How To Get Unemployment 1099 Online

I received a 1099-G from the Ohio Department of Job and Family Services ODJFS. To access this form please follow these instructions.

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

PUA Login false Coronavirus and Unemployment Insurance Benefits.

How to get unemployment 1099 online. Appeal requests may be submitted online at unemploymentohiogov by email to UITaxAppealsjfsohiogov by fax to 614 752-4952 or by mail to Unemployment Tax Appeals P O. How do I get my 1099-G. ODJFS issues IRS 1099-G tax forms to recipients of unemployment.

Go the website of your states labor department. We also send this information to the IRS. If you do not have an online account with NYSDOL you may call.

Where to find your 1099G info Your 1099G tax form will be mailed to you by Jan. You can access your Form 1099G information in your UI Online SM account. You can elect to be removed from the next years mailing by signing up for email notification.

ODJFS has created a new online portal that provides a direct way for Ohioans to notify the agency if they believe their identity was stolen and used to file a fraudulent unemployment claim. If you DID apply andor receive unemployment benefits from ODJFS. Pacific time except on state holidays.

Your 1099-G will be electronically available in your BEACON portal. From the Unemployment Insurance Benefits Online page below under the Get your NYS 1099-G section select the year you want in the NYS 1099-G drop-down menu box with an arrow and then select the Get Your NYS 1099-G button. 1099-G forms are delivered by email or mail and are also available through a claimants DES online account.

How to Access Your 1099-G Form Online Log in to your IDES account. Why is the amount in box one of my 1099G. You can opt to receive your 1099-G electronically by providing your consent through the BEACON portal or mobile app.

The appeal must be in writing and it must state the reasons the employer believes the determination was incorrect. You can also download your 1099-G income statement from your unemployment benefits portal. The most common use of the 1099-G is to report unemployment compensation as well as any state or local income tax refunds you received that year.

If you see a 0 amount on your 2020 form call 1-866-401-2849 Monday through Friday from 8 am. This is the fastest method for receiving your tax forms if you selected Electronic as your correspondence type. In most cases 1099-Gs for the previous year are mailed on or before January 31.

After you have successfully logged into your IDES account navigate to the dropdown menu titled Individual Home in orange. Log into CONNECTand go to My 1099-G 49Ts in the main menu. Expanded Eligibility Resource Hub The new federal Pandemic Unemployment Assistance or PUA program provides benefits for many individuals ineligible for state unemployment benefits including self-employed workers 1099 tax filer.

If you did not receive a 1099-G tax form because your address is not updated in your account you may request a new 1099-G and get your address changed at desazgov1099G-Report. You may access your IRS Form 1099-G for UI Payments for current and previous tax years on MyUI portal by entering your social security number and four-digit personal identification number PIN. All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st.

If you received a 1099-G from ODT please click here for additional information and frequently asked questions. Navigate to the page that provides information on unemployment claims. This page should explain your states time frame to mail 1099-Gs to residents who received unemployment benefits during the tax year in question.

Every year we send a 1099-G to people who received unemployment benefits. Receive a 1099-G tax form in the mail stating that they received unemployment benefits in 2020 when in fact they did not. This is the fastest method for receiving your tax forms if you selected Electronic as your correspondence type.

In the form insert your new address and click the box under the address line. Box 182830 Columbus Ohio 43218-2830. How to Get Your 1099-G online.

Please note this Individual Home menu is different than the Individual menu that you see on IDESs public-facing website. If you were a phone filer it will. I never received my 1099-G form because my address wasnt updated.

It will be available to view in early February on the Online Claims System in the tab titled 1099G Tax forms toward the bottom of the page. We will mail you a paper Form 1099G if you do. 31 2021 all individuals who received unemployment benefits in 2020 will receive an IRS Form 1099-G from the Division of Employment Security.

1099Gs are available to view and print online through our Individual Online Services. I received a 1099-G from the Ohio Department of Taxation ODT. The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021.

Remember even if you were unemployed you still have to file income taxes.

