Where To Find Principal Business Code On 1099-misc

Youll also find the commonly used distribution codes in Box 7. Small Business Administration SBA and other US.

Https F Hubspotusercontent40 Net Hubfs 3465794 Your 20ultimate 20guide 20to 201099s Pdf

View solution in original post.

Where to find principal business code on 1099-misc. I cant seem to find the principal business code of a company I had contract work with and I need it now to get my taxes done. It is asking for a principal business code. Avoid trudging through the Census Database.

Amounts shown on a Form 1099 such as Form 1099-MISC Form 1099-NEC and Form 1099-K. If you got a 1099-misc with a number in box 7 then by tax. If principal source of income is from farming activities file Schedule F Form 1040 and enter code on line B Schedule F Form 1040.

These Principal Business Activity Codes are based on. Select the category that best describes your primary business activity for example Real Estate. This income is subject to SE tax at 153 this is shown on line 57 of Form 1040.

33642 Aircraft engine and engine parts manufacturing. As a result all partnerships must report business interest expense to partners on Schedules K-1 Form 1065. Gross receipts for sec-tion 448c2.

Principal Business or Professional Activity Codes Schedule C. Business codes used in Sections 1 2 and 3 Dont see the code you are looking for. Principal Business Professional Activity NAICS Codes Accommodation Food Services Drinking Places Accommodation 721310 Rooming boarding houses 721210 RV recreational vehicle parks recreational camps 721100 Traveler Accommodation including hotels motels bed breakfast inns Food Services Drinking Places 722410 Drinking.

Code N box 20. For business name write your name principal business code -- turbotax will show you a list of codes accounting method- cash. To see a list of codes please view pages 17-18 in the IRS link.

See the instructions on your Form 1099 for more information about what to report on Schedule C. I received a 1099 misc form for washing cloths for the kitchen where i work. A principal business code is a six-digit number that classifies the main type of product you sell or main type of service you offer.

Principal business code for 1099. You may be subject to state and local taxes and other requirements such as business licenses and fees. Now find the six-digit code assigned to this activity for example 531210 the code for offices of real estate agents and brokers and enter it on Schedule C or C-EZ line B.

Then you put net income or loss on line 12 of Form 1040. This list of Principal Business Activities and their associated codes is designed to classify an enterprise by the type of activity in which it is engaged to facilitate the administration of the Internal Revenue Code. Assigned to this activity for example 531210 the code for offices of real estate agents and brokers and enter it on Schedule C Form 1040.

Then select the activity that best identifies the principal source of your sales or receipts for example real estate agent. Regulations section 1163j-6h created a new section 704d loss class for business interest expense effective for tax years beginning after November 12 2020. Code AG box 20.

Use the BEST Free Resource for NAICS SIC Information. It covers any miscellaneous income. You will report your income and expenses on schedule C or C-EZ Form 1040.

With our Business Code Search Tool you can enter a description keyword or 4-6 digit NAICS code to find the associated business codes for use in the Business Research and Development Survey. Read through the list of codes in the instruction book and enter the code thats closest to whatever you did to earn that money. It is used for filing federal tax returns with the Internal Revenue Service IRS applying for loans with the US.

Received a distribution from a life insurance policy or annuity with service by Principal in the last tax year. Finding Your NAICS SIC Codes has never been easier. The principle business code is a six digit code that corresponds to the type of work you perform.

Youll get a Form 1099-MISC from any business that paid you 600 or more this year. Check with your state and local governments for more information.

Paycheck Protection Program First Draw 1st State Bank

Paycheck Protection Program First Draw 1st State Bank

Https Www Raymondjames Com Media Rj Dotcom Files Wealth Management Why A Raymond James Advisor Client Resources Tax Reporting 2019 Composite Form 1099 Guide Pdf

