What Are The Different Types Of Firms In The Securities Industry

With crime a being concern for most security companies are constantly in demand. They serve as financial intermediaries in various ways.

Insurance For The Financial Services Industry Lockton Companies Financial Services Financial Institutions Property And Casualty

Insurance For The Financial Services Industry Lockton Companies Financial Services Financial Institutions Property And Casualty

When it comes to equity there are two types Common Stock and Preferred Equity.

What are the different types of firms in the securities industry. What Are Different Types of Securities. B National firms specializing in corporate finance and trading such as Goldman Sachs Salomon Brothers and Morgan Stanley. Below highlights the types of securities firms and underscores their corresponding functions.

The firms in the security industry vary by size and specialization. What are the different types of firms in the securities industry and how does each type differ from the others. CH1 CH2 CH3 CH4 CH5 CH6 CH7 CH8 CH9 CH10 CH11 CH12 CH13 CH14 CH15 CH16 CH17 CH18 CH19 CH20 CH21 CH22 CH23 CH24 CH25 CH26 Problem.

1CQ1 1CQ2 1CQ3 1CQ4 1QP 2CQ1 2CQ2 2CQ3 2CQ4 2QP 3CQ1 3CQ2 3CQ4 3QP 4CQ1. Heres a brief breakdown of each. Common Stock is the simplest form of equity.

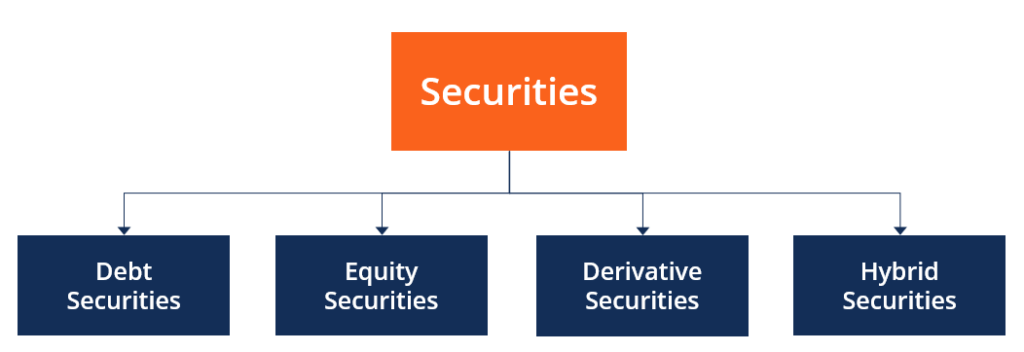

The firms trading department also has separate divisions that trade different types of securities. Securities fall into three broad categories. The different levels of risk associated with these kinds of organizations.

These are typically shares in a corporation commonly known as stocks. Mid-Size firm 151 499 registered representatives. Dustry and they remain major players in the development of securities offerings.

Industry data shows that over a 50-year period between 1959 and 2008 stocks generate an average annual investment return of 918. Securities Offerings issuance andor trading of stock. Types of firms in securities industry.

They specialize in trading and corporate finance. Financial institutions such as investment banks investment companies and brokerage firms that help firms place securities and help investors buy and sell them. Debt equity or derivative.

Securities Industry Three types of organizations traditionally compose the securities industry. They deal with corporate and retail clients. Second we distinguish products into final goods and intermediate goods.

What Are the Different Types of Securities. Large firm 500 or more registered representatives. Distribu-tion firms come together in syndication under the guidance of an.

Investment bank securities firms facilitate the following functions. What are the different types of firms in the securities industry and how does each type differ from the others. Small firm 1 150 registered representatives.

Primary function of finance companies is to provide loans to individuals who are not able to obtain loan from commercial banks due to poor credit ratings. These divisions may focus on trading bonds stocks or. That means youll literally own a portion of that company.

Today the term security refers to just about any negotiable financial instrument such as a stock bond options contract or shares of a mutual fund. Security services are needed in the world of business as well as for personal safety. Nov 17 2020 0759 PM.

There are multiple types of securities but most fall under three categories. What are the different types of firms in the securities industry and how does each type differ from the others. First we distinguish firms into foreign firms and domestic firms which are further divided into private firms and publicly owned firms.

Full line firms that are segregated into view the full answer. The various fims in the securities industry that vary primarily by size and specialization are. Investment Banks Securities firms may constitute investment banks.

Equity securities debt securities and derivatives. Good security can provide a sense of well being and safety to those who wish to protect their property or themselves. Securities firms include investment banks investment companies and brokerage firms.

Securities firms place securities for corporations and businesses in either the primary or secondary. A National full-line firms servicing both retail and corporate clients such as Merrill Lynch. There are two types of securities you are purchasing equity in a company or debt in a company that can potentially be converted into equity.

