In Islamic Finance What Are The 3 Types Of Ownership

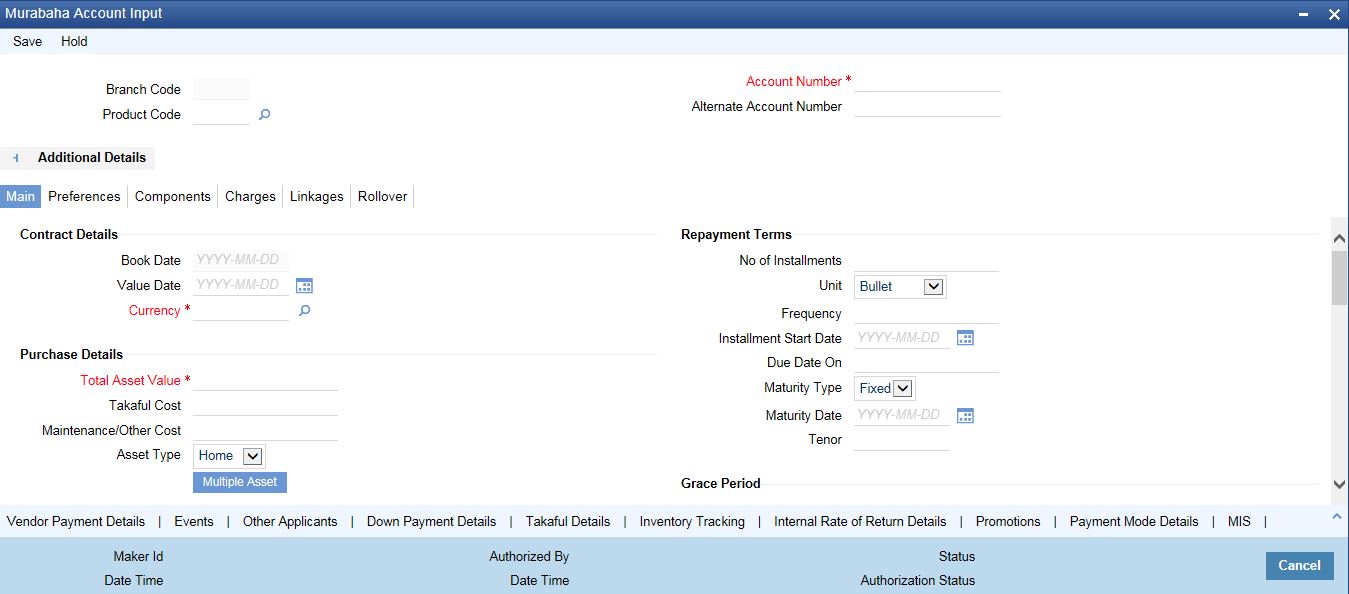

Direct Investment and Islamic Syndication. Some of the modes of Islamic bankingfinance include Mudarabah profit-sharing and loss-bearing Wadiah safekeeping Musharaka joint venture Murabahah cost-plus and Ijara leasing.

Free Lecture On Salam An Islamic Mode Of Finance For More Free Lectures Study Notes Visit Www Aims Education Islamic Banking Study Notes Finance Lecture

Free Lecture On Salam An Islamic Mode Of Finance For More Free Lectures Study Notes Visit Www Aims Education Islamic Banking Study Notes Finance Lecture

Diminishing partnership Sale modes.

In islamic finance what are the 3 types of ownership. Civil Partnership in Islamic Finance. You will not be able to go back or skip questions. Islamic modes of financing 2.