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

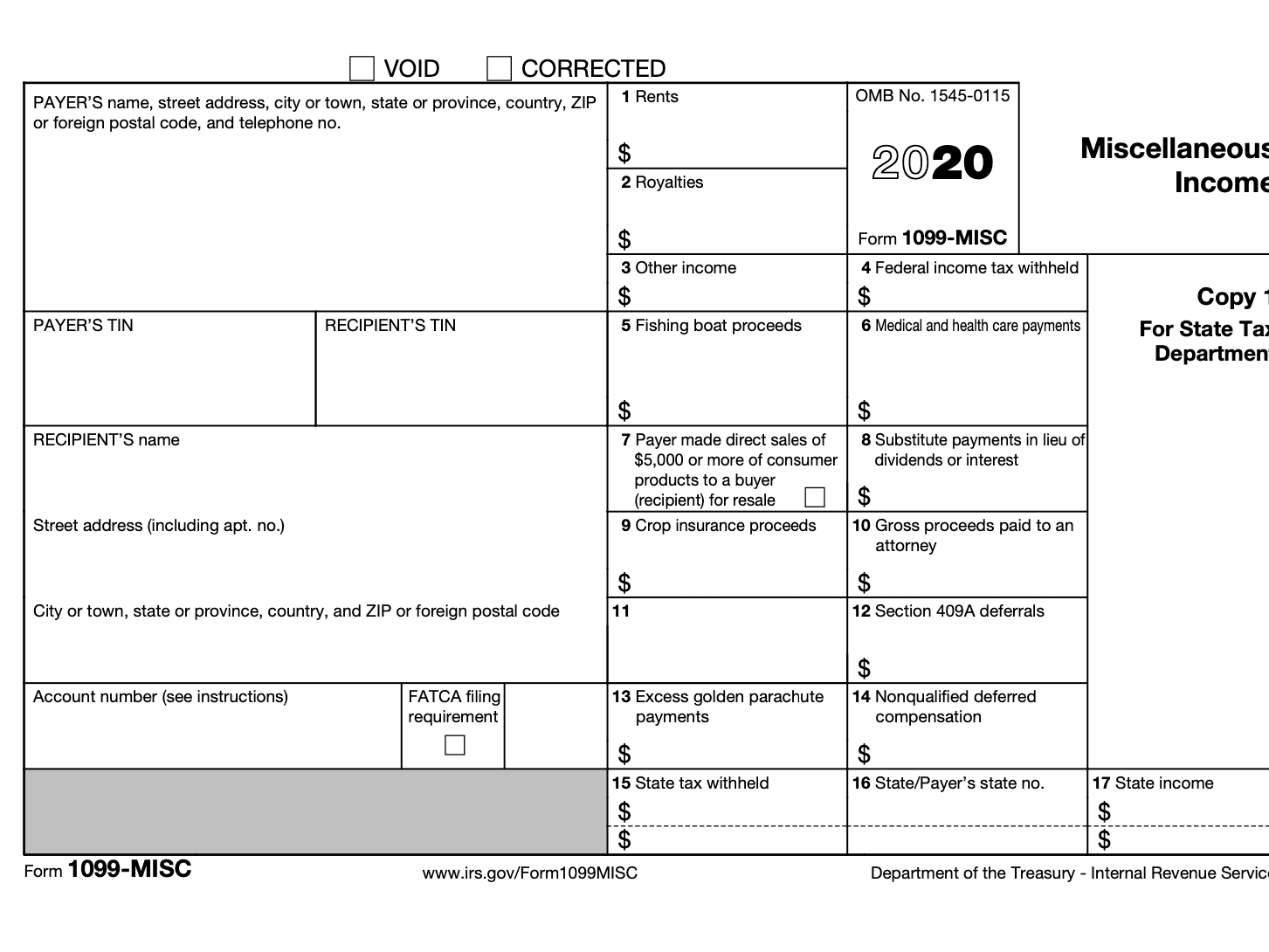

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Manage 1099 Sales Reps Independent Contractors Professional Insurance Independent Contractor Sales Rep

How To Manage 1099 Sales Reps Independent Contractors Professional Insurance Independent Contractor Sales Rep

