Do Corporations Send 1099s

Suppose you hire a contractor for 10000 to remodel your house. Heres another way to remember.

Federal Form 1099 Misc Deadline Irs Forms Irs 1099 Tax Form

Federal Form 1099 Misc Deadline Irs Forms Irs 1099 Tax Form

Payments made by PayPal or another third-party network gift card debit card or credit card also dont require a 1099.

Do corporations send 1099s. In this case there is no need to send out a 1099-MISC form because the work was for personal purposes. 1099-MISCs should be sent to single-member limited liability company or LLCs or a one-person Ltd. Sole proprietor Do send 1099.

Vendors who operate as C- or S-Corporations do not require a 1099. But not an LLC thats treated as an S-Corporation or C-Corporation. However a single member LLC sole proprietorship partnership or unincorporated contractor.

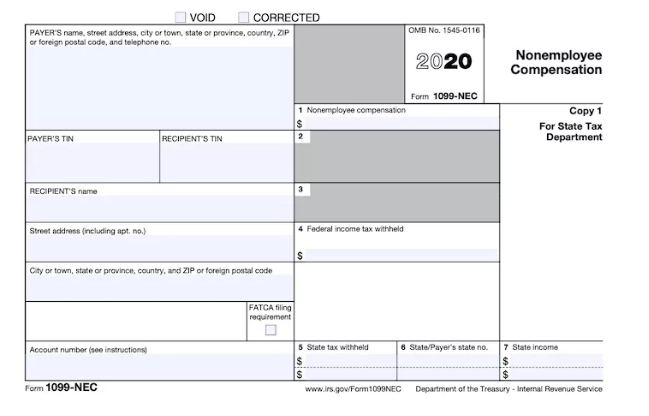

Payments made to for-profit medical providers. Do not report payments to corporations on Form 1099-MISC unless reporting payments for medical health or legal services. You are required to send Form 1099-NEC to vendors or sub-contractors during the normal course of business you paid more than 600 and that includes any individual partnership Limited Liability Company LLC Limited Partnership LP or Estate.

You do need to send 1099s to single-member limited liability company or LLCs or a one-person Ltd. The following payments made to corporations generally must be reported on Form 1099-MISC. An easy way to remember the IRS rule is that corporations do not receive 1099 forms regardless of whether they are S or C corporations.

Canceled debts reportable under section 6050P must be reported on Form 1099-C. Exception to the general rule. See the Instructions for Forms 1099-A and 1099-C.

If you are paid as a contractor by one or more of your clients you will receive the 1099-NEC but you do not need to send it to the IRS. Another important point to note. To make this job easier be sure your accounts payable clerk uses the full legal name of the vendor not just an abbreviation or shortened version of the name.

You do not need to send this form to vendors of storage freight merchandise or related items or when rent is paid to a real estate agent. Lawyer fees even if the attorney is incorporated. Refer to the General Instructions for Forms 1099 1098 5498 and W-2G PDF for more information on 1099 reporting.

Reportable payments to corporations. Generally payments to a corporation including a limited liability company LLC that is treated as a C or S corporation do not have to be reported on a 1099-Misc. There is no need to send 1099-MISCs to corporations.

If your vendor is a corporation a C Corp or an S Corp you do not need to issue them a 1099. If you close a transaction with a title company or attorney as most people do they will collect the necessary information and file Form 1099-S for you. You will need to provide a 1099 to any vendor who is a.

If you are in business whether self-employed or running a company you must send a 1099 form with copies to the IRS to anyone that you pay money to unless the payments meet one or more of the. Medical and health care payments reported in box 6. This includes S-Corporations and C-Corporations.

If your attorney has exceeded the threshold they receive a 1099 whether theyre incorporated or not. Beware that a limited liability corporation LLC is not a corporation and those companies should be included in your 1099 reporting. This includes S-Corporations and C-Corporations -- they also dont receive 1099 1099-MISCs.

The major exception to the 1099 requirement is payments to corporations. You do not need to send 1099-MISCs to corporations. In general corporations do not need to receive 1099s.

But not an LLC thats treated as an S-Corporation or C-Corporation. You should also issue 1099-MISC forms for. Most payments to incorporated businesses do not require that you issue a.

If the seller certifies that the sale price is for 250K or less and the sale is for their principal residence the transaction is not reportable. From IRSs 1099-Misc instructions. The following payments made to corporations generally must be reported on Form 1099-MISC.

Additionally if you make a payment to a limited liability company LLC that is treated either as a C-corporation or an S-corporation for tax purposes you also do not need to issue a 1099 form. The exception to this rule is with paying attorneys. Sole proprietors partnerships and unincorporated contractors do.

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Do I Need To Send 1099s Lauren Gann Cpa Pllc

Make Sure You Have A W 9 For Each Recipient In 2020 Irs Forms 1099 Tax Form Tax Forms

Make Sure You Have A W 9 For Each Recipient In 2020 Irs Forms 1099 Tax Form Tax Forms

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Filing 1099s Who Gets One Capforge

Filing 1099s Who Gets One Capforge

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Do I Need To File 1099s Deb Evans Tax Company

Do I Need To File 1099s Deb Evans Tax Company

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Rules For When To Issue A 1099 Form To A Vendor The Dancing Accountant

Rules For When To Issue A 1099 Form To A Vendor The Dancing Accountant

How Does An Irs 1099 Misc Different From A W 9 When Filing Taxes Filing Taxes Irs Forms Employer Identification Number

How Does An Irs 1099 Misc Different From A W 9 When Filing Taxes Filing Taxes Irs Forms Employer Identification Number

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Super Forms Miscs305 1099 Misc Miscellaneous Income Preprinted Set 3 Part Sale Reviews Irs Tax Forms Tax Forms Irs Taxes

Super Forms Miscs305 1099 Misc Miscellaneous Income Preprinted Set 3 Part Sale Reviews Irs Tax Forms Tax Forms Irs Taxes

Need Help On 1099 Misc Form Online Filing Website Services Efile Online

Need Help On 1099 Misc Form Online Filing Website Services Efile Online