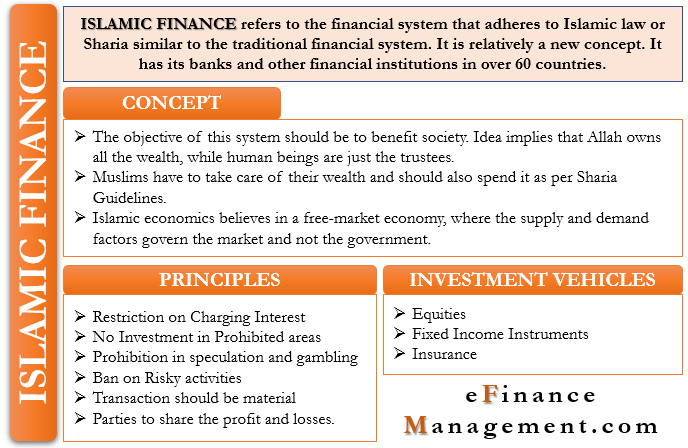

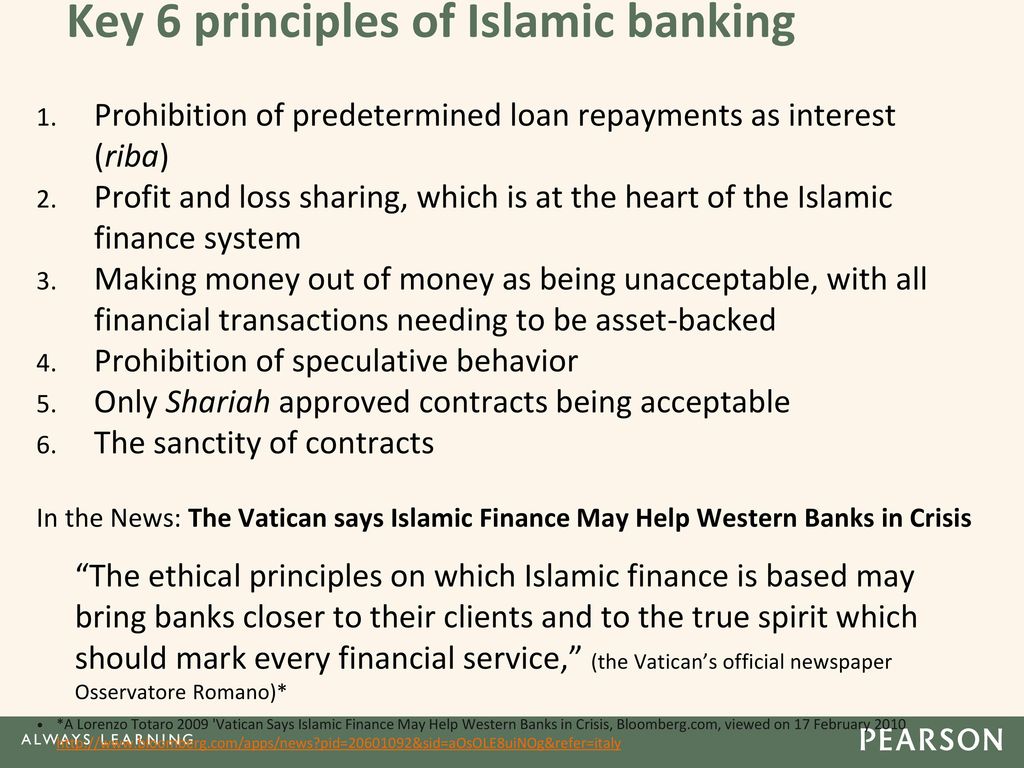

Islamic investing is investing with a commitment to the Shariah the divine guiding principles revealed by God to humankind in the Quran and demonstrated by the Prophet Muhammad peace be upon him. The three types of halal mortgage alternatives are. Most of these principles are common to most religions and morality systems including the three Abrahamic religions Islam Christianity.

