Business Loan From Axis Bank Eligibility

The process to apply for Axis Business Loan through Paisabazaar is easy and simple follow the below-mentioned steps. They can be a salaried doctor an employee of a reputed public or private limited company or a government sector employee including Public Sector Undertakings Central as well as Local bodies.

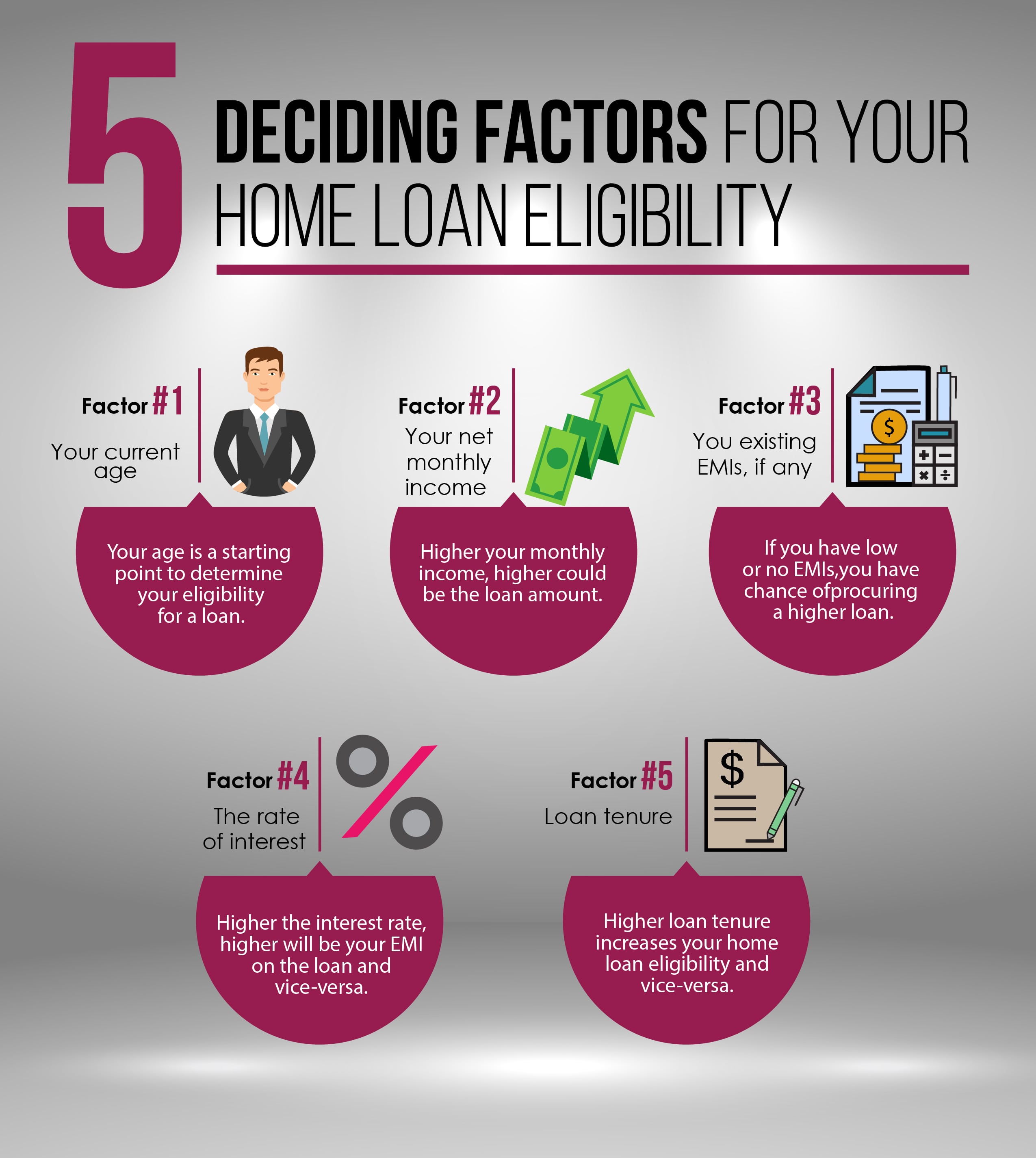

Best Home Loan Plan In India Best Home Loans Home Loans Loan Interest Rates

Best Home Loan Plan In India Best Home Loans Home Loans Loan Interest Rates

How the same will be appropriated in the loan account in the absence of any specific instructions from me.

