Can You Get An Sba Disaster Loan If You Owe The Irs

If youre interested in the SBA 7a loan but not sure if you qualify our team at SBA7aloans offers free consultations to business owners just like you. You can apply directly to SBAs Disaster Assistance Program at.

Https Www Sba Gov Sites Default Files Resource Files Eidl Bdo Presentation March 26 Pdf

Im Carter Im a CPA and can help you out.

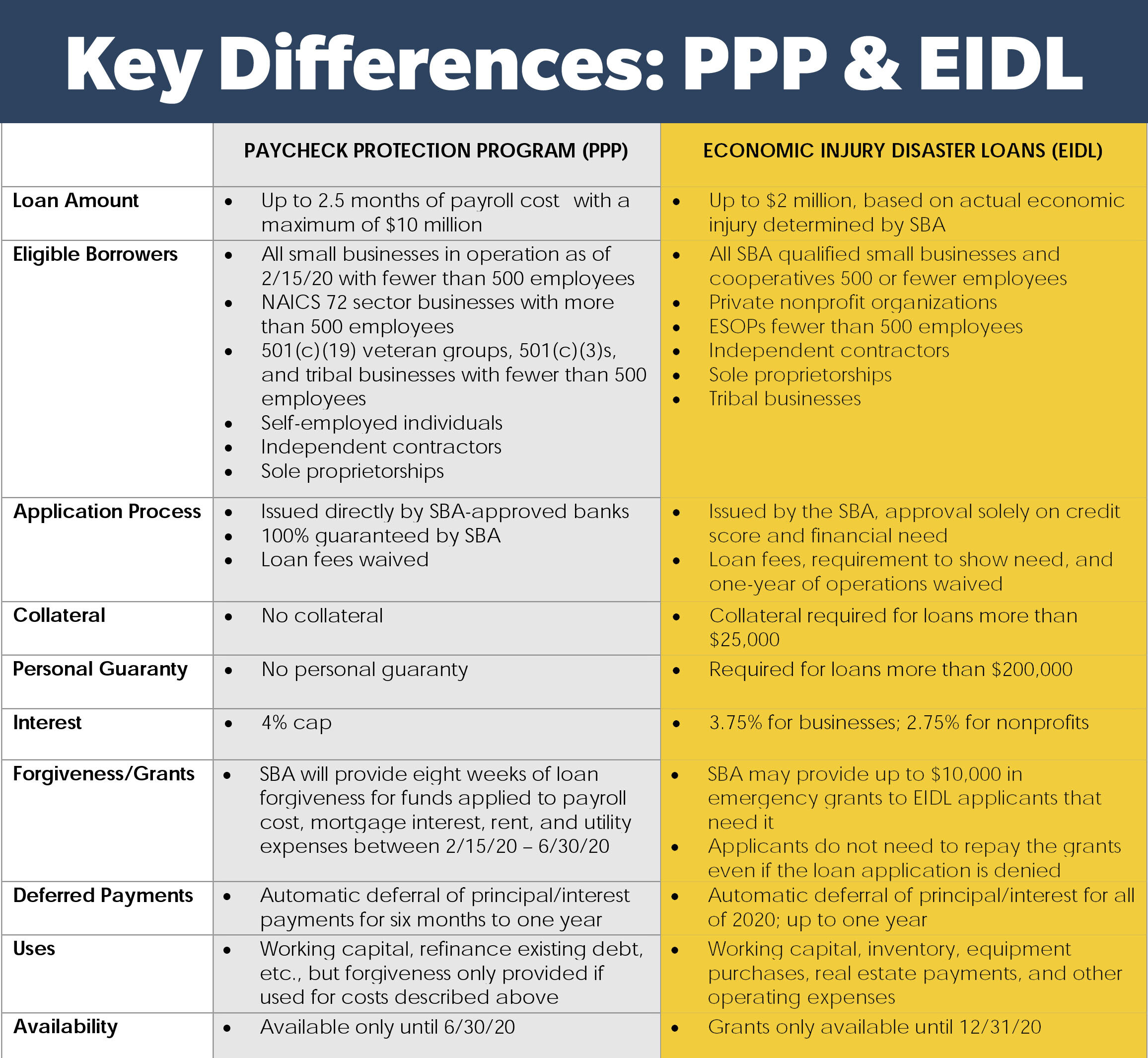

Can you get an sba disaster loan if you owe the irs. Its a powerful kick-starter for our economy. The EIDL can be treated the same as any other loan but what about the EIDL grant. An SBA 7a loan is the Small Business Administrations SBA most popular loan and its not hard to see why.

