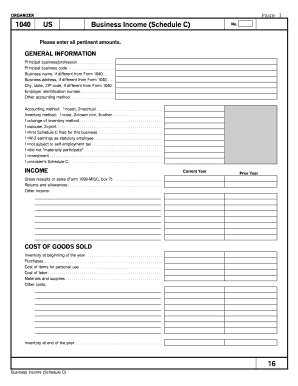

1040 Business Income Schedule C Form Organizer

1040 US Business Income Schedule C cont 16. 5100 5400 ttaxpayer sspouse blankjoint Federal Amount Paid Date Paid TS.

An activity qualifies as a business if.

1040 business income schedule c form organizer. Nonbusiness portion will carry to Schedule A. Attach Forms 1099 WAGES SALARIES AND TIPS Employer name. Was your home rented out or used for business.

How to Fill Out Schedule C on Form 1040. Nonbusiness portion will carry to Schedule A. Schedule C-EZ Form IRS 1040 is used instead of Schedule C by qualifying small businesses and statutory employees with expenses of 5000 or less.

1040 US Business Income Schedule C 16 16 ORGANIZER Series. Page Completed INCOME AND EXPENSES Schedule C CONTINUED Rent or lease. 1040 US Tax Organizer Tax Organizer ORGANIZER Form 1099-K - Merchant card and third party network payments.

ORGANIZER 1040 US Business Income Schedule C C Business Income Schedule C Kevin E. DIVIDEND INCOME Payer name. Business percentage will be applied to indirect.

Other business property Repairs and maintenance Supplies Taxes and licenses Enclose copies of payroll tax returns. Business address if different from Form 1040. 2019 Amount 2018 Amount 1040 US Business Use of Home Form 8829 29 Business Use of Home Form 8829 29 ORGANIZER Series.

Business address if different from Form 1040. 1040 US Business Income Schedule C cont 16 p2 Business Income Schedule C cont 16 p2 ORGANIZER Series. Business name if different from Form 1040.

Painting or repairs made to specific areas or rooms used for business. Painting or repairs made to specific areas or rooms used for business. Business Income Schedule C cont 16 p2 ORGANIZER Series.

Please enter all pertinent 2010 amounts. Painting or repairs made to specific areas or rooms used for business. The total is tallied at the end.

PENSIONS IRA AND GAMBLING INCOME Payer name. Partnerships generally must file Form 1065. 2020 Amount 2019 Amount Page 2.

2010 1040 US Business Income Schedule C cont 16 p2 Business Income Schedule C cont 16 p2 ORGANIZER Series. Vehicles machinery and equipment b. Did you receive a distribution from or make a contribution to a retirement plan 401k IRA etc.

Business name if different from Form 1040. Nonbusiness portion will carry to Schedule A. Nonbusiness portion will carry to Schedule A.

Your primary purpose for engaging in the activity is for income or profit. Farm Income Schedule FForm 4835 19 ORGANIZER. Filling out the Schedule C form consists of listing information about your business and business income as well as any expenses.

2018 Amount 2017 Amount 1040 US Business Use of Home Form 8829 29 Business Use of Home Form 8829 29 ORGANIZER Series. P2 Business Income Schedule C cont No. Attach to Form 1040 1040-SR 1040-NR or 1041.

Use Schedule C Form 1040 or 1040-SR to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Please enter all pertinent amounts. Business percentage will be applied to indirect.

SCHEDULE C Form 1040 Department of the Treasury Internal Revenue Service 99 Profit or Loss From Business Sole Proprietorship Go to wwwirsgovScheduleC for instructions and the latest information. 1040 US Business Income Schedule C cont 16 p2 Business Income Schedule C cont 16 p2 ORGANIZER Series. 2020 Amount 2019 Amount 1040 US Business Use of Home Form 8829 29 Business Use of Home Form 8829 29 ORGANIZER Series.

