Does Onlyfans Send You A Tax Form

Many OnlyFans Content Creators have contacted me with tax questions. If it was in 2020 you can prepare a 2020 tax return in early 2021.

A U S Guide For People With An Onlyfans Account And The Need To Pay Their Taxes On Time Bazaar Daily News

A U S Guide For People With An Onlyfans Account And The Need To Pay Their Taxes On Time Bazaar Daily News

In order to do this the tweet says OnlyFans is blocking.

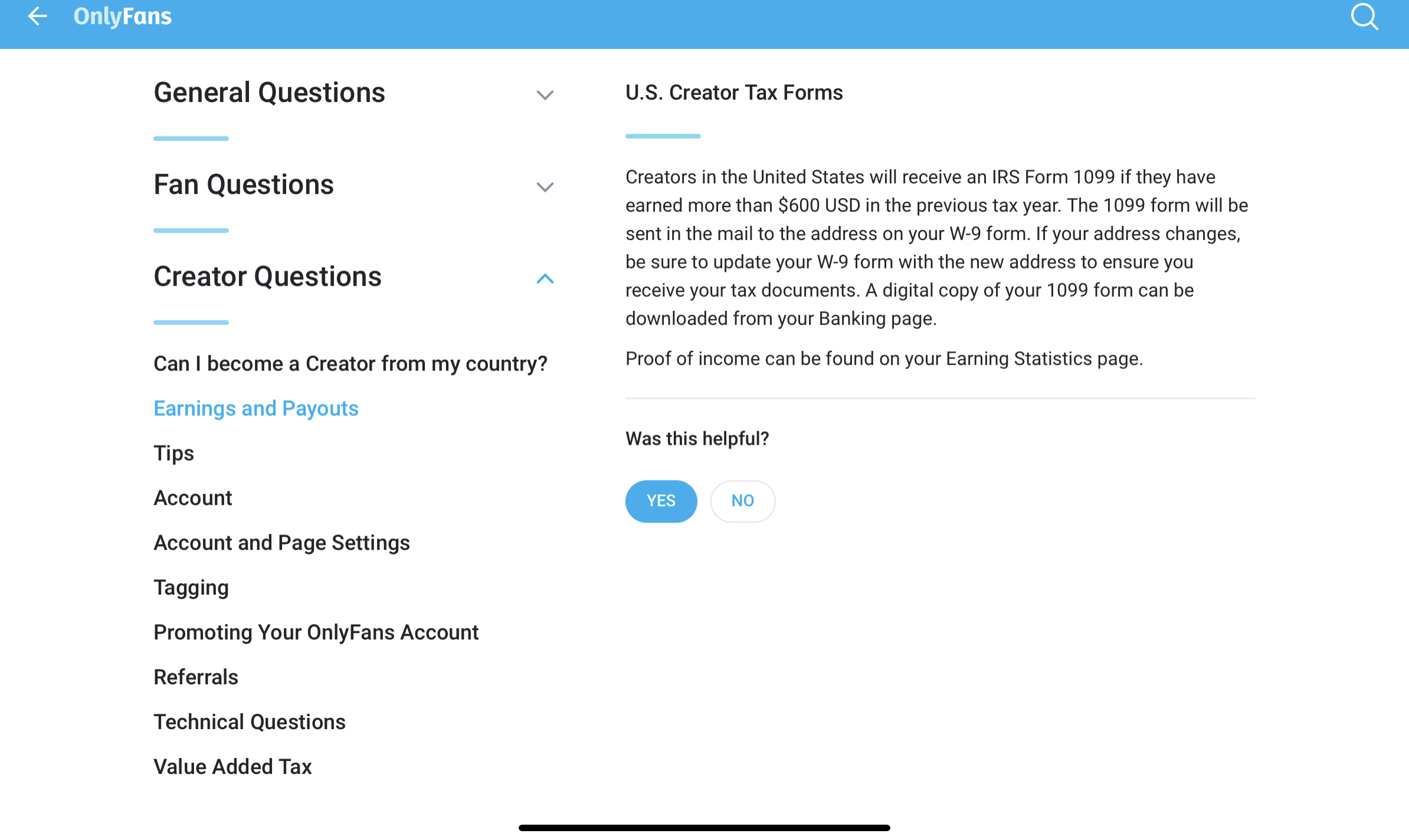

Does onlyfans send you a tax form. Most OnlyFans creators will fill out a form Schedule C Profit or Loss From A Business and include that on their form 1040 tax return. The only thing that OnlyFans will send you in the mail is your IRS Form 1099 which is a tax form. You will be send a 1099 form to file your income as misc since you are not employed by only fans.

So basically it works out to 1413 of the self-employment income. What makes OnlyFans so lucrative is a combination of your subscriber numbers and your subscription rate. Because income taxes are not taken out of performers earnings they have to pay taxes at the end of the year.

OnlyFans will issue you these around tax time. If you have tax and accounting questions call me on 732-673-0510. You will be able to use the Free File software so.

Im an onlyfan creator in the USA also. If you do not know much about it you can talk to your accountant. You will be responsible for any taxes that would pay from your check at a normal job.