Choose how much you want your loan amount to be up to the maximum quoted 3. The lender must verify the transcripts to information provided by the borrower and used by the lender to evaluate repayment of the loan. 3716 TOP can take up to 25 of your Civil Service Retirement benefits to satisfy a defaulted SBA loan balance.

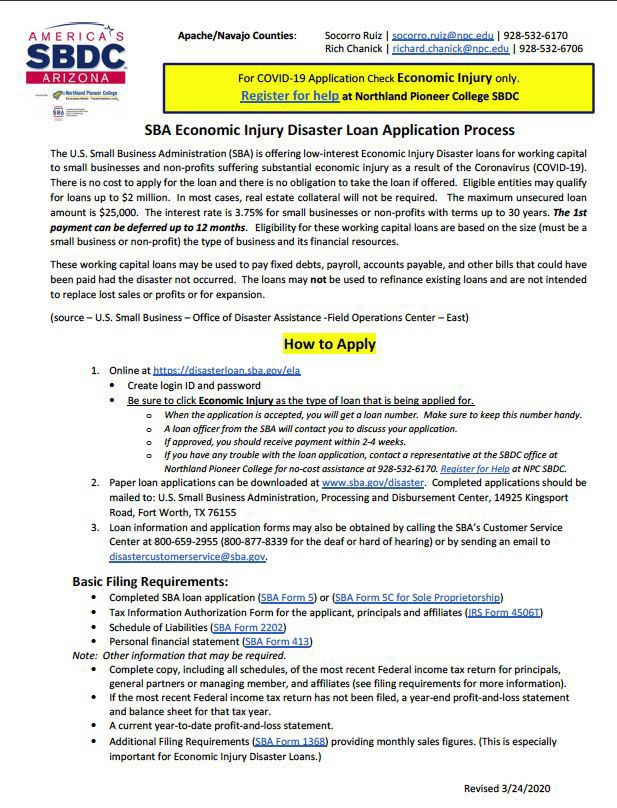

A low-interest disaster loan from the Small Business Administration loan must be repaid and therefore does not reduce the casualty loss amount. SBAs Disaster Assistance Program at. Let me know if you need anything else.

No that is simply an estimate of the loan you may be qualified to receive. Under 31 USC. Homeowners and renters need to fill out an SBA disaster home loan application and the IRS Form 4506-T Request for Transcript of Tax Return.

You will be required to complete the disaster loan application as well as submit IRS Form 4506-T which gives permission for the IRS to release your tax return to the SBA. You need to navigate to the httpscawebsbagov site to view your SBA loan information. After getting approved for an Economic Injury Disaster Loan EIDL from the federal government I was concerned.

If not please leave a rating. Log into your SBA Loan Portal 2. Whether youre suffering from lost revenue or any other crisis theres a solution to get you back on your feet.

The tax-deductible factors for small business loans for disaster circumstances could exist if either the home is used as collateral or other rules are introduced. Applicants can have an existing SBA Disaster Loan and still qualify for an EIDL for this disaster but the loans cannot be consolidated. However amounts of the loan if any which are cancelled or forgiven are included in gross income in the year of cancellation.

Civil Service Retirement Benefits. While the SBA processes your identity theft report you may still get monthly invoices. Prior to submitting an application for an SBA loan lenders must obtain income tax return transcripts from the IRS.

3716 TOP can take the lesser of 15 or amount over 75000 of your Social Security benefits to satisfy a defaulted SBA loan balance. Contact SBA7aloans now to make your free appointment and get on your way to funding your venture. This can be a risky endeavor so the federal government provides them to help entrepreneurs who might not be able to get a loan under normal circumstances.

For delegated lenders PLP or SBA Express the transcripts must be obtained and verified prior to first disbursement. DisasterLoansbagov There is no cost to apply. Additionally insurance or other reimbursements received and not required to be repaid will reduce the casualty loss.

An SBA loan is intended to help a small business get up and running. Be sure to click the. The lender must verify the transcripts to information provided by the borrower and used by the lender to evaluate repayment of the loan.