41dbd0b9be576bf08df9ff00000b8c1c.jpg)

Business loan from axis bank eligibility. Below is a list of criteria to qualify for an Axis Bank Personal Loan. The main factors affecting the eligibility of Axis Bank Business Loan are age income repayment capacity and the credit score of the applicant. Factors Affecting Axis Credit Card Eligibility Age.

The guidelines for eligibility may differ from bank to bank. Check Axis Bank eligibility criteria of Personal Loan for salaried individuals self-employed individuals learn about documents required to apply for business loan. If you apply for Axis Bank Business Loan at an early age your repaying capacity will be high and Axis Bank Business Loan eligibility will also be high.

Minimum of 3 years. You must be at least 18 years old. Repay in up to 15 years.

Self-employed professionals including chartered accountants doctors dentists engineers architects management consultants company secretaries and cost accountants are also eligible to apply for Axis bank home loans. A pre-qualified customer can get an instant loan approval in just a matter of a few clicks. Eligibility for Axis Bank Business Loans Axis Bank has detailed the list of eligible applicants as well as the eligibility requirements for its business loans to small business units that have a turnover of up to Rs.

Other parameters that a loan seeker must satisfy in order to be eligible for getting a business loan for their business are mentioned below. Self-employed professionals must be at least 21 years old while applying for the home loan. Straightaway apply for HDB Financial Service business loan that is available at a reasonable rate of interest for the maximum tenure of 5 years.

Now Chartered Accountants Engineers or Doctors can apply for business loan online. The age limit for Axis Bank Business Loan Eligibility lies between 21 to 65 years. Visit the website to know more.

Business Loan Calculator - Calculate your EMI for a business loan interest rates and eligibility by using Axis Bank business loan EMI Calculator. The candidates with business registration under following categories are eligible to apply for the business loan-Proprietorship Firm. The applicant should be a salaried employee.

Axis Bank Business Loan up to 5000000. A timely repayment with no record of default can help you score 750 and above to get the approval. Fill in and submit the loan application form.

Factors that affects Axis Bank Business Loan Eligibility. Minimum 21 years at the time of loan application. If you are a doctor or medical practitioner you can avail of a business loan to purchase medical equipment or renovate your clinic premises.

Trust Societies for educational institutes Hospitals. The scores range from 300-900 depending on the pattern of your loan or card repayment routine. Maximum 65 years at the end of loan tenure.

Axis Bank Business Loan Eligibility Criteria Any Indian citizen having his own business and having residual income and the ability to repay the loan is eligible for Axis Bank business loans. No Axis Bank financing requires that your business be under current ownership of atleast 3 years In case of any pre-payment excess amount paid by me to the Bank. Such list of eligible applicants includes Individuals with business registration.

For Axis Bank Business Loan the following are the main eligibility criteria. Axis Bank Business Loan Eligibility Criteria. Apply for 24x7 Online Business Loan by checking your eligibility now.

Having a big business deal in hand and require a loan to increase your working capital. Axis Bank offers collateral-free EMI based Business Loans for professionals who are looking to grow their practice. Check Axis Business Loan Rates Eligibility Calculate EMI Apply Online on Finance Buddha.

