What Information Do You Need To Give Someone A 1099

EIN or Social Security Number. Earnings reported by brokerages on a 1099-DIV or.

W9 Vs 1099 Irs Forms Differences And When To Use Them

W9 Vs 1099 Irs Forms Differences And When To Use Them

If the following four conditions are met you must generally report a payment as nonemployee compensation.

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

What information do you need to give someone a 1099. Make sure you have the current name address and social security numbers on file for your independent contractors. A lawsuit settlement that you have paid out also requires you to issue a 1099-MISC. You made the payment to someone who is not your employee.

The IRS form Reasonable Cause Regulations Requirements for Missing and Incorrect NameTINs has detailed information about the type of requests you should make how often to make them generally just once per year and what records you should keep. You pay an individual at least 600 over the course of a year provided this payment or payments was for a prize rent or service including materials or parts. You must secure and submit several documents when you make payments to someone by 1099.

It is not for personal payments. The series of documents you need are used to verify the identifying information of the person you are paying report the payees 1099 earnings and summarize the information you report on the 1099. Youll also need to provide a 1099-Misc to anyone you pay 10 or more in royalties.

If you are in a trade or business you must prepare 1099-MISC forms to show the amounts you have paid to others during the year. How to File 1099s. Both you and your contractor will need it to fill out your taxes.

Every 1099-NEC comes with a Copy A and a Copy B. When you hire independent contractors for your small business you need to give them a 1099-Misc if you paid them 600 or more in the previous tax year. File Form 1099-MISC for each person you have given the following types of payments to during the tax year.

The form shows how much they earned from you. You need one 1099-MISC form for every independent contractor you paid that year. Use a W-9 form from workers to.

Tools and materials are provided. You dont need to issue 1099s for payment made for personal purposes. The IRS considers trade or business to include.

Company provides training on a certain method of job performance. If you pay independent contractors you may have to file Form 1099-NEC Nonemployee Compensation to report payments for services performed for your trade or business. If you dont have this information on file the IRS will allow you to withhold 28 of the person or companys pay.

Even though your employer should report your income directly to the IRS your tax preparer will also need the information on your W-2 form s to complete your tax forms. The 1099-NEC reports how much an independent contractor earned but not including payments made via credit cards or third party settlement platforms while working with you. Write your business name business tax ID number the contractors name and contractors tax ID number--likely her Social Security number--on the 1099 Form.

Do not designate someone as a 1099 Employee if. This information should have been collected via W-9 form. Their email makes it way easier to send their 1099.

They can and should report it based on their own records of how much they were paid. Where you report the information you receive via a 1099 will depend on the type of income received. Employees must follow set schedule.

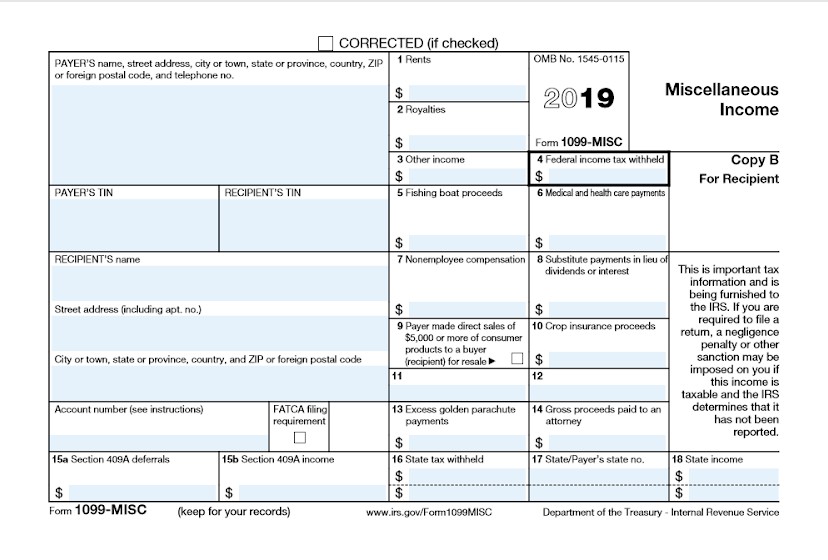

Form 1099-MISC Miscellaneous Income is an information return businesses use to report payments eg rents and royalties and miscellaneous income. The general rule is that business owners must issue a Form 1099-NEC to each person to whom they have paid at least 600 in rents services including parts and materials prizes and awards or other income payments. Youll file Copy A with the IRS and send Copy B to your contractor.

At least 10 in royalties or broker payments in lieu of dividends or tax-exempt interest. Some people mistakenly think that they need a 1099-MISC in order to report the income on their own tax return. If you hold more than one job youll need to provide W-2s from each employer.

The 1099 employee designation is an important one and you cannot afford to make a mistake. Now that you know who you need to issue 1099s to you will need some information from them. You provide benefits such as vacation overtime pay etc.

Form 1099-MISC is only for payments you make in the course of your business. In general you have to issue a 1099-MISC tax form whenever. Follow this 1099 Decision Tree to help you decide who you need to supply a form to.

Step 1 - Check Your Information. 1 Operating for gain or profit A non-profit organization including 501 c3 and d organizations.

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

Pin On Dndfinancialservices Org

Pin On Dndfinancialservices Org

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

How To Read Your 1099 Robinhood

How To Read Your 1099 Robinhood

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Do I Need To File 1099s Deb Evans Tax Company

Do I Need To File 1099s Deb Evans Tax Company

Can Tax Form 1099 K Derail Your Ecommerce Taxes Taxjar Blog

Can Tax Form 1099 K Derail Your Ecommerce Taxes Taxjar Blog

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

Change To 1099 Form For Reporting Non Employee Compensation Ds B

Change To 1099 Form For Reporting Non Employee Compensation Ds B

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Filing A 1099 Misc Form The Right Way Before January 31 2019 Small Business Ideas Startups Business Basics Successful Business Owner

Filing A 1099 Misc Form The Right Way Before January 31 2019 Small Business Ideas Startups Business Basics Successful Business Owner

1099 Misc Form Reporting Requirements Chicago Accounting Company

1099 Misc Form Reporting Requirements Chicago Accounting Company

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Get Clear On The Difference Between The 1099 Misc And 1099 Nec