overview And Tips 2014 2015 Quickbooks Online Quickbooks Quickbooks Online Quickbooks Online Plus

Quickbooks 1099 Overview And Tips 2014 2015 Quickbooks Online Quickbooks Quickbooks Online Quickbooks Online Plus

How To Pay Multiple Bills Using A Check In Quickbooks Online Quickbooks Online Quickbooks Online

How To Pay Multiple Bills Using A Check In Quickbooks Online Quickbooks Online Quickbooks Online

How To Prepare And E File 1099s In Quickbooks Desktop In 2020 Quickbooks Filing Preparation

How To Prepare And E File 1099s In Quickbooks Desktop In 2020 Quickbooks Filing Preparation

Quickbooks Tutorial How To Print 1099 Form In Quickbooks Online Quickbooks Quickbooks Online Quickbooks Tutorial

Quickbooks Tutorial How To Print 1099 Form In Quickbooks Online Quickbooks Quickbooks Online Quickbooks Tutorial

Quickbooks Online Quickbooks Online Is Developed By Intuit Their Accountancy Platform Is Geared Towards Quickbooks Online Free Accounting Software Quickbooks

Quickbooks Online Quickbooks Online Is Developed By Intuit Their Accountancy Platform Is Geared Towards Quickbooks Online Free Accounting Software Quickbooks

1099 Form 2016 News Irs Forms 1099 Tax Form Tax Forms

1099 Form 2016 News Irs Forms 1099 Tax Form Tax Forms

Doug Sleeter On About Me Quickbooks Quickbooks Online Small Business Accounting

Doug Sleeter On About Me Quickbooks Quickbooks Online Small Business Accounting

Irs Form 5 B Irs Form 5 B Will Be A Thing Of The Past And Here S Why Irs Forms 1099 Tax Form Tax Forms

Irs Form 5 B Irs Form 5 B Will Be A Thing Of The Past And Here S Why Irs Forms 1099 Tax Form Tax Forms

Quickbooks Chart Of Accounts In 2020 Quickbooks Chart Of Accounts Accounting

Quickbooks Chart Of Accounts In 2020 Quickbooks Chart Of Accounts Accounting

Pin By Get Back To Business On Quickbooks Online Tutorial Quickbooks Quickbooks Online Online Tutorials

Pin By Get Back To Business On Quickbooks Online Tutorial Quickbooks Quickbooks Online Online Tutorials

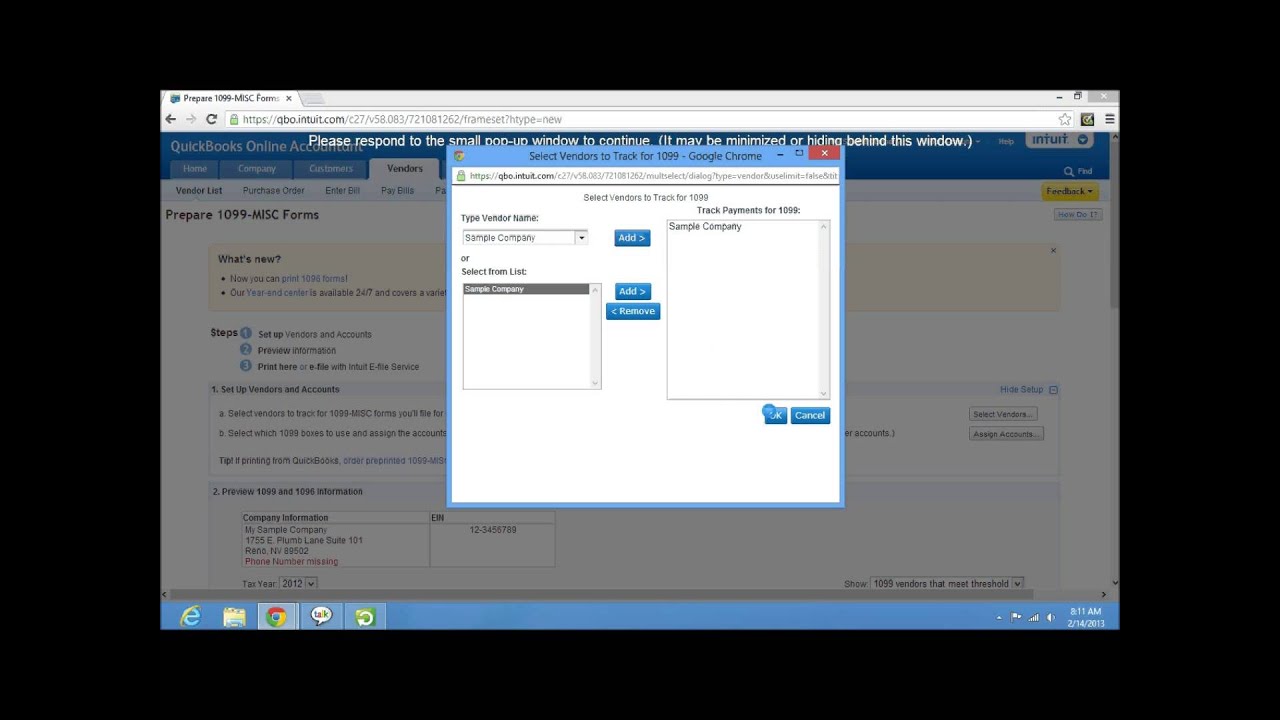

Learn How To Prepare Form In Quickbooks 1099 Wizard For More Information Dial Our Quickbooks Support Phone Num Quickbooks Mobile Credit Card Quickbooks Online

Learn How To Prepare Form In Quickbooks 1099 Wizard For More Information Dial Our Quickbooks Support Phone Num Quickbooks Mobile Credit Card Quickbooks Online

How To Prepare Quickbooks 1099 Misc Forms Crop Insurance Quickbooks Preparation

How To Prepare Quickbooks 1099 Misc Forms Crop Insurance Quickbooks Preparation

Doug Sleeter On About Me Quickbooks Create Invoice Quickbooks Tutorial

Doug Sleeter On About Me Quickbooks Create Invoice Quickbooks Tutorial

Set Up Printing Alignment For 1099 Tax Forms In Quickbooks Quickbooks 1099 Tax Form Tax Forms

Set Up Printing Alignment For 1099 Tax Forms In Quickbooks Quickbooks 1099 Tax Form Tax Forms

Pin On Quickbooks Course In Chandigarh

Pin On Quickbooks Course In Chandigarh

1099 Forms Free Download 1099 Forms Free Driverlayer Search Engine Irs Forms 1099 Tax Form Tax Forms

1099 Forms Free Download 1099 Forms Free Driverlayer Search Engine Irs Forms 1099 Tax Form Tax Forms

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

Quickbooks Enhanced Payroll Explore The Services Features Quickbooks Payroll Quickbooks Payroll

Quickbooks Enhanced Payroll Explore The Services Features Quickbooks Payroll Quickbooks Payroll

How To Create A 1099 Report In Quickbooks Online Quickbooks Quickbooks Online Online

How To Create A 1099 Report In Quickbooks Online Quickbooks Quickbooks Online Online