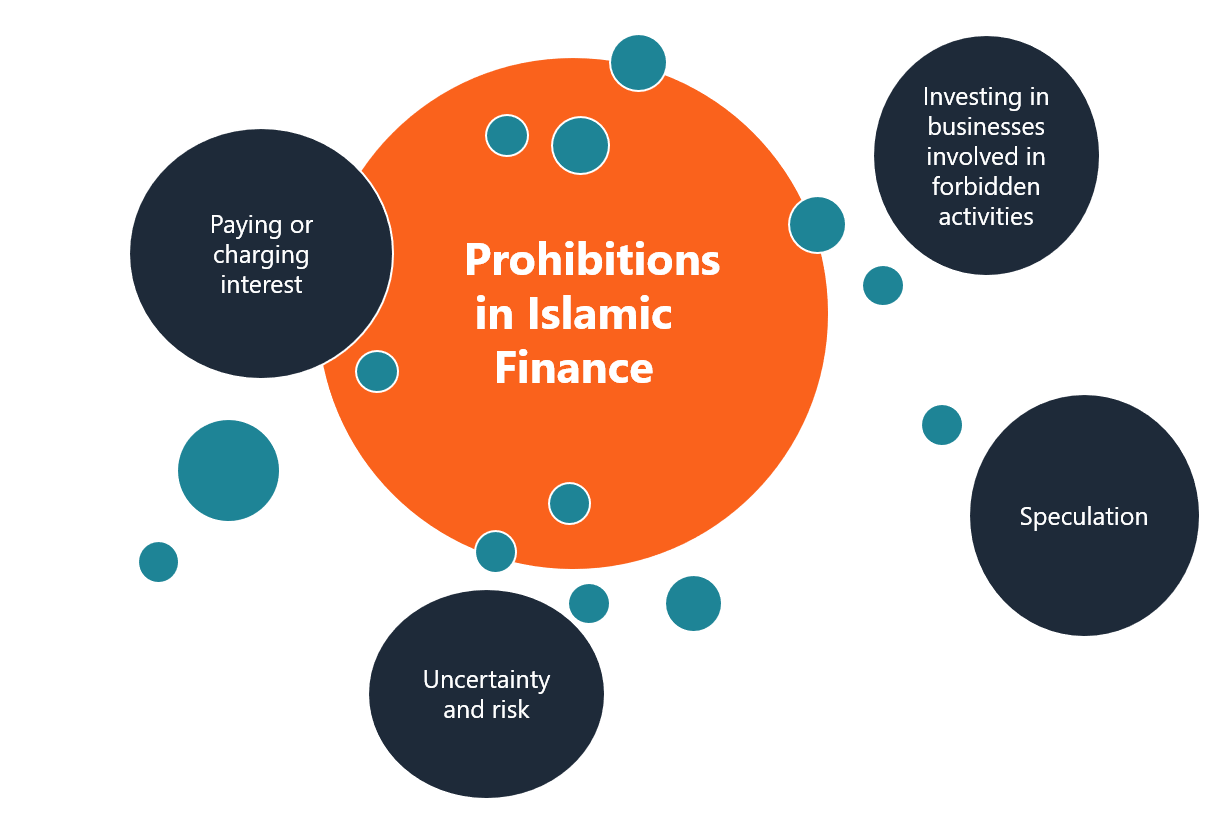

Islamic finance quiz consists of truefalse questions. The common practices. Monopoly in all forms.