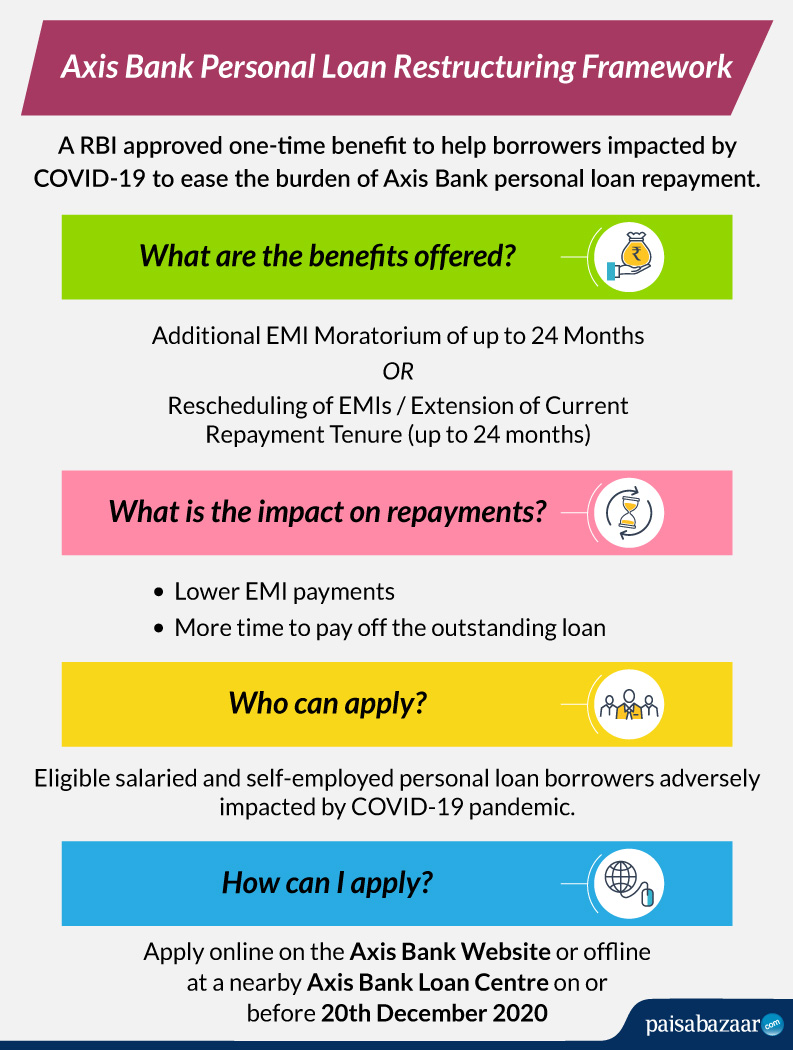

Axis Bank Personal Loan Restructuring Covid 19 Paisabazaar Com

Axis Bank Personal Loan Restructuring Covid 19 Paisabazaar Com

5 Things You Did Not Know About Personal Loan Axis Bank

5 Things You Did Not Know About Personal Loan Axis Bank

Business Loan Eligibility And Interest Rate Axis Bank

Business Loan Eligibility And Interest Rate Axis Bank

41dbd0b9be576bf08df9ff00000b8c1c.jpg) Heres How To Open A Ppf Account Axis Bank

Heres How To Open A Ppf Account Axis Bank

How To Get Your Personal Loan Approved Very Easily

How To Get Your Personal Loan Approved Very Easily

11 Best Banks For Business Loan In India 2021 Review Comparison Cash Overflow

11 Best Banks For Business Loan In India 2021 Review Comparison Cash Overflow

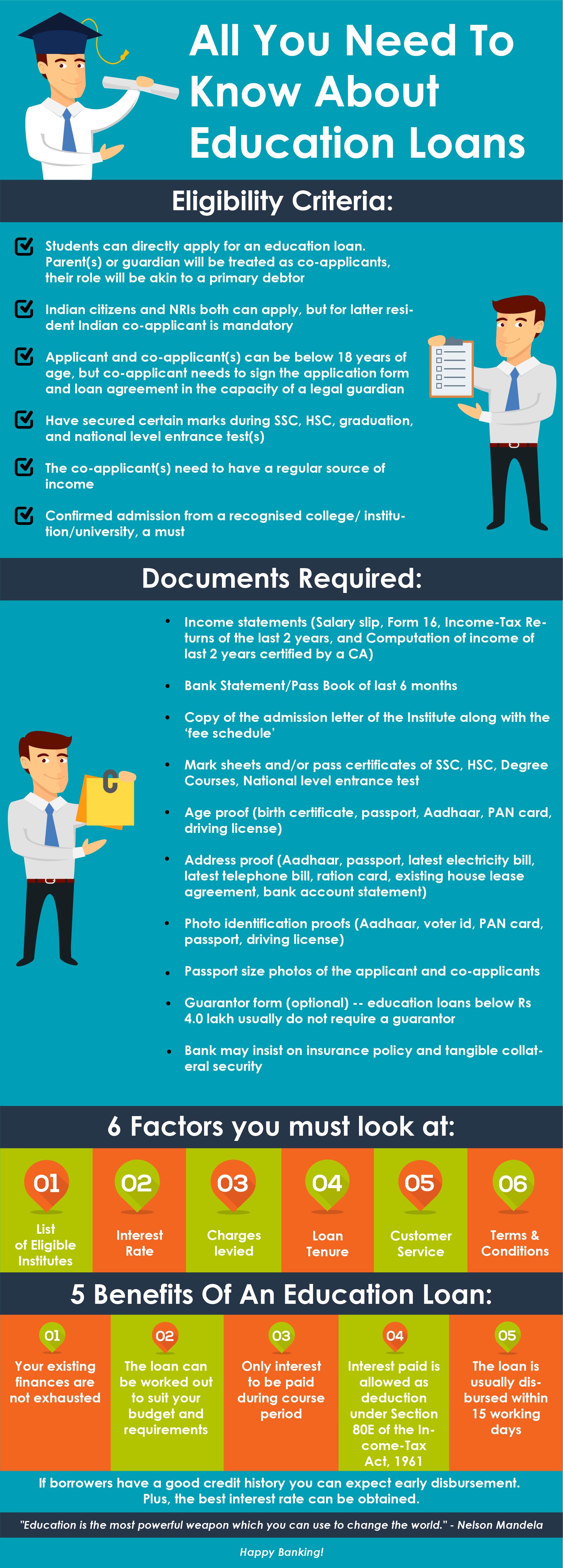

All You Need To Know About Education Loan Axis Bank

All You Need To Know About Education Loan Axis Bank

.jpg) How A Personal Loan Can Fulfil Your Dream Vacation Axis Bank