Irs Discussions Answers And Free Resources For Banking Professionals

Irs Discussions Answers And Free Resources For Banking Professionals

24 Printable Form 1065 Templates Fillable Samples In Pdf Word To Download Pdffiller

24 Printable Form 1065 Templates Fillable Samples In Pdf Word To Download Pdffiller

Https Csqa Thomson Com Ua Ut 2013 Cs Us En Pdfs Sdeex Pdf

Freelance Taxes Income Taxes Arcticllama Com

Freelance Taxes Income Taxes Arcticllama Com

Https Www Irs Gov Pub Irs Prior F1096 1991 Pdf

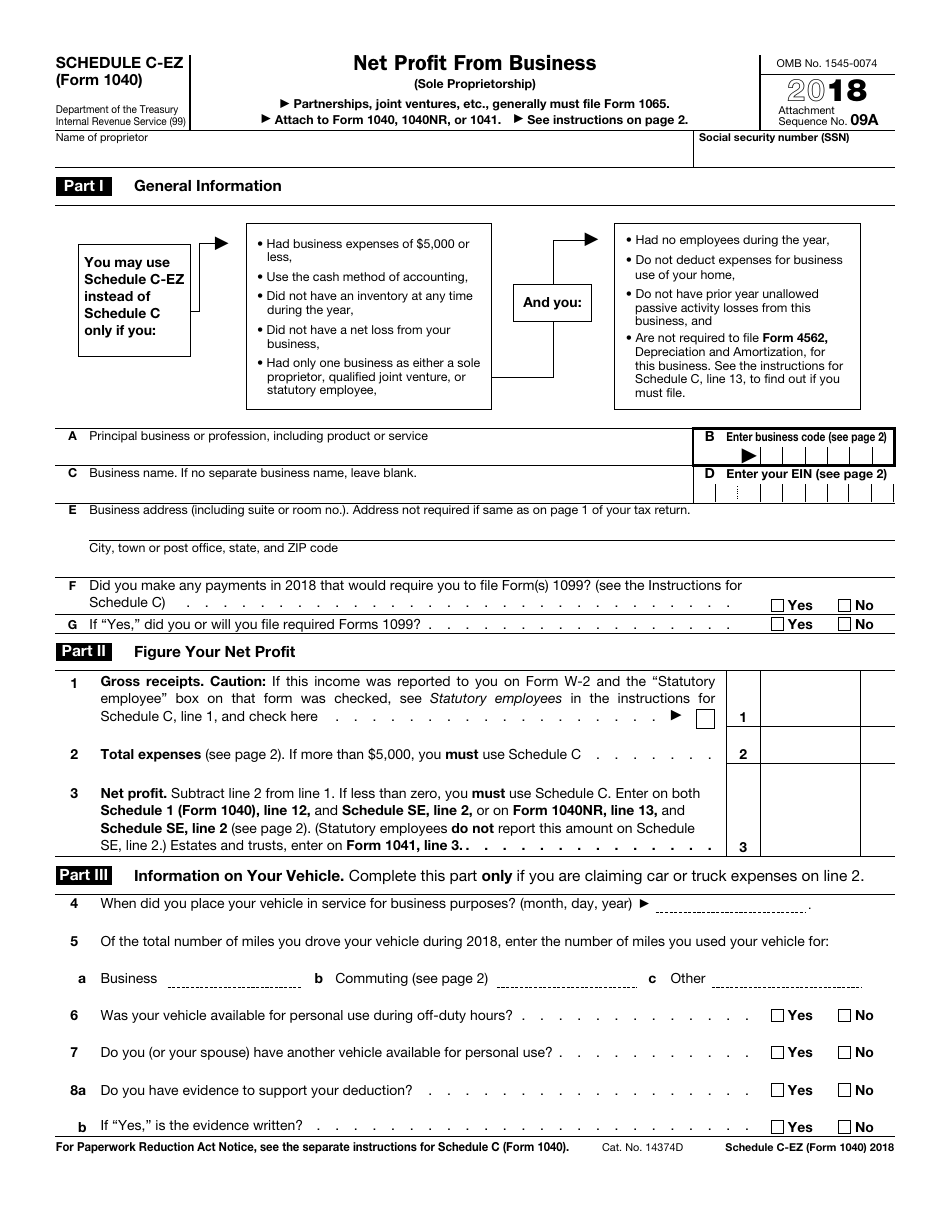

Form 1040 Schedule C Ez Net Profit From Business Sole Proprietorship

Irs Form 1040 Schedule C Ez Download Fillable Pdf Or Fill Online Net Profit From Business Sole Proprietorship 2018 Templateroller

Irs Form 1040 Schedule C Ez Download Fillable Pdf Or Fill Online Net Profit From Business Sole Proprietorship 2018 Templateroller

Https Www Raymondjames Com Media Rj Dotcom Files Wealth Management Why A Raymond James Advisor Client Resources Tax Reporting 2019 Composite Form 1099 Guide Pdf

1099 Nec Tax Services Accounting Firms Accounting Services

1099 Nec Tax Services Accounting Firms Accounting Services

24 Printable Form 1065 Templates Fillable Samples In Pdf Word To Download Pdffiller

24 Printable Form 1065 Templates Fillable Samples In Pdf Word To Download Pdffiller

Form 5472 Info Return Of A 25 Foreign Owned U S Or Foreign Corp Eng Quickbooks Informative Foreign

Form 5472 Info Return Of A 25 Foreign Owned U S Or Foreign Corp Eng Quickbooks Informative Foreign

Https Www Raymondjames Com Media Rj Dotcom Files Wealth Management Why A Raymond James Advisor Client Resources Tax Reporting 2019 Composite Form 1099 Guide Pdf

Https Www Sba Gov Sites Default Files Articles 11am Small Business Tax Workshop Pdf

2017 Form Irs 1065 Fill Online Printable Fillable Blank Pdffiller

2017 Form Irs 1065 Fill Online Printable Fillable Blank Pdffiller

Schedule C Form 1040 Free Fillable Form Pdf Sample Formswift

Schedule C Form 1040 Free Fillable Form Pdf Sample Formswift