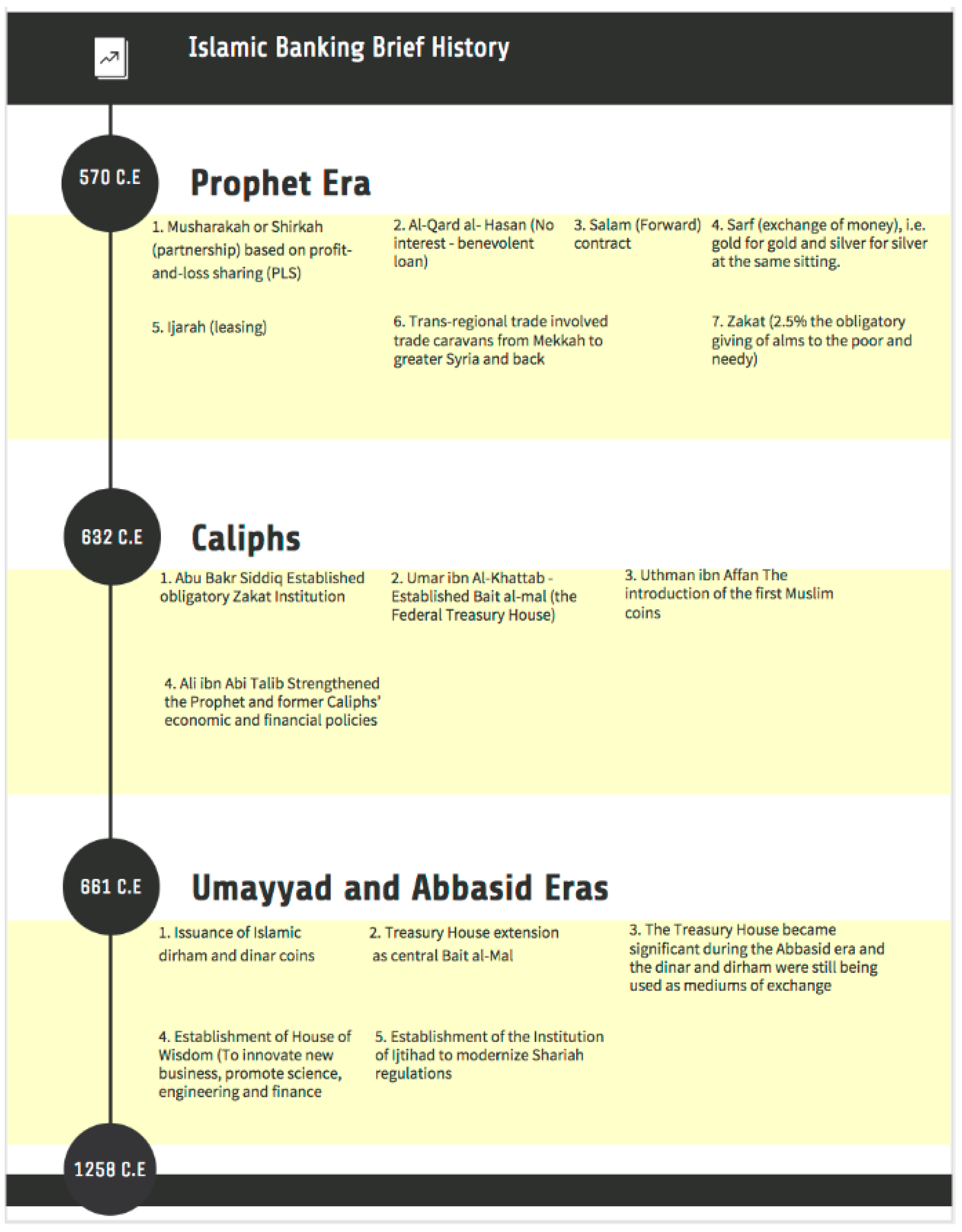

The common practices of Islamic finance and banking came into existence along with the foundation of Islam. Cheating in quality quantity weight or any specifications of the goods and services traded or acquired or disposed of. Islamic finance is a type of financing activities that must comply with Sharia Islamic Law.

TYPES OF OWNERSHIP IN ISLAMIC PERSPECTIVE BASED ON CAPACITY OF OWNERSHIP i Complete Ownership This type of ownership combines both legal and beneficial ownership in one person and entitles him to all rights over that property. Islamic finance refers to how businesses and individuals raise capital in accordance with Sharia or Islamic lawIt also refers to the types of investments that are permissible under this form of. The concept can also refer to the investments that are permissible under Sharia.

In an Ijara home purchase plan you make monthly payments that are part rent and part capital to finance your final purchase. The Joaalah Contract in Islamic Finance. This means that one is can own certain property and its usufruct.

The Arabic term ijara means providing services and goods temporarily for a wage. Types of sharia mortgage. Salam Contract in Islamic Finance.

All answers are final. However the establishment of formal Islamic finance occurred. The Quran prohibits riba which literally means increase.

Hire-Purchase Leasing in Islamic Finance. This type of business is a business run by an individual. There are three main categories of Islamic financial instruments or Islamic modes of finance.

All the criteria in Islamic economic are similar with the other types of individual business outside the Islamic. Debt Based or Trade Based products. Such as Musharakah and Mudarabah.