INTEREST INCOME Payer name. SCHEDULE C FOR SOLE-PROPRIETORS 1040 INCOME AND EXPENSES Schedule C Description Amount Part I Income Gross receipts or sales Returns and allowances Other income List type and amount Part II - Cost of Goods Sold Inventory at beginning of year Purchases less cost of items withdrawn for personal use. You are involved in the activity.

Direct Deposit Estimates Form 1040 ES 3 6 ORGANIZER Series. You can use this schedule if you operated a business or practiced a profession as a sole proprietorship or qualified joint venture or you were a statutory employee and you have met all the requirements listed in Schedule C-EZ Part I. Last years amounts are provided for your reference.

Please enter 2018 indirect expenses in full. Please enter 2020 indirect expenses in full. Were you notified or audited by either the IRS or the State taxing agency.

INDIVIDUAL TAX ORGANIZER 1040 Page 10 of 22 I-36 2005 AICPA Inc. 1040 US Business Income Schedule C 16 16 ORGANIZER Series. Business Use of Home Form 8829 29 ORGANIZER.

No state income tax. In the income and expenses sections individual items are listed with a space to enter the dollar amounts earned or spent. Painting or repairs made to specific areas or rooms used for business.

2020 Amount 2019 Amount 1040 US Business Use of Home Form 8829 29 Business Use of Home Form 8829 29 ORGANIZER Series. Business percentage will be applied to indirect. 1040 US Business Income Schedule C cont 16 p2 Business Income Schedule C cont 16 p2 ORGANIZER.

2014 2014 Amount 2013 Amount. Please enter 2019 indirect expenses in full. Please enter 2020 indirect expenses in full.

Fillable Online 2019 Schedule C Form 1040 Or 1040 Sr Internal Revenue Fax Email Print Pdffiller

Fillable Online 2019 Schedule C Form 1040 Or 1040 Sr Internal Revenue Fax Email Print Pdffiller

Blank Schedule C Form 1040 Page 1 Line 17qq Com

Blank Schedule C Form 1040 Page 1 Line 17qq Com

Fillable Form 1040 Schedule C 2019 In 2021 Sole Proprietor Tax Forms Benefit Program

Fillable Form 1040 Schedule C 2019 In 2021 Sole Proprietor Tax Forms Benefit Program

How To Deduct Property Taxes On Irs Tax Forms Irs Tax Forms Mortgage Interest Irs Taxes

How To Deduct Property Taxes On Irs Tax Forms Irs Tax Forms Mortgage Interest Irs Taxes

Schedule C Form 1040 Profit Or Loss From Business Internal Revenue Service Internal Revenue Service Sole Proprietorship Profit

Schedule C Form 1040 Profit Or Loss From Business Internal Revenue Service Internal Revenue Service Sole Proprietorship Profit

Http Www Protaxpdx Com Resources R56169 Schedule 20c Pdf

Printable Schedule C Form 1 Seven Printable Schedule C Form 1 Rituals You Should Know In 1 Irs Tax Forms Irs Taxes Tax Forms

Printable Schedule C Form 1 Seven Printable Schedule C Form 1 Rituals You Should Know In 1 Irs Tax Forms Irs Taxes Tax Forms

