Do Inc Companies Get 1099

Unincorporated contractor or partnershipLLP Do send 1099. Most corporations dont get 1099-MISCs Another important point to note.

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

As mentioned you pay all the taxes.

Do inc companies get 1099. If your attorney has exceeded the threshold they receive a 1099 whether theyre incorporated or not. Use Form 1099-MISC to report gross proceeds of 600 or more during the year including payments to corporations Box 10. For tax purposes theyre treated as corporations so in general they dont get a 1099.

Attorneys fees even if the lawyer is incorporated. The major exception to the 1099 requirement is payments to corporations. The exception to this rule is with paying attorneys.

But it will hurt you. Generally payments to a corporation including a limited liability company LLC that is treated as a C or S corporation. IncomeStatementsEWTtaxstateohus or by calling.

They are amounts paid in other ways like in a lawsuit settlement agreement for example. Questions regarding the W-21099 Upload Feature can be directed to the Employment Tax Division at. In this case a manager or member of a company can file a 1099 for that person since for tax purposes the LLC is treated as a person For contractors that operate and file taxes as corporations such as a C-corp.

A 1099-NEC form is used to report amounts paid to non-employees independent contractors and other businesses to whom payments are made. There is no need to send 1099-MISCs to corporations. If your vendor is a corporation a C Corp or an S Corp you do not need to issue them a 1099.

Some payments do not have to be reported on Form 1099-MISC although they may be taxable to the recipient. This payment would have been for services performed by a person or company who IS NOT the payors employee. An LLC that elects treatment as an S-Corporation or C-Corporation Do NOT send 1099.

Most Forms 1099 arrive in late January or early February but a few companies issue the forms throughout the year when they issue checks. You do not need to issue a 1099-NEC for the operator. Think about coming up with 30 of your total annual pay and writing a check on April 14 Also you wont have health insurance unless you buy it without company subsidy.

All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st. W-2 Upload Frequently Asked Questions. Gross proceeds arent fees for an attorneys legal services.

Or Ltd are also exempt from 1099 requirements with the exception of those you pay for medical or health care or law firms that youve hired for legal services. Most payments to incorporated businesses do not require that you issue a 1099. You do not have to send a 1099-MISC form to corporations nor to limited liability companies which have made an election to be treated as corporations for income tax purposes.

Instructions to Form 1099-NEC. Due to the high level of administrative reporting for corporations the IRS exempts corporations from needing to receive a Form 1099-MISC. Updated W-21099 Upload Feature NOW LIVE on the Ohio Business Gateway.

Businesses will now file Form 1099-NEC for each person in the course of the payors business to whom they paid at least 600 during the year. The company is providing the operator and the equipment and the rental company will be responsible to issue a 1099. 1099-MISCs should be sent to single-member limited liability company or LLCs or a one-person Ltd.

The 1099 method of being a company driver makes it easy on the company - they just write you a check. However a few exceptions exist that require a. Those whos names contain Corporation Company Incorporated Limited Corp Co Inc.

Use Form 1099-NEC to report payment of attorney fees for services. 1099 Upload Frequently Asked Questions. Non-employees receive a form each year at the same time as employees receive W-2 formsthat is at the end of Januaryso the information can be included in the recipients income tax return.

It would be highly unusual if not unheard of for an insurance agency to function as anything other than a corporation or a limited liability taxed as a corporation. Alas there are some exceptions to this rule. 1099Gs are available to view and print online through our Individual Online Services.

This includes S-Corporations and C-Corporations -- they also dont receive 1099 1099-MISCs. You still need to issue 1099s for. Payments for which a Form 1099-MISC is not required include all of the following.

You can elect to be removed from the next years mailing by signing up for email notification.

If You Were Tuned To The News Aug 8 You Might Have Heard The Irs Released Proposed Regulations On The New 20 Percent Busines Tax Forms 1099 Tax Form Irs Forms

If You Were Tuned To The News Aug 8 You Might Have Heard The Irs Released Proposed Regulations On The New 20 Percent Busines Tax Forms 1099 Tax Form Irs Forms

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Form C S Is An Abridged 3 Page Income Tax Returns Form For Eligible Small Companies To Report Their Income To Singapore Business Business Infographic Tax Forms

Form C S Is An Abridged 3 Page Income Tax Returns Form For Eligible Small Companies To Report Their Income To Singapore Business Business Infographic Tax Forms

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

The Most Common Type Of 1099 Is The 1099 Misc This Form Needs To Be Completed For Anyone Who Has Pro Accounting Services Small Business Bookkeeping Accounting

The Most Common Type Of 1099 Is The 1099 Misc This Form Needs To Be Completed For Anyone Who Has Pro Accounting Services Small Business Bookkeeping Accounting