Besides a completed application form each business owner would need to complete IRS Form 4506-T. Report the problem right away to the SBAs Office of Disaster Assistance and follow their guidance on what to do. Once you receive the initial loan quote.

Prior to submitting an application for an SBA loan lenders must obtain income tax return transcripts from the IRS. There is no obligation to take the loan if offered. The SBA disaster business loan application calls for more documentation.

The only restriction like that is you cannot have defaulted on an SBA Loan in the past 7 years. An SBA 7 a loan. The second stimulus bill clarified that the grant will be tax-free.

Paygov is unable to assist with enrolling or logging into the SBAs Capital Financial System please contact the SBA for assistance at clssbagov or 1-833-572-0502 M-F 8 am - 8 pm. The maximum unsecured loan amount is 25000. However you ought to consider all of your sources for emergency funding before applying to the SBA as disaster loans may only apply to businesses without any other options.

In short the TOP program can. If you buy through our links we may earn money from affiliate partners. Small businesses and individual owners are able to claim losses in federal tax returns based on the year a disaster occurs.

Disasterloansbagov There is no cost to apply There is no obligation to take the loan if offered The maximum unsecured loan amount is 25000 Applicants can have an existing SBA Disaster Loan and still qualify for. Theres no restrictions on the PPP loan for back taxes. If you or your business is billed for an SBA EIDL loan you dont owe.

The Economic Injury Disaster Loan EIDL is a loan option available through the SBA to help businesses struggling with financial hardship due to COVID-19. The SBA doesnt make any of the loans itself but makes it all possible.

Https Www Sba Gov Sites Default Files Articles Eidl Information And Documentation 3 27 2020 Final Pdf

Sba Economic Injury Disaster Loan Application Process Latest News Wmicentral Com

Sba Economic Injury Disaster Loan Application Process Latest News Wmicentral Com

Quick Guide Sba Disaster Loan Application Specific To Coronavirus Covid 19 Youtube

Quick Guide Sba Disaster Loan Application Specific To Coronavirus Covid 19 Youtube

Economic Injury Disaster Loan Eidl Update Miller Musmar

Economic Injury Disaster Loan Eidl Update Miller Musmar

Sba S Economic Injury Disaster Loan Program Womble Bond Dickinson Jdsupra

Sba S Economic Injury Disaster Loan Program Womble Bond Dickinson Jdsupra

11 Steps To Apply For The Coronavirus Disaster Loan Finder Com

11 Steps To Apply For The Coronavirus Disaster Loan Finder Com

Https Www Sba Gov Sites Default Files Articles Eidl Information And Documentation 3 27 2020 Final Pdf

How To Get An Sba Disaster Loan Eidl Bench Accounting

How To Get An Sba Disaster Loan Eidl Bench Accounting

How To Apply For The Sba Economic Injury Disaster Loan Rapid Finance

How To Apply For The Sba Economic Injury Disaster Loan Rapid Finance

How To Apply For An Sba Disaster Loan

How To Apply For An Sba Disaster Loan

Do You Qualify For An Sba Disaster Loan Divvy

Do You Qualify For An Sba Disaster Loan Divvy

How To Apply For The Sba Economic Injury Disaster Loan Eidl Revised Practice Financial Group

How To Apply For The Sba Economic Injury Disaster Loan Eidl Revised Practice Financial Group

Sba S Economic Injury Disaster Loan Program Womble Bond Dickinson Jdsupra

Sba S Economic Injury Disaster Loan Program Womble Bond Dickinson Jdsupra

Do You Qualify For An Sba Disaster Loan Divvy

Do You Qualify For An Sba Disaster Loan Divvy

Sba Loan Application Is Lengthy But Worth Getting Started Right Away Bus Motorcoach News

Sba Loan Application Is Lengthy But Worth Getting Started Right Away Bus Motorcoach News

Sba Economic Injury Disaster Loans Are Still Available Br Startup Junkie

Sba Economic Injury Disaster Loans Are Still Available Br Startup Junkie

Are You Qualified For The 2021 Sba Targeted Eidl Advance

Are You Qualified For The 2021 Sba Targeted Eidl Advance

Applying For Sba Eidl Disaster Assistance

Applying For Sba Eidl Disaster Assistance