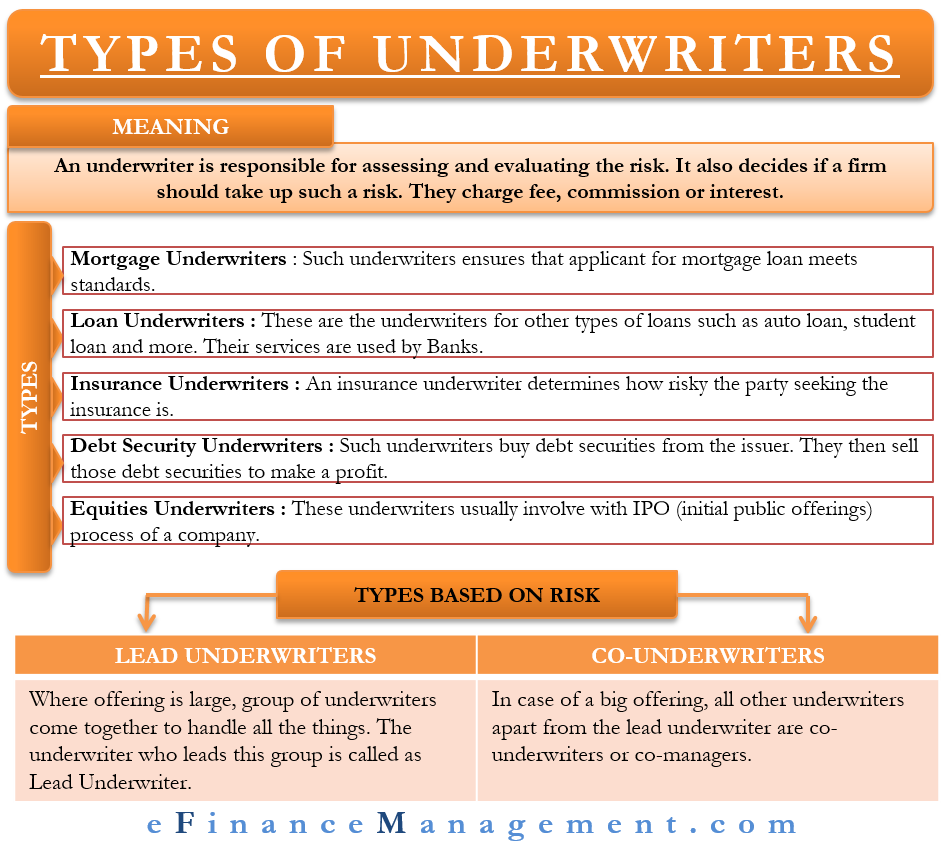

Types Of Underwriters Brief Role Of Each Of Them Efinancemanagement

Types Of Underwriters Brief Role Of Each Of Them Efinancemanagement

Types Of Capital Rationing Hard And Soft Finance Blog Accounting And Finance Economics Lessons

Types Of Capital Rationing Hard And Soft Finance Blog Accounting And Finance Economics Lessons

Wealthcare India Securities Pvt Ltd Offers Different Types Of Mutual Fund Investment Advise Such As Debt Sc Mutuals Funds Systematic Investment Plan Investing

Wealthcare India Securities Pvt Ltd Offers Different Types Of Mutual Fund Investment Advise Such As Debt Sc Mutuals Funds Systematic Investment Plan Investing

/dotdash_Final_Securities_Industry_Essentials_SIE_Exam_Apr_2020-01-c3f95f3ac10840b295210c17ba28d83e.jpg) Securities Industry Essentials Sie Exam Overview

Securities Industry Essentials Sie Exam Overview

Sec Awards Almost 2 Million To Whistleblower Investment Advisor Securities And Exchange Commission Investment Companies

Sec Awards Almost 2 Million To Whistleblower Investment Advisor Securities And Exchange Commission Investment Companies

Introduction To Primary Market Raising Capital Marketing Learn Stock Market

Introduction To Primary Market Raising Capital Marketing Learn Stock Market

Financial Securities Financial Financial Management Accounting And Finance

Financial Securities Financial Financial Management Accounting And Finance

Goldman Sachs Hiring Freshers For Software Engineer Post Be Btech Me Mtech Eligible To Apply Software Engineer Financial Institutions Financial Services

Goldman Sachs Hiring Freshers For Software Engineer Post Be Btech Me Mtech Eligible To Apply Software Engineer Financial Institutions Financial Services

Preference Shares And Its Different Types Sag Rta Preferences Exams Funny Different Types

Preference Shares And Its Different Types Sag Rta Preferences Exams Funny Different Types

/GettyImages-824185000-03c0d898d7e449ac8fef137d17f73dd1.jpg) Common Examples Of Marketable Securities

Common Examples Of Marketable Securities

Gumu For Salesforce Sage 300 Integration Finance Planner Finance Infographic Finance Jobs

Gumu For Salesforce Sage 300 Integration Finance Planner Finance Infographic Finance Jobs

Find Discriminatory Between Commercial And Investment Banks By Lorenzo V Tan Investment Banking Investing Retail Banking

Find Discriminatory Between Commercial And Investment Banks By Lorenzo V Tan Investment Banking Investing Retail Banking

Investmentbanking Investment Banking Goldman Sachs Investment Firms Investing Raising Capital

Investmentbanking Investment Banking Goldman Sachs Investment Firms Investing Raising Capital

Investment Banking Definition Lenn Mayhew Lewis Investment Banking Investing Raising Capital

Investment Banking Definition Lenn Mayhew Lewis Investment Banking Investing Raising Capital

Utah Business Corporate Law Attorney Coulter Law Group Business Tax Business Law Sole Proprietorship

Utah Business Corporate Law Attorney Coulter Law Group Business Tax Business Law Sole Proprietorship

Types Of Security Overview Examples How They Work

Types Of Security Overview Examples How They Work

What Are Bonds In The Stock Market What Are Its Types Stock Market Learn Stock Market Stock Portfolio

What Are Bonds In The Stock Market What Are Its Types Stock Market Learn Stock Market Stock Portfolio

125 Good Names For Investment Companies Investment Companies Names For Companies Credit Companies

125 Good Names For Investment Companies Investment Companies Names For Companies Credit Companies