Can I Use Turbotax Free With A 1099

Feature available within Schedule C tax form for TurboTax filers with 1099-NEC income. The IRS Free File Program is a public-private partnership that provides free.

All states are completely free with IRS Free File Program delivered by TurboTax.

Can i use turbotax free with a 1099. He had some box 2 income on his 1099 and the free Turbo Tax edition said that he wasnt eligible for the free version but instead needed to upgrade to the 60 version to complete Schedule 1. E-file online with direct deposit to receive your tax refund the fastest. I started to use turbotax free edition with my teenage son.

If you qualify there is another free software program available from TurboTax which will allow you to enter self-employment income. Dont have any major medical expenses. If you qualify you may also be able to use the online Freedom edition of TurboTax that includes Schedule C.

W-2 income Limited interest and dividend income reported on a 1099-INT. To get started or learn whether you qualify for the IRS Free File Program visit. Taxpayers are eligible for TurboTax Free Edition if they file a simple tax return Form 1040Form 1040-SR or Form 1040Form 1040-SR unemployment income only with no schedules.

TurboTax online makes filing taxes easy. Feature available within Schedule C tax form for TurboTax filers with 1099-NEC income. Military members can file through any TurboTax Online not CDdesktop or TurboTax Live product including Free Edition Deluxe Premier and Self-Employed.

Available in mobile app only. Try it for FREE and pay only when you file. IRS Free File program delivered by TurboTax.

Choose easy and find the right product for you that meets your individual needs. The IRS Free File Program delivered by TurboTax edition is a full featured personal tax program and on a separate website from the TurboTax online editions. Check out this link for more info on products and pricing.

If you only have a W-2 from work and various Form 1099s you may only need the TurboTax Free Edition. You can use the free edition if you. You just need to enter your W-2 and verify your military rank when prompted within TurboTax Online and your discount will be applied when you are ready to file.

Available in mobile app only. If you are using the online version of TurboTax Self-Employed would enable you to enter both employee and self-employment income and expenses and maximize deductions geared toward self-employment. TurboTax is the easy way to prepare your personal income taxes online.

Dont own a business or have 1099-MISC income. The Form 1099s the Basic version supports are. 50 million hard-working taxpayers can file their simple federal and state taxes for free.

Available in TurboTax Self-Employed and TurboTax Live Self-Employed starting 1252021. We went to HR Block free online and completed his return for free. Try the Freedom Edition.

1099-NEC Snap and Autofill. 1099-NEC Snap and Autofill. 1099-NEC Snap and Autofill.

1099-MISC Miscellaneous Income 1099-INT Interest Income. Available in TurboTax Self-Employed and TurboTax Live Self-Employed starting 1252021. If you are eligible you can use the IRS Free File Program delivered by TurboTax which is free to file both a federal and state tax return.

If you use TurboTax to file your taxes well ask about your unemployment income and put the information in all the right tax forms for you. If you qualify for free federal filing you also qualify for free state filing. You can file with TurboTax Free Edition if you only have the following situations.

That includes W-2 income limited interest and dividend income reported on a 1099-INT or 1099-DIV claiming the standard deduction Earned Income Tax Credit the Child Tax Credit and unemployment income. Available in mobile app only. TurboTax is here to help with our Unemployment Benefits Center.

Feature available within Schedule C tax form for TurboTax filers with 1099-NEC income. Dont own a home or rental property. You cannot enter a 1099Misc or self-employment income when you are using the Free Edition.

Remember to keep all of your forms including any 1099-G form you receive with your tax records. Enter some simple information and if you qualify you can choose TurboTax to file your taxes online for free. Available in TurboTax Self-Employed and TurboTax Live Self-Employed starting 1252021.

An income statement including W2s or 1099s. Made less than 100000.