May 19 2004 0000 By Sohail Zubairi Special to Gulf News In an earlier article I briefly touched upon the subject of a lessee sub. This means your ownership share of the property remains consistent throughout the length of the term. Murabaha Trade with markup or cost-plus sale.

It simply means equity finance. Different types of asset ownership Published. Gambling and betting in all forms.

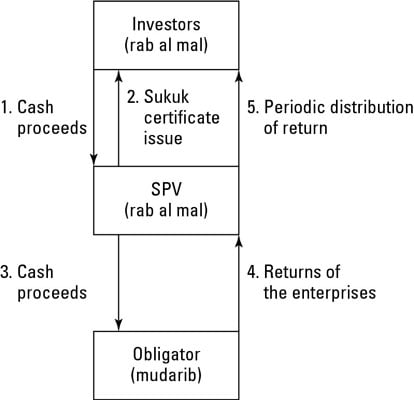

Such as Mudarabah Musawamah Salam and Istisna. Sukuk and Tawarruq Contracts in Islamic Finance. Salam Rent based modes.

Basic instruments include. Hammoudi puts the problem this way. Cost-plus financing murabaha profit-sharing mudaraba leasing ijara partnership musharaka and forward sale baysalam.

Leasing or Renting Ijara in Islamic Finance. He own capital and can makes loan on behalf of himself if he thinks that it is needed. Hoarding especially with food stuffs which are not allowed to stay in traders hands for more than 40 days.

Islamic modes of financing 1. Islamic finance is a type of financing activities that must comply with Sharia Islamic Law. Use exploit or appropriate his property Give it as.

You must answer each question before you go to the next one. The ijara contract as you may guess involves providing products or services on a lease or rental basis. In the ijara contract a person or party is given the right to use the object the usufruct for a period.

These constitute the basic building blocks for developing a wide array of more complex financial instruments. There are basically three modes of Islamic financing are. He also has complete authority to.

The concept can also refer to the investments that are permissible under Sharia.

Https Www Un Org Esa Ffd High Level Conference On Ffd And 2030 Agenda Wp Content Uploads Sites 4 2017 11 Background Paper Islamic Finance Pdf

Pin On Islamic Finance Lectures

Pin On Islamic Finance Lectures

Islamic Finance An Overview Sciencedirect Topics

Islamic Finance An Overview Sciencedirect Topics

Jrfm Free Full Text Developments In Risk Management In Islamic Finance A Review Html

Jrfm Free Full Text Developments In Risk Management In Islamic Finance A Review Html