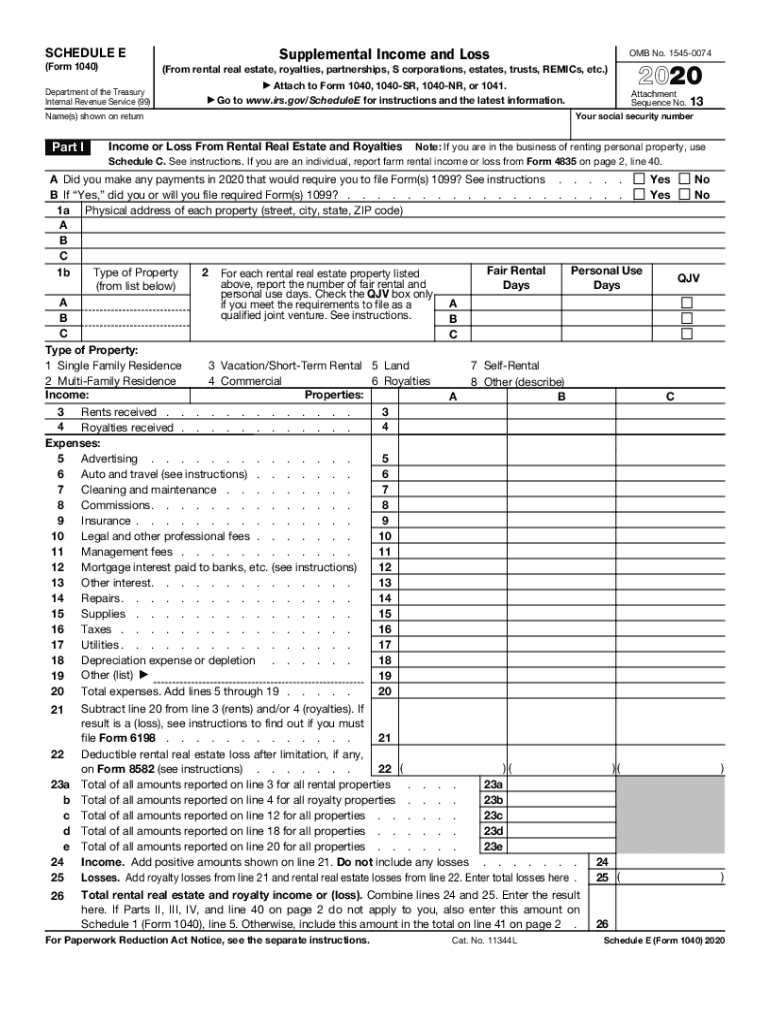

2020 Form Irs 1040 Schedule E Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1040 Schedule E Fill Online Printable Fillable Blank Pdffiller

Editable Schedule C Fill Online Printable Fillable Blank Pdffiller

Editable Schedule C Fill Online Printable Fillable Blank Pdffiller

Schedule C Form 1040 2021 Who Has To File Irs Tax Forms Irs Taxes Tax Forms

Schedule C Form 1040 2021 Who Has To File Irs Tax Forms Irs Taxes Tax Forms

Checklist For Irs Schedule C Profit Or Loss From Business 2018 Tom Copeland S Taking Care Of Business Profitable Business Turbotax Sole Proprietorship

Checklist For Irs Schedule C Profit Or Loss From Business 2018 Tom Copeland S Taking Care Of Business Profitable Business Turbotax Sole Proprietorship

Blank Schedule C Form 1040 Page 1 Line 17qq Com

Blank Schedule C Form 1040 Page 1 Line 17qq Com

Indie Authors Should Consider Using Schedule C Irs Tax Forms Irs Taxes Tax Forms

Indie Authors Should Consider Using Schedule C Irs Tax Forms Irs Taxes Tax Forms

Checklist For Irs Schedule C Profit Or Loss From Business 2015 Tom Copeland S Taking Care Of Business

Checklist For Irs Schedule C Profit Or Loss From Business 2015 Tom Copeland S Taking Care Of Business

Http Blauco Com Cms2 Wp Content Uploads 2017 01 Schedule C Business Income Organizer Pdf

Mary Kay Inventory Spreadsheet 2018 Excelguider Com Mary Kay Mary Kay Business Mary Kay Marketing

Mary Kay Inventory Spreadsheet 2018 Excelguider Com Mary Kay Mary Kay Business Mary Kay Marketing

Editable Schedule C Fill Online Printable Fillable Blank Pdffiller

Editable Schedule C Fill Online Printable Fillable Blank Pdffiller

Irs 1040 Form Schedule C 2016 Irs 1040 Irs Forms Irs

Irs 1040 Form Schedule C 2016 Irs 1040 Irs Forms Irs