1099 Misc Form 1099 Misc Tax Basics Irs Tax Forms Tax Forms Form Example

1099 Misc Form 1099 Misc Tax Basics Irs Tax Forms Tax Forms Form Example

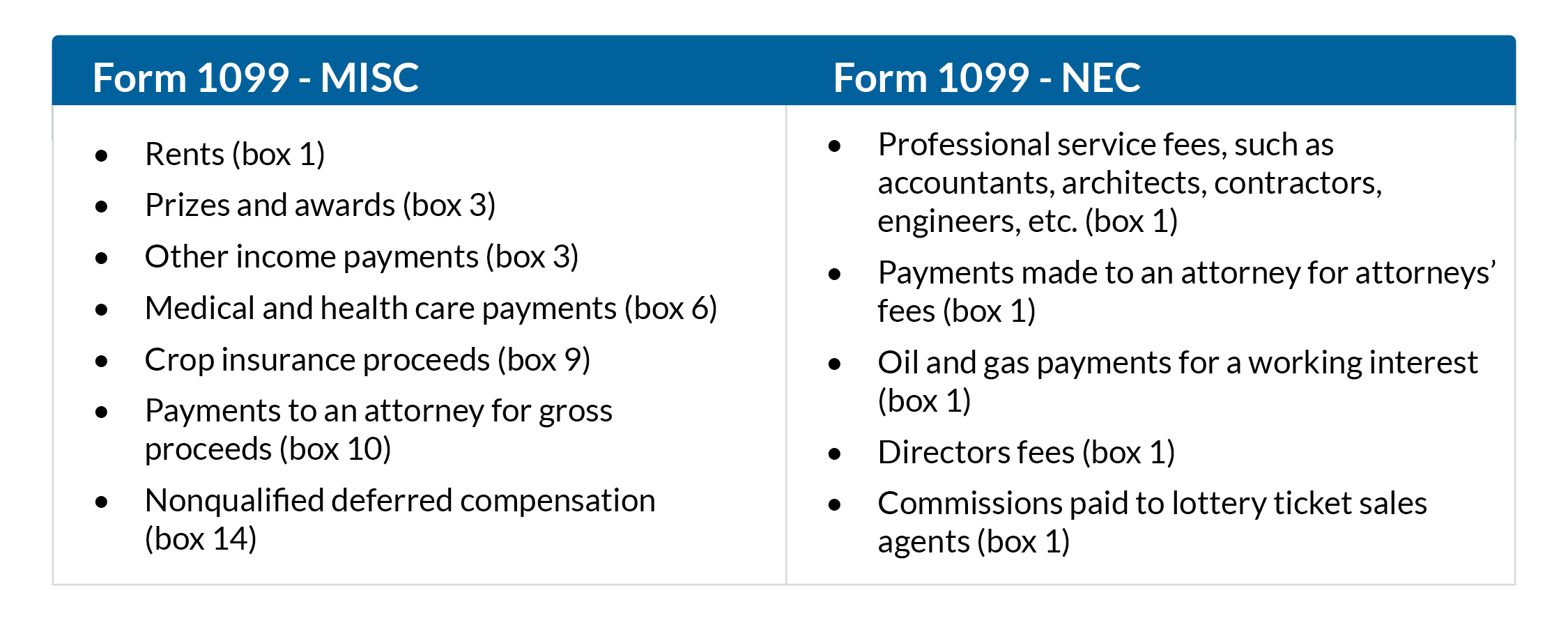

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Am I Supposed To File A 1099 Misc Form The Smart Keep Inc Small Business Tax Tax Organization Tax Quote

Am I Supposed To File A 1099 Misc Form The Smart Keep Inc Small Business Tax Tax Organization Tax Quote

1099 Form Fillable What Is A 1099 Form And How Do I File E What Is A 1099 Business Letter Template Email Signature Templates

1099 Form Fillable What Is A 1099 Form And How Do I File E What Is A 1099 Business Letter Template Email Signature Templates

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Is Your Business Prepared For Form 1099 Changes Rkl Llp

Is Your Business Prepared For Form 1099 Changes Rkl Llp

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Form Irs 1099 Misc 2013 Irs Forms Irs Form

Form Irs 1099 Misc 2013 Irs Forms Irs Form

Do You Need To Send Out 1099s Profit Planner Books Kickstart Accounting Services Accounting Services Small Business Bookkeeping Tax Organization

Do You Need To Send Out 1099s Profit Planner Books Kickstart Accounting Services Accounting Services Small Business Bookkeeping Tax Organization

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Do I Need A 1099 For An Llc Llc Limited Liability Company Irs Forms

Do I Need A 1099 For An Llc Llc Limited Liability Company Irs Forms