Can A Sole Proprietor Have Two Ein Numbers

For example from a sole proprietorship to an LLC or corporation. If they did business under the main umbrella theyd all need to use the same EIN.

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

The owner of a sole proprietorship has sole responsibility for making decisions receives all the profits claims all losses and does not have.

Can a sole proprietor have two ein numbers. In fact in some instances having a separate EIN for ones business may even be preferable. Seriously as a sole proprietor you may have one 1 business or several businesses. If you have already registered your business as an LLC or you are a sole proprietor but have a few different business ventures in mind you may wonder can I use the same EIN for multiple businesses.

But there are a few reasons why it can be beneficial for sole proprietors to have an EIN. A sole proprietor is not an employee of his own business. Generally businesses need a new EIN when their ownership or structure has changed.

Usually it is totally acceptable for a sole proprietor to use his or her social security number in the place of any other tax identification number. In this instance the sole proprietor uses his or her social security number instead of an EIN as the taxpayer identification number. You may think you have two separate entities but the reality is it is still just you at the end of the day -- and its you.

For all other entities there are no limits on the number of EINs one may file for new businesses. The Internal Revenue Service says you must report your income and your expenses from any endeavor entered into with a profit motive. The Sole Proprietor may change business typename by filing the appropriate documentation with his or her local municipality.

You file excise tax returns eg alcohol tobacco or firearms You change your form of business. Answer A sole proprietor without employees and who doesnt file any excise or pension plan tax returns doesnt need an EIN but can get one. Sole proprietors or independent contractors Most notably the CARES Act relaxes affiliation standards for businesses in the food or hospitality industry NAICS codes beginning in 72 as long as they dont have more than 500 employees per location.

A sole proprietorship is an unincorporated business that is owned by one individual. The individual may use the same EIN for Dave Alexander DBA Daves Spotless Car Wash and Dave Alexander DBA Daves Diner In short the primary reason a sole proprietor needs an EIN is wage withholding. The simple answer to the question of how many EINs you are allowed is as many as the number of business entities you have.

You will use your SSN rather than your Employer Identification Number EIN. That can be one or a dozen or even more. When EIN Is Required for Sole Proprietors.

Once you hire employees or file excise or pension plan tax returns you will immediately require an EIN. There is no legal limit to the number of separate businesses an individual or entity can own and operate and there is likewise no limit to the number of EINs you can apply for. Sole proprietors and single owner Limited Liability Company may choose to use either their SSN or ITIN as their Tax ID Number provided they dont have employees.

Tax Identification Number TIN Protect Professional Identity Online for 1099 submissions. However there are some times when a separate number is necessary. You have one or more employees.

An individual who operates several businesses as a sole proprietor needs only one employer identification number. If youre a sole proprietor you must have an EIN to. For Sole Proprietors only one EIN can be issued to the individual.

File for a new EIN. There is no limit to the number of businesses in which you may engage. There are some instances in which a sole proprietor is required to have an EIN.

Considering the importance of protecting your identity online we recommend to all writers bloggers affiliates marketers social media specialists and publishers that they should establish a tax identity number with the United States IRS sometimes referred to as a TIN Tax ID Number or EIN. Youre not alone and it isnt a problem related to just sole proprietorships. Sole proprietors dont file a business tax return so many decide to use a social security number instead of an employer identification number EIN on forms like W-9s.

Even so you may want to obtain an EIN anyway. The EIN for a sole proprietorship is generally used to file and provide information statements eg 1099-MISC or W-2 etc The statements have separate filing requirements than your Form 1040 business returns and are treated as separate issues by the Internal Revenue Service. While an EIN is required for general partnerships corporations and multi-member LLCs sole proprietorships and single-member LLCs are required to get an EIN if they have employees.

Have a Keogh or Solo 401k retirement plan. Sometimes Its Required An EIN is a taxpayer identification number. A sole proprietor with an existing EIN who becomes a sole owner of a limited liability company LLC will require another EIN for the LLC.

Can you have multiple EIN numbers. You file pension tax returns. However most sole proprietors dont need to obtain an EIN and can use their Social Security numbers instead.

It is the simplest kind of business structure. A single business or entity can have only one although there are situations where you will need to apply for a new one due to changes to your business. A sole proprietor must have a federal Employer Identification Number EIN if any of the following apply.

The only stipulation is that each new EIN is appropriated for a separate and distinct entity.