In the United States anyone who makes a yearly income of 600 is subject to paying taxes by filing a 1099 form. So yes OnlyFans take out taxes. You only made a small amount so you will not owe much--if anything.

OnlyFans will send your tax form with your yearly income and you file as a 1099. Well try your destination again in 15 seconds. All of the accounting that we discussed a few moments ago would go on this form.

For most processors it is 20k AND 200 transactions. This means that you can claim back tax which may be up to 50 of the item cost if you. A program like TurboTax can walk you through it or you can see an accountant.

To put you in complete control you decide how much to charge your fans for a subscription so set a rate that you think is fair reasonable and affordable for your audience. The income made from OnlyFans is subject to income tax and maybe national insurance if you are not working through a company and content creators should be filing personal income tax returns with HMRC for the profit they make from the site to not do so is tax evasion and is illegal. Not sure that the standards are for onlyfans and whether they will give you a 1099Misc or not but if you made over 400 of income as an independent contractor you are required to file a tax return and pay self employment tax for Social Security and Medicare.

These forms are provided to those who have earned self-employment income. You will be required to pay back around 25ish since 1099self employment isnt taxed. It comes under the category of self-employed.

The tweet concludes that OnlyFans is stealing from creators as an underhanded way of paying back taxes the company owes to the UK. So that you can save a lot of money. You may also need to file a Schedule C form to determine the income and expenses.

The total for SE tax is 153 but its applied to 9235 of your self-employment income. Depending on the specifics of your local laws a whole bunch of things can be written off as a tax expense. Yes you can show the expenses in this.

Onlyfans will not send you any sort of income document so you just use your own records of how much you made. He can help you file your tax. OnlyFans counts as self-employment from a taxation point-of-view.

Tax Memo OnlyFans Content Creator Income Is Taxable Include It On Your Tax Returns. Yes set aside at least 20-30 of your earnings to start with because you WILL have to pay tax on this income. And anyway your income is received online only so if you steal tax you will be caught.

You are an independent contractor to the IRS. Check your onlyfans payment agreement there should be a threshold of when they send you a 1099. I promise all calls are kept strictly confidential.

OnlyFans the popular content creation platform for porn is allegedly blocking users and stealing their profits according to a viral tweet posted by Twitter user caseywaves on August 9. This will be sent to your address on file if you earn more than 600 on the platform. Youll get a 1099 self employment tax form if you make more than 600 per year.

Yes OnlyFans will send mail to your house. Typically around 1-3 of your fans will subscribe. You will be able to do that on a site called Free File.

So your income will be shown at the top and your various expenses will be shown in the middle part of the form. Since 1099 work is considered running a business you can deduct documented expenses.

The Ultimate Onlyfans Guide What Is Onlyfans How Much Money Can You Make

The Ultimate Onlyfans Guide What Is Onlyfans How Much Money Can You Make

The Ultimate Onlyfans Guide What Is Onlyfans How Much Money Can You Make

The Ultimate Onlyfans Guide What Is Onlyfans How Much Money Can You Make

How To Make Money On Onlyfans Onlyfans Guide

How To Make Money On Onlyfans Onlyfans Guide

The Ultimate Onlyfans Guide What Is Onlyfans How Much Money Can You Make

The Ultimate Onlyfans Guide What Is Onlyfans How Much Money Can You Make

Can Onlyfans See Who Follows Them Quora

Does Onlyfans Send Anything Physical In The Mail

Does Onlyfans Send Anything Physical In The Mail

Onlyfans Qa Taxes What My Bf Family Thinks Creepy Men How Much I Ve Made Big Announcement Youtube

Onlyfans Qa Taxes What My Bf Family Thinks Creepy Men How Much I Ve Made Big Announcement Youtube

Can Onlyfans See When You Take A Screenshot Quora

Is My Onlyfans Income Taxable Ocelot Accounting

Is My Onlyfans Income Taxable Ocelot Accounting

I Make Money From Onlyfans How Do I File My Taxes Youtube

I Make Money From Onlyfans How Do I File My Taxes Youtube

Tax Memo Onlyfans Content Creator Income Is Taxable Include It On Your Tax Returns Chris Whalen Cpa

Tax Memo Onlyfans Content Creator Income Is Taxable Include It On Your Tax Returns Chris Whalen Cpa

Freelance Digital Marketing Specialists For Hire Online Fiverr Email Marketing Campaign Email Marketing Email Marketing Services

Freelance Digital Marketing Specialists For Hire Online Fiverr Email Marketing Campaign Email Marketing Email Marketing Services

How Much Do Girls Make On Onlyfans Monthly Quora

Onlyfans Qa Taxes What My Bf Family Thinks Creepy Men How Much I Ve Made Big Announcement Youtube

Onlyfans Qa Taxes What My Bf Family Thinks Creepy Men How Much I Ve Made Big Announcement Youtube

Can Onlyfans See Who Follows Them Quora

What Charges Could You Get If You Were Underage And You Made An Only Fans Page Quora

Onlyfans Do I Have To Pay Taxes Follower

Onlyfans Do I Have To Pay Taxes Follower

Can You Screenshot Onlyfans 2020 Why Am I Not Able To Take A Screenshot In The Onlyfans App Quora

How To Delete An Onlyfans Account With A Current And Pending Balance In Your Account Quora