How To Enter 1099 Misc Fellowship Income Into Turbotax Evolving Personal Finance Evolving Personal Finance

Turbotax Review 2021 The Easiest Tax Software To Use

Turbotax Review 2021 The Easiest Tax Software To Use

How To Enter 1099 Misc Fellowship Income Into Turbotax Evolving Personal Finance Evolving Personal Finance

How To Enter 1099 Misc Fellowship Income Into Turbotax Evolving Personal Finance Evolving Personal Finance

Solved Where Do I Enter The Information From My 1099 R In Turbotax

Solved Where Do I Enter The Information From My 1099 R In Turbotax

Solved Turbotax Is Forcing Me To Give Bank Fein On Less T

Solved Turbotax Is Forcing Me To Give Bank Fein On Less T

How To Enter 1099 Misc Fellowship Income Into Turbotax Evolving Personal Finance Evolving Personal Finance

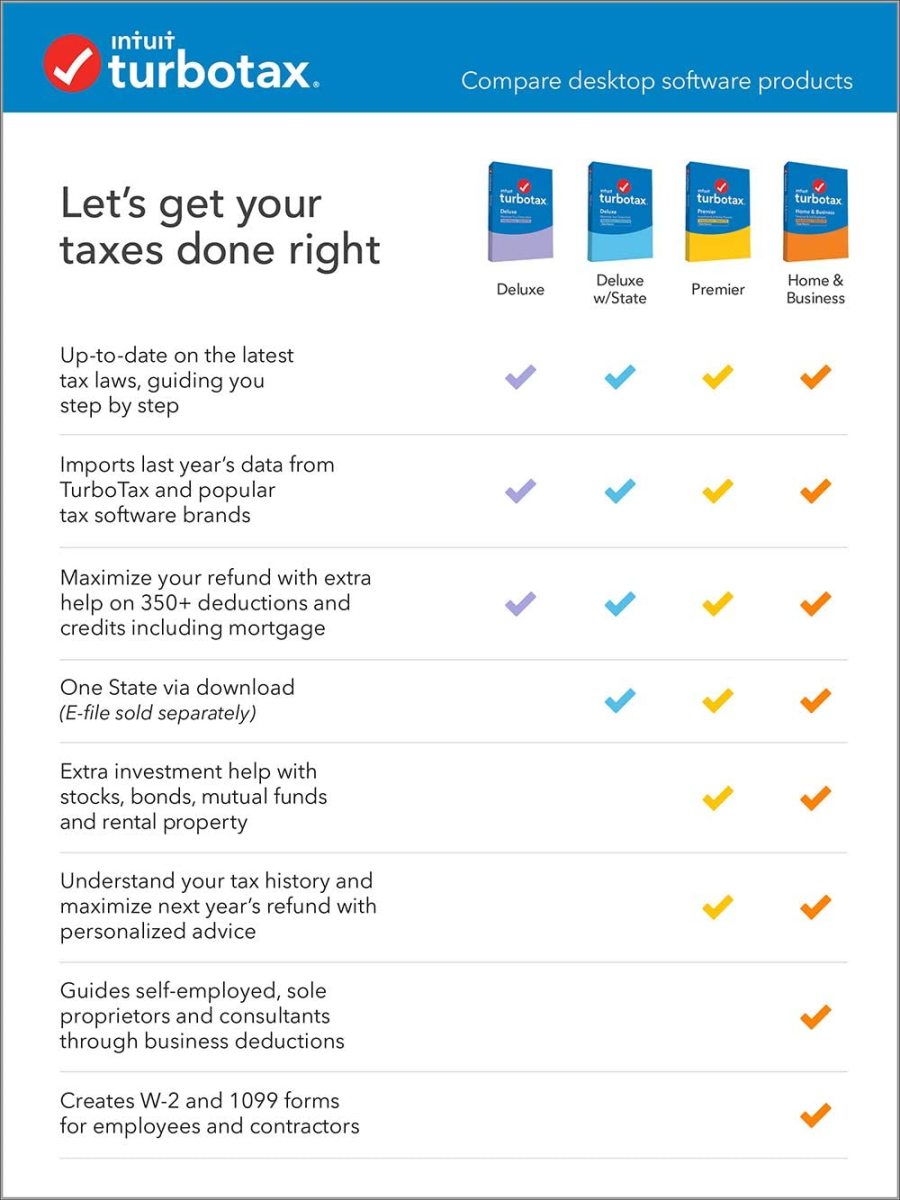

Which Version Of Turbotax Do I Need Toughnickel

Which Version Of Turbotax Do I Need Toughnickel

How To Enter 1099 Misc Fellowship Income Into Turbotax Evolving Personal Finance Evolving Personal Finance

Re 1099 Misc Assuming Business Ownership

Re 1099 Misc Assuming Business Ownership

Re How To Report Graduate Student Stipend In Turb

Re How To Report Graduate Student Stipend In Turb

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How To Enter 1099 Misc Fellowship Income Into Turbotax Evolving Personal Finance Evolving Personal Finance