How To Apply For An Ein For Your Llc Online Step By Step Llc University

How To Apply For An Ein For Your Llc Online Step By Step Llc University

What S An Ein Number How To Get An Ein For Your Llc 3 Ways Llc University

What S An Ein Number How To Get An Ein For Your Llc 3 Ways Llc University

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

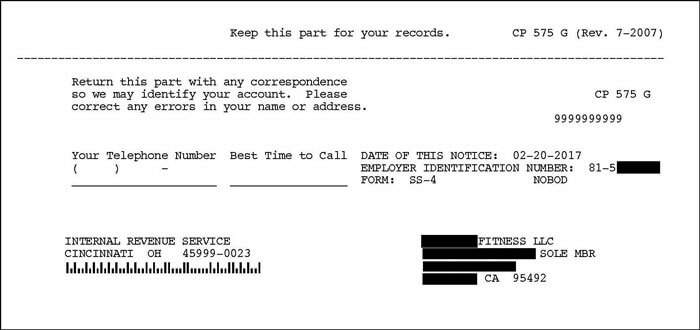

When To Apply For An Ein As A Sole Proprietor

When To Apply For An Ein As A Sole Proprietor

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

Learn How To Fill Out A W 9 Form Correctly And Completely

Learn How To Fill Out A W 9 Form Correctly And Completely

Reporting Of Certain Currency Transactions For Sole Proprietorships And Legal Entities Operating Under A Doing Business As Dba Name Fincen Gov

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Reporting Of Certain Currency Transactions For Sole Proprietorships And Legal Entities Operating Under A Doing Business As Dba Name Fincen Gov

Https Dcf Wisconsin Gov Files W2 Pdf 6448 Pdf

Driving With An Llc Or Corp How To Send Your Ein To Uber Or Lyft Ridesharing Driver

Driving With An Llc Or Corp How To Send Your Ein To Uber Or Lyft Ridesharing Driver

When Does A Sole Proprietor Need An Ein How To Start An Llc

When Does A Sole Proprietor Need An Ein How To Start An Llc

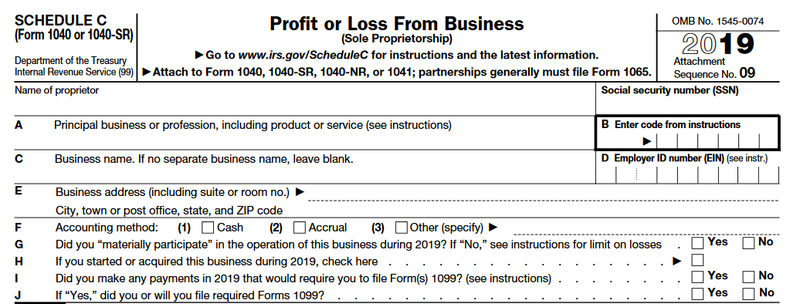

How Do I Input My Ein For My Single Member Llc Or Sole Proprietorship

How Do I Input My Ein For My Single Member Llc Or Sole Proprietorship

When Does A Sole Proprietor Need An Ein How To Start An Llc

When Does A Sole Proprietor Need An Ein How To Start An Llc

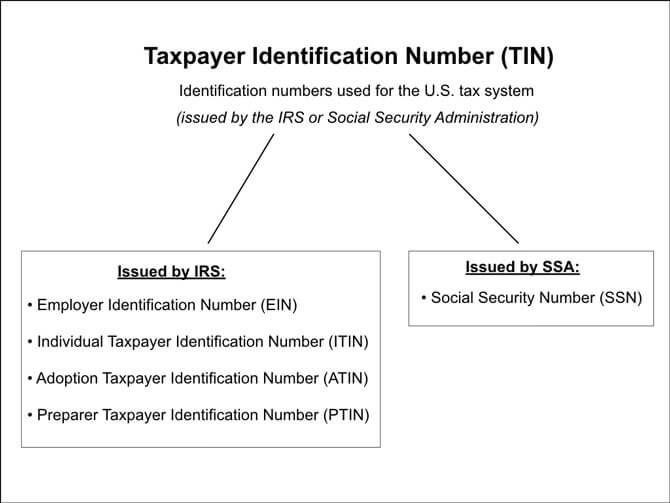

Tin Ssn Ein And Itin Taxpayer Id Numbers Llc University

Tin Ssn Ein And Itin Taxpayer Id Numbers Llc University

Can You Have Multiple Ein Numbers

Can You Have Multiple Ein Numbers

Starting A Sole Proprietorship Business With Your Ein Number

Starting A Sole Proprietorship Business With Your Ein Number