Topic 3 Islamic Financial System Flashcards Quizlet

Topic 3 Islamic Financial System Flashcards Quizlet

What Is Islamic Finance And What Can It Do Decision Sciences Institute

What Is Islamic Finance And What Can It Do Decision Sciences Institute

What Is Islamic Finance And What Can It Do Decision Sciences Institute

What Is Islamic Finance And What Can It Do Decision Sciences Institute

Types Of Sukuk In Islamic Finance Dummies

Types Of Sukuk In Islamic Finance Dummies

Islamic Finance An Overview Sciencedirect Topics

Islamic Finance An Overview Sciencedirect Topics

Islamic Finance Meaning Principles Concept And More

Islamic Finance Meaning Principles Concept And More

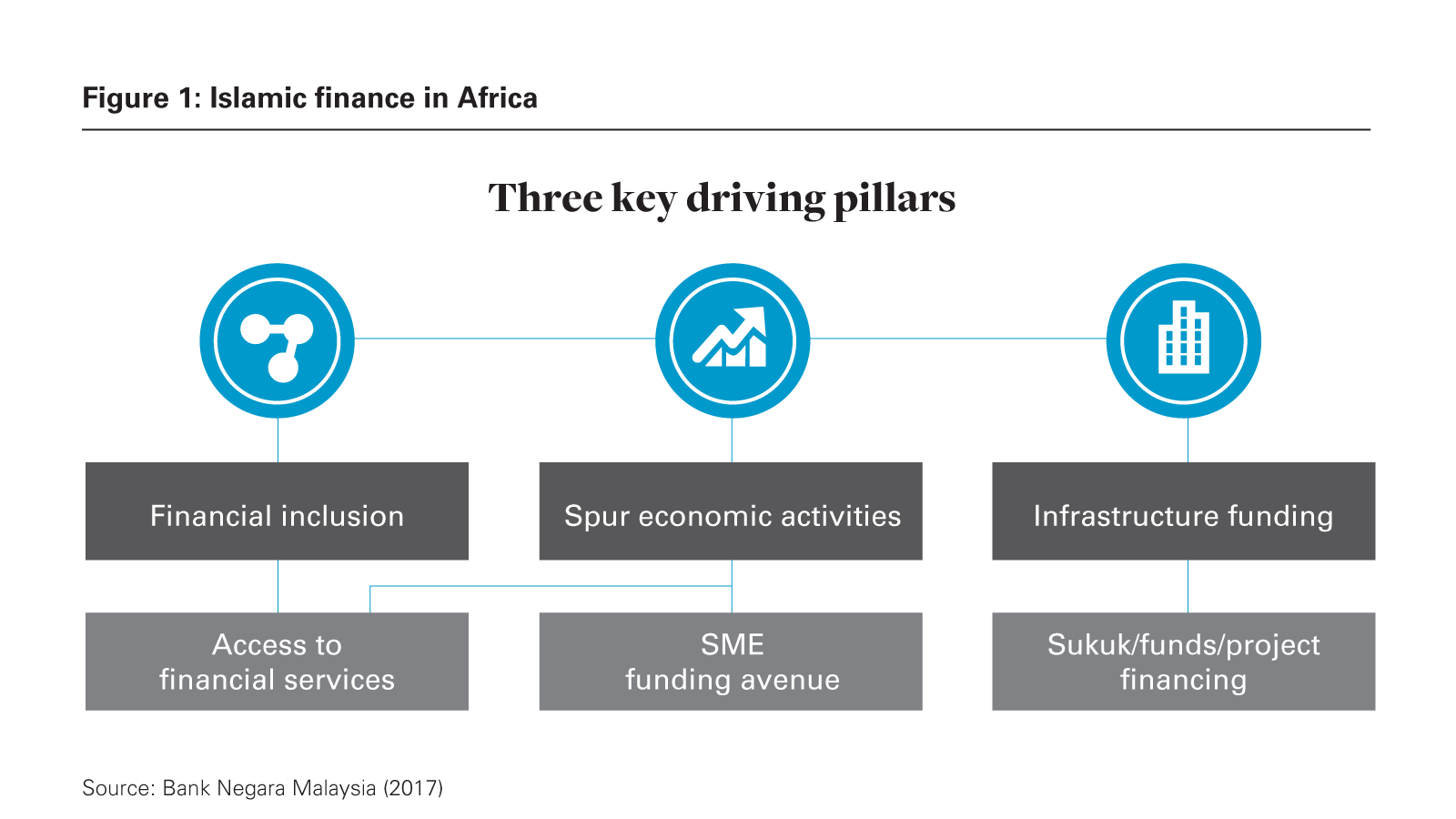

Islamic Finance In Africa Opportunities And Challenges White Case Llp

Islamic Finance In Africa Opportunities And Challenges White Case Llp

Islamic Finance Principles And Types Of Islamic Finance

Islamic Finance Principles And Types Of Islamic Finance

Https Www Un Org Esa Ffd High Level Conference On Ffd And 2030 Agenda Wp Content Uploads Sites 4 2017 11 Background Paper Islamic Finance Pdf