How A Personal Loan Can Fulfil Your Dream Vacation Axis Bank

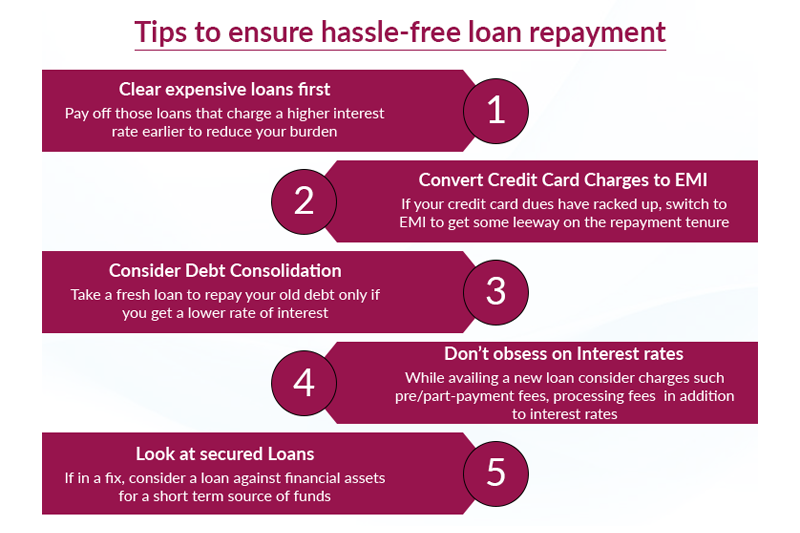

Loan Repayment Five Tips To Follow And Save Money Axis Bank

Loan Repayment Five Tips To Follow And Save Money Axis Bank

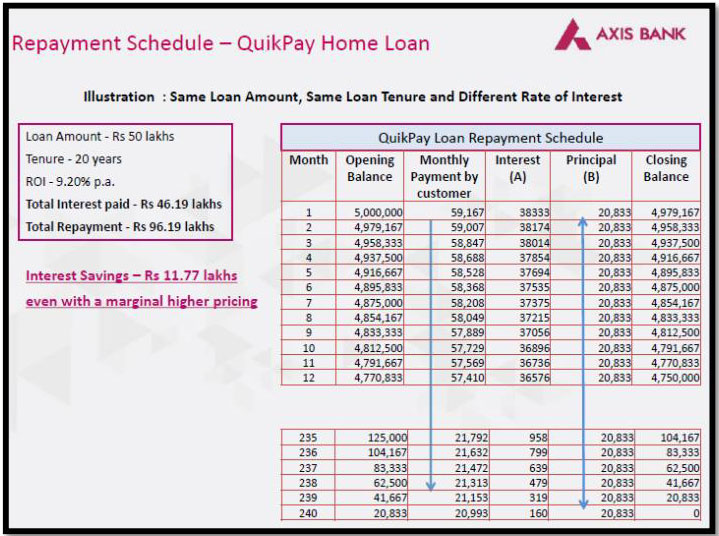

Quikpay Home Loan Reduce The Interest Outgo Of Your Home Loan

Quikpay Home Loan Reduce The Interest Outgo Of Your Home Loan

Axis Bank Home Loan Frequently Asked Questions

Axis Bank Home Loan Frequently Asked Questions

Business Loan Eligibility And Interest Rate Axis Bank

Business Loan Eligibility And Interest Rate Axis Bank

All You Need To Know About Axis Bank 24x7 Business Loan Axis Bank

All You Need To Know About Axis Bank 24x7 Business Loan Axis Bank

Axis Bank Business Loan Interest Rates Docs Required Eligibility

Axis Bank Business Loan Interest Rates Docs Required Eligibility

Corporate Banking Business Banking Services And Solutions Online

Corporate Banking Business Banking Services And Solutions Online