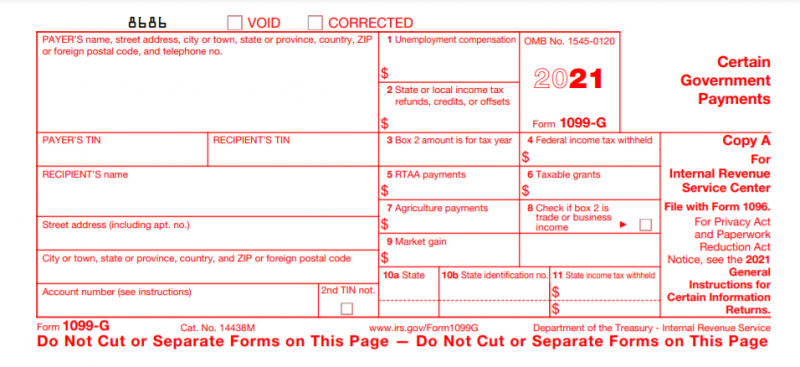

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

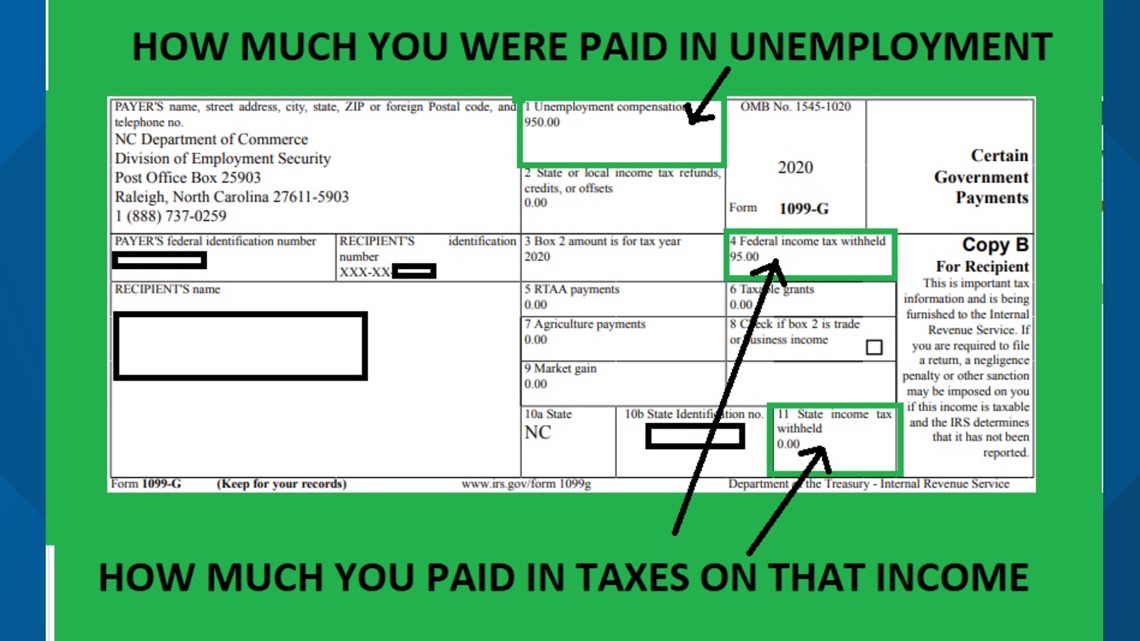

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

1099 Tax Forms Available Soon For Pa Unemployment Claimants Erie News Now Wicu And Wsee In Erie Pa

1099 Tax Forms Available Soon For Pa Unemployment Claimants Erie News Now Wicu And Wsee In Erie Pa

Account Ability 1098 1099 3921 3922 5498 W2 Forms Envelopes Tax Forms Tax Refund W2 Forms

Account Ability 1098 1099 3921 3922 5498 W2 Forms Envelopes Tax Forms Tax Refund W2 Forms

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

Form Irs 1099 Misc 2013 Irs Forms Irs Form

Form Irs 1099 Misc 2013 Irs Forms Irs Form

I Need This Self Employed Tax Preparation Printables Instantdownload Smallbusiness Expensetracking Accoun Small Business Small Business Plan Tax Checklist

I Need This Self Employed Tax Preparation Printables Instantdownload Smallbusiness Expensetracking Accoun Small Business Small Business Plan Tax Checklist

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractors Or That Hav In 2021 Bookkeeping Business Business Tax Small Business Bookkeeping

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractors Or That Hav In 2021 Bookkeeping Business Business Tax Small Business Bookkeeping

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Deadlines For The 2018 Tax Year W 2 And 1099 Misc Forms Irs Tax Forms Federal Taxes Tax Deadline

Deadlines For The 2018 Tax Year W 2 And 1099 Misc Forms Irs Tax Forms Federal Taxes Tax Deadline

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

Unemployment Benefits Are Taxable Look For A 1099 G Form 13newsnow Com

Unemployment Benefits Are Taxable Look For A 1099 G Form 13newsnow Com