What Is Islamic Finance And What Can It Do Decision Sciences Institute

What Is Islamic Finance And What Can It Do Decision Sciences Institute

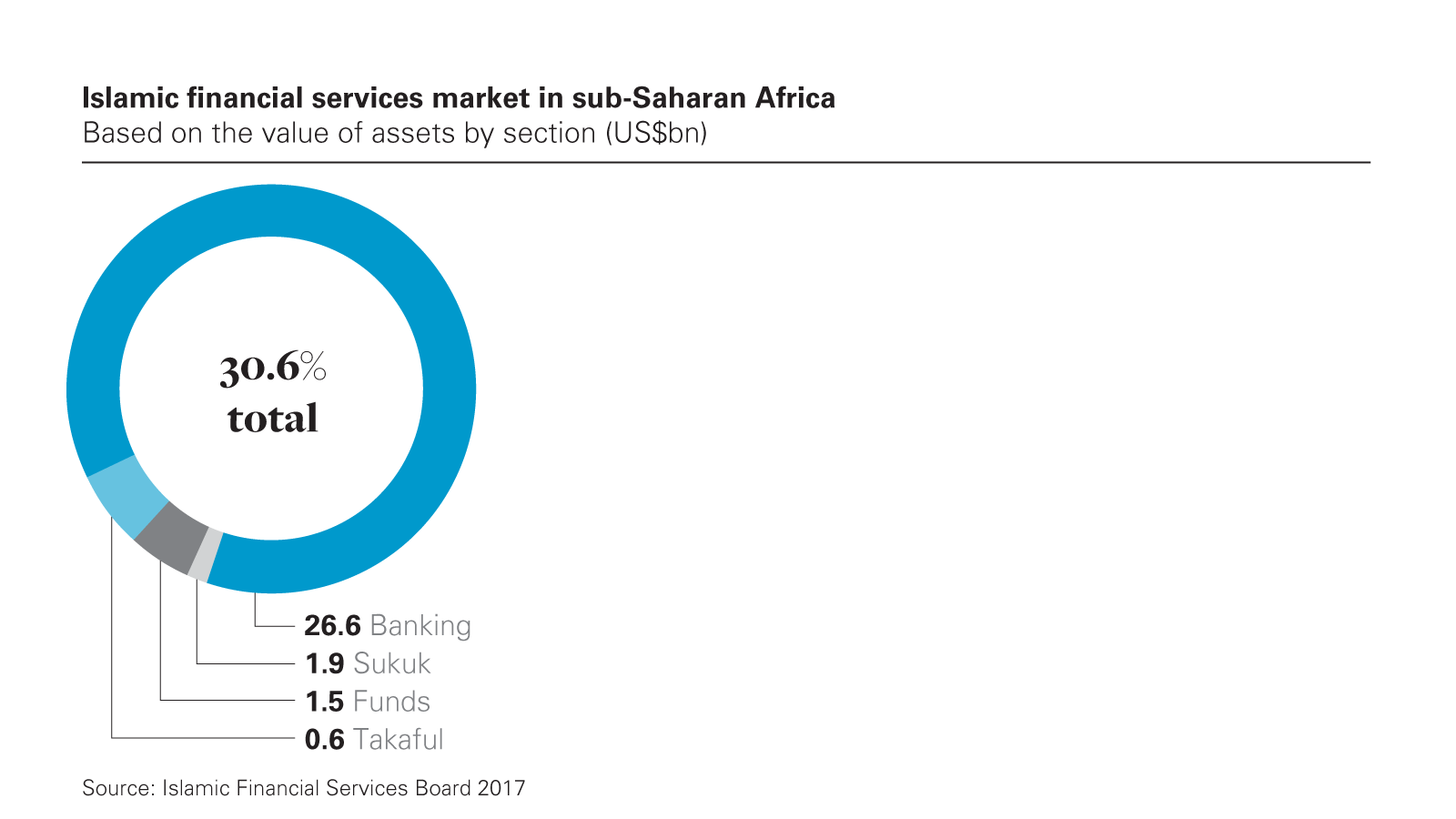

Islamic Finance In Africa Opportunities And Challenges White Case Llp

Islamic Finance In Africa Opportunities And Challenges White Case Llp

How Different Is Islamic Banking From The Traditional Banking S Silverman Books Blog Writer

How Different Is Islamic Banking From The Traditional Banking S Silverman Books Blog Writer

Chapter 1 Introduction To Islamic Banking And Finance Ppt Download

Chapter 1 Introduction To Islamic Banking And Finance Ppt Download

:max_bytes(150000):strip_icc()/PROJECT-DEVELOPER-9bddde300c994be3871dd9790d